With no state income tax, landlord-friendly laws, and steady population growth, Florida continues to be an investor-friendly place to build your rental property portfolio. But the Sunshine State is big, so where can you find turnkey rental property for sale?

Quick Answer: Where to Find the Best Rental Properties for Sale in Florida

Florida’s rental property opportunities vary by region:

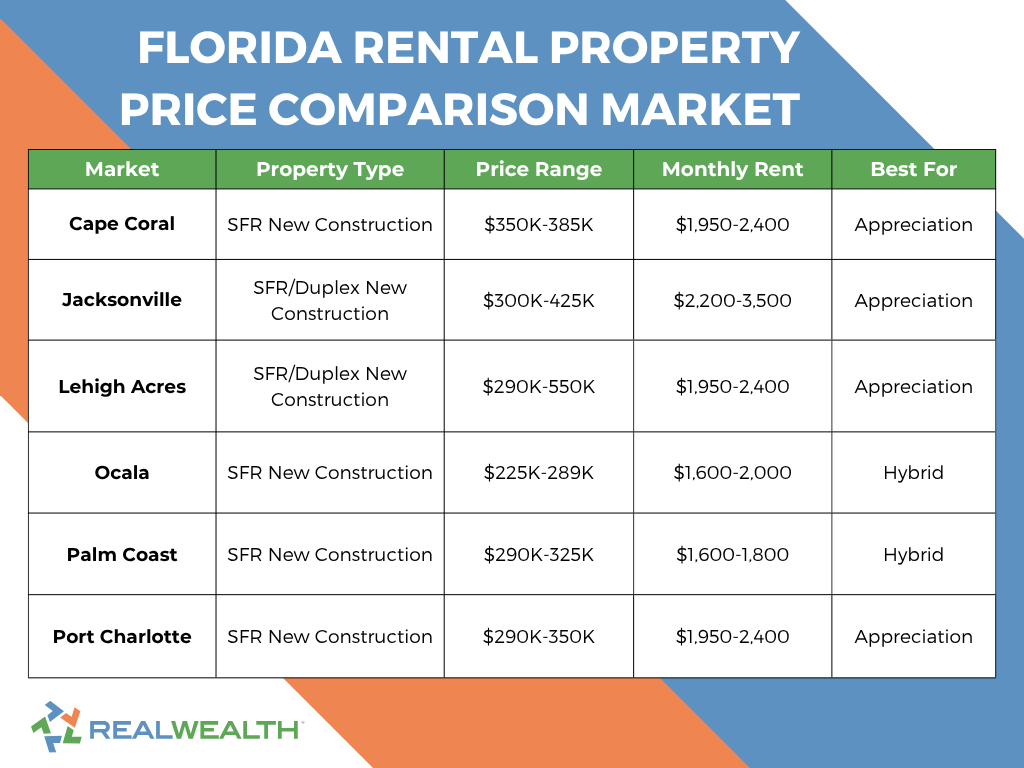

- Southwest Florida (Gulf Coast): Cape Coral, Lehigh Acres, Port Charlotte — Focus on appreciation with new construction $290K-$385K

- Northeast Florida: Jacksonville, Palm Coast — Steady growth with properties $300K-$425K

- Central Florida: Ocala — Most affordable entry points at $225K-$289K

All prices reflect new construction turnkey rental properties for sale through the vetted property teams in RealWealth’s network. All come with property management in place. Where can you find investment properties for sale in Florida? RealWealth members can contact property teams directly for available inventory. If you are not a member, join RealWealth →

