Where are the best places to buy rental property this year? As a seasoned real estate investor with decades of experience in single-family and multifamily properties in the United States and abroad, I’m often asked this question. To help you narrow down the best market for your real estate investment goals, we’ve rounded up the top choices for 2026.

25 Best Places to Buy Rental Property in 2026

Not sure where to invest in real estate this year? We've rounded up 25 of the best places to buy rental property in 2026 for cash flow and appreciation.

Before we dive into our best places to buy rental property for 2026, here are some tips for analyzing potential real estate markets.

3 Factors for Analyzing a Real Estate Market

Before researching and analyzing markets, you’ll want to understand your real estate investment goals so you can avoid making impulse decisions. Ask yourself, “What do I want from my investment?” Knowing your goals and the answer to this question is critical to choosing the right path for you.

I’ve found that the best cities to invest in share three factors: job and population growth, and affordability.

1. Job Growth

Because population growth correlates with the availability of job opportunities, real estate investors should prioritize markets where job opportunities are expanding.

When assessing a location for a strong job market, here are key points to keep in mind:

- Number of jobs. The number of jobs in an area signifies which locations are experiencing growth and which are not.

- Rise in median salary. The median salary is the midpoint of all wages. When it rises, it indicates a growing economy with a demand for skilled workers.

- Job diversity. A strong mix of industries and workforce signals a location is on an upward momentum.

- Commercial buildings. When the economy improves, industries expand, and more commercial buildings and towers are built.

2. Population Growth

Despite what the numbers on your pro forma may say, a rental property only brings in revenue if you can find someone willing to rent it. To identify the best places to buy rental properties in 2026, look for areas with strong population growth and housing demand.

To analyze a region’s real estate market, look for signs of population growth, as this often translates into higher housing demand. Real estate markets with growing populations also tend to have strong economies. When more jobs are available, more people can afford to pay rent.

When demand for houses outpaces supply, home prices rise, and rents increase. When you invest in rental properties in an area with high population growth and housing demand, your investment should pay off over time as rents rise.

3. Affordability

Every housing market has its own pricing and market trends. Different factors come into play when researching where to invest in rental property. Here are three:

- Location. A property’s location, including the city and neighborhood, plays a big role in its current value, appreciation potential, and how long it takes to recoup your initial investment. At RealWealth, we recommend that investors avoid high-priced markets such as New York City, Los Angeles, and San Francisco, and instead focus on markets with strong appreciation and job growth, such as Cleveland, Ohio; San Antonio, Texas; and Jacksonville, Florida.

- Price-to-rent ratio. Investors use this benchmark number to gauge an area’s potential profitability. To find this number, divide the median home price by the median yearly rent. The calculated number lets you know if renting or owning a property is cheaper. A price-to-rent ratio of 15 or lower favors buying, while 21 and above means it’s cheaper to rent than buy. The higher the price-to-rent ratio, the worse the market is for real estate investing (rentals in particular). It also translates to lower cash flow potential. Conversely, an area with affordable real estate but increasing rents will almost always make for a good investment.

- Fixer-upper. A fixer-upper in a popular or up-and-coming neighborhood can also be a good investment if you have the time, money and experience to make improvements that increase rent and property values.

- Turnkey rental properties: Move-in-ready rental properties that have been renovated or are new construction, and are rent-ready, with professional management. Unlike fixer-uppers, turnkey properties let you start generating rental income immediately without the time, money, or experience needed for renovations. At RealWealth, we work with vetted property teams that meet our REAL Income Property Standards—ensuring properties are in strong rental markets, structurally sound, professionally managed, and priced appropriately. For investors who want cash flow without the hassle of rehab work, turnkey properties offer a straightforward path to building a rental portfolio.

When you find a market with all three factors – job growth, population growth, and affordability – you’ll likely be able to find good real estate investment opportunities for both cash flow and appreciation.

To help you with your market research, we’ve rounded up 25 of the best