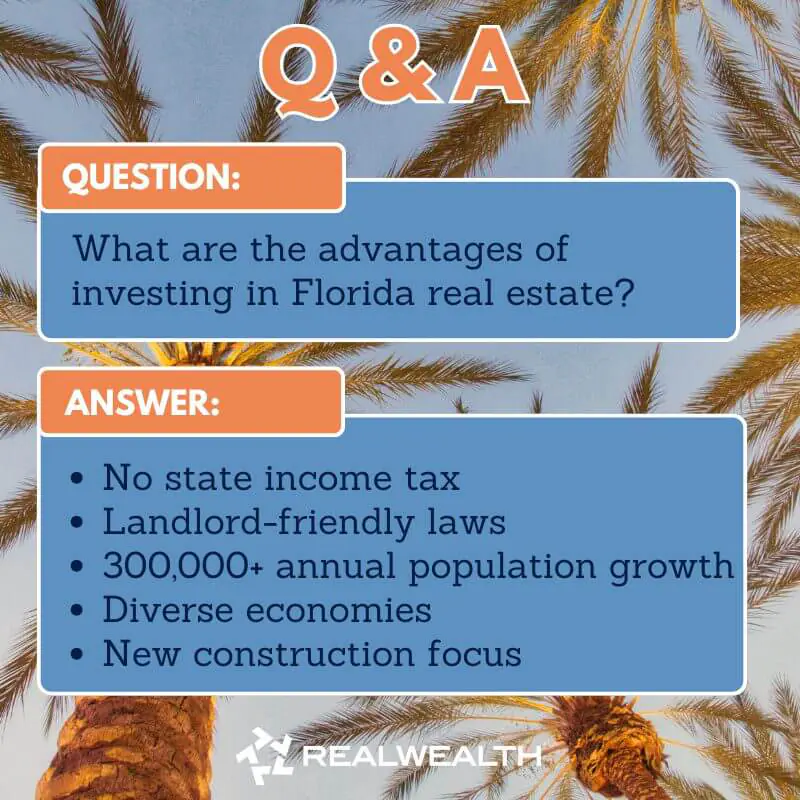

Why Invest In Florida Real Estate?

The Florida housing market offers real estate investors unique advantages:

- No state income tax on rental income

- Landlord-friendly laws with efficient eviction processes

- 300,000+ annual population growth creates steady demand

- Diverse economies across regions reduce risk

- New construction focus means lower maintenance costs

Below, we’ve highlighted six of the top markets where you can find rental property for sale in Florida.

6 Markets For Your Next Florida Rental Property Investment

1. Cape Coral, Florida

Over the past decade, Cape Coral’s real estate market has experienced significant property value appreciation, making it a key player in Southwest Florida’s housing boom. In addition, its growing retiree population and tourism drive rental demand.

- Region: Southwest Florida

- Median Price for a Turnkey SFR: $350,000 to $385,000

- Median Rent: $1,950 to $2,400

- Investor Focus: Cash Flow & Appreciation

- Type of Properties for Sale: New Construction

Our network includes two teams that sell in Cape Coral. Click on the buttons below to connect and see sample inventory.

New to Florida real estate investing? Check out the best real estate markets in Florida for investors or catch up on our free webinars about what is working in Florida’s markets today, and what types of investment properties for sale in Florida are available.

2. Jacksonville, Florida

Backed by a strong, diverse economy and three major Navy bases, Jacksonville offers investors economic stability and job growth. This mix of factors helps real estate investors buy rental property for sale in Florida with confidence.

- Region: Southwest Florida

- Median Price for a Turnkey SFR: $330,000 to $450,000

- Median Rent: $1,975 to $2,500

- Investor Focus: Cash Flow & Appreciation

- Type of Properties for Sale: New Construction (SFR/Duplexes)

3. Lehigh Acres, Florida

In Lehigh Acres, investors can find affordable entry points and strong appreciation potential. This presents investors with an attractive combination of affordability, growth potential, and strong rental demand.

- Region: Southwest Florida

- Median Price for a Turnkey SFR: $290,000 to $330,000

- Median Rent: $1,950 to $2,400

- Investor Focus: Cash Flow & Appreciation

- Type of Properties for Sale: New Construction (SFR/Duplexes)

Our network includes two teams that sell in Lehigh Acres. Click on the buttons below to connect and see sample inventory.

3. Ocala, Florida

If you want to invest in Florida real estate, but want the highest cash flow, Ocala is the best choice. While rental properties for sale in Orlando and Tampa have higher price points, emerging markets like Ocala are more affordable and offer a dynamic mix of growth, consistent rental demand, and cash flow— all supported by ongoing infrastructure improvements and new development.

- Region: Southwest Florida

- Median Price for a Turnkey SFR: $225,000 to $289,000

- Median Rent: $1,600 to $2,000

- Investor Focus: Cash Flow & Appreciation

- Type of Properties for sale: New Construction

Our network includes two teams that sell in Ocala. Click on the buttons below to connect and see sample inventory.

5. Palm Coast, Florida

Palm Coast’s coastal location, paired with affordable property and strong appeal to retirees and remote workers, makes it attractive to real estate investors seeking rental properties for sale in Florida at lower price points and with a reliable return on investment.

- Region: Southwest Florida

- Median Price for a Turnkey SFR: $300,000 to $325,000

- Median Rent: $1,600 to $1,800

- Investor Focus: Cash Flow & Appreciation

- Type of Properties for Sale: New Construction

6. Port Charlotte, Florida

Over the past ten years, Port Charlotte has seen notable home value growth, ongoing infrastructure improvements, and strong population growth throughout the county, all of which contribute to this upward trend.

- Region: Southwest Florida

- Median Price for a Turnkey SFR: $290,000 to $350,000

- Median Rent: $1,950 to $2,400

- Investor Focus: Cash Flow & Appreciation

- Type of Properties for Sale: New Construction

Our network includes two teams that sell in Port Charlotte. Click on the buttons below to connect and see sample inventory.

Why Purchase Property Through Teams in the RealWealth Network?

Here’s what makes these opportunities different: every property team in RealWealth’s network has been thoroughly vetted. They meet our R.E.A.L. Income Property™ Standards, meaning they’re selling quality properties in solid neighborhoods with realistic rent projections and established property management.

Whether you’re looking at rental properties for sale in Florida towns like Jacksonville, Cape Coral, Ocala, or any of the other Florida markets we serve, you’re getting access to teams with proven track records with our members. In addition, we have been investing in Florida and advising investors for more than 15 years, and are very familiar with the market cycles of the area and what deals make sense for investors to hold.

Investor tip: We always recommend that our members do their due diligence and double-check all numbers and potential investment properties to ensure they meet the R.E.A.L. Income Property™ Standards.

Ready to Explore Rental Properties For Sale in Florida?

RealWealth members can view current inventory, pro formas, and connect directly with vetted property teams in our network. Our investment counselors, who help guide all of our members for free, can help you determine which Florida market aligns best with your goals—whether that’s maximizing cash flow, building long-term appreciation, or finding the right balance of both. Join RealWealth→

Frequently Asked Questions About Rental Properties for Sale in Florida

Florida rental property prices vary by region. Central Florida markets like Ocala start around $225,000-$289,000. Northeast Florida markets like Jacksonville average $330,000. Southwest Florida Gulf Coast markets like Cape Coral range from $350,000 to $385,000. Overall, expect $225,000-$550,000 depending on location and property type through RealWealth’s network. View available Florida rental properties →

The best Florida cities depend on your goals: Jacksonville — Most stable with a diversified economy; Cape Coral — Strongest appreciation (95% since 2014); Ocala — Lowest entry point with better cash flow; Lehigh Acres — Affordability meets growth potential; Palm Coast — Coastal living at reasonable prices.

All markets offer new construction with vetted property management. Explore the best real estate markets in Florida →

Yes. Florida’s population grows by 300,000+ annually, creating sustained demand. The state offers no income tax, landlord-friendly laws, and a diversified economy. Key markets have appreciated 95%-138% over the past decade. While some coastal markets have cooled (creating buying opportunities), strong fundamentals support continued long-term performance. Read Florida housing market predictions →

New construction offers:

1) Lower maintenance costs with builder warranties

2) Modern features that attract quality tenants

3) No renovation delays — immediate rental income

4) New builds are much cheaper to insure

5) Better financing options

6) Properties meet RealWealth’s quality standards

Learn more about turnkey real estate investing →

You typically need 20-25% down plus closing costs and reserves:

1) Ocala ($250K): ~$62,500 total

2) Jacksonville ($330K): ~$82,000 total

3) Cape Coral ($370K): ~$92,000 total

This includes down payment, closing costs, and 3-6 months’ reserves. RealWealth members get access to our recommended lenders offering conventional and non-conventional loans that qualify based on property income, not personal income. In addition, some Florida property teams offer RealWealth members incentives, such as buy-downs or other discounts. Learn how to buy your first rental property →

Rental yields vary by market:

1) Central Florida (Ocala): 6.5-7.5% — strongest cash flow

2) Northeast Florida (Jacksonville): 6.0-6.5% — balanced returns

3) Southwest Florida (Cape Coral): 5.5-6.5% — appreciation focused

Net cash-on-cash returns typically range from 4-7% in year one, increasing as rents rise while mortgages stay fixed. Learn how to analyze a real estate deal →

Yes, Florida is one of the most landlord-friendly states:

1) Fast eviction process (2-4 weeks for non-payment)

2) No rent control — adjust rents to market rates

3) Strong property owner protections

4) State law preempts restrictive local ordinances

5) Flexible security deposit rules

This environment makes Florida particularly attractive for out-of-state investors. Discover more landlord-friendly states →

Hurricane damage is covered by standard homeowner’s insurance; however, flood insurance is not. We don’t recommend buying in a flood zone where additional flood insurance would be advised or even required by your lender.

Hurricane risk varies by region:

1) Lower risk: Jacksonville/Northeast Florida and inland Central Florida (Ocala). Insurance: $1,200-$2,000 annually.

2) Higher risk: Gulf Coast markets (Cape Coral, Lehigh Acres, Port Charlotte). Insurance: $2,500-$5,000+ annually.

New construction includes impact windows, reinforced roofing, and modern codes that reduce damage risk. Professional property management ensures proper storm preparation. Always double-check your insurance costs when buying rental property for sale in Florida. Explore Jacksonville real estate investing →

vs. Texas: Both have no state income tax, but Florida has lower property taxes.

vs. California: Florida has no state income tax (vs. 13.3%), landlord-friendly laws, and lower prices.

vs. Midwest: Florida real estate offers appreciation of 6-10% annually, while the Midwest appreciates at 2-5%.

Compare the best places to buy rental property →

Yes. Florida is excellent for 1031 exchanges because it has no state income tax, strong appreciation, landlord-friendly laws, and the property teams we work with have 1031 exchange replacement properties for sale now and can work with the strict identification timelines.

Key requirements:

1) Use a qualified intermediary

2) Identify replacement properties within 45 days

3) Close within 180 days

4) Exchange like-kind investment property

RealWealth works with experienced intermediaries and can help you find properties meeting exchange timelines. Find 1031 exchanges rental properties for sale in top markets →

RealWealth’s property teams focus on new construction in A and B neighborhoods:

1) Jacksonville: Suburban areas near major employers (healthcare, finance, logistics) with good schools and I-295 access. View Jacksonville investment properties →

2) Cape Coral: Infill lots in established neighborhoods with canal access and modern amenities. View Cape Coral investment properties →

3) Ocala: Growing suburban areas near expanding healthcare and manufacturing employment centers.

Property teams specialize in identifying neighborhoods meeting R.E.A.L. Income Property Standards → with strong rental demand and growth potential.

Your hold periods depend on your strategy, be it cash flow, appreciation, or a hybrid approach. Real estate builds wealth over time. The longer you hold, the more you benefit from appreciation, mortgage paydown, and inflation working in your favor. Learn about real estate investing strategies →

The best cities for rental property investing strike a balance between affordability, job growth, population increases, and strong rent-to-price ratios. Many investors are finding great opportunities in the Midwest, Southeast, and parts of Texas and Florida. See the complete list in our guide, 25 Best Places To Buy Rental Property.

To buy your first rental property, you’ll need to set clear goals, get pre-approved for financing, choose the right market, and analyze properties for cash flow and long-term potential. For step-by-step instructions, read How To Buy Your First Rental Property.

When you become a free RealWealth member, you get access to a network of vetted property teams across Florida’s best investment markets. Whether you’re looking at affordable entry points in Central Florida (Ocala, Citrus Springs), steady growth in Northeast Florida (Jacksonville, Palm Coast), or appreciation potential in Southwest Florida (Cape Coral, Lehigh Acres, Port Charlotte), these teams know their local markets inside and out. Plus, you’ll work with your investment counselors who can help you figure out which market and property type makes the most sense for your goals. No pressure, just real guidance from people who’ve been there. If you haven’t already, join RealWealth.

Common mistakes include underestimating expenses, skipping due diligence, selecting the wrong market, or failing to have property management in place. Learn from other investors’ missteps in the Top 18 Biggest Mistakes When Buying Rental Property.

Investors earn returns from four primary sources: monthly cash flow, property appreciation, principal loan paydown, and tax benefits. We break these down in How to Make Money from Rental Properties Today.

Yes, with the right roadmap. Many busy professionals successfully close on their first property in three months or less by following a proven process. See the plan here: How to Buy Rental Property in 90 Days to Start Earning While You Sleep.

The best strategy depends on your goals and risk tolerance. Options include turnkey investing, BRRRR, house hacking, short-term rentals, and long-term buy-and-hold. Explore strategies in How to Invest in Rental Properties and Actually Build Wealth: 10 Proven Tips.

Yes. With just four well-performing rental properties, many investors create enough monthly income to retire comfortably. Learn how in Rental Properties for Retirement: How Four Rentals Can Set You Up for Success.

The answer depends on cash flow per property, location, and financing. On average, investors may need anywhere from 5 to 15 rentals. Find a full breakdown in How Many Rental Properties Do You Need To Make $100k Annually?

Yes, investors build long-term wealth through rental properties by combining cash flow, appreciation, loan paydown, and tax advantages. Over time, these factors compound, making investing in rental properties a proven strategy for achieving financial freedom and building generational wealth. Read our full guide on How To Build Wealth By Investing In Rental Properties.

Getting started is simple. Join RealWealth for free to access vetted turnkey teams, investment counselors, and sample property pro formas. Your RealWealth Investment Counselor can help tailor your investing strategy to a Florida market that best meets your goals, connect you with trusted teams, and guide you through your purchase—so you can confidently grow your real estate portfolio and build long-term wealth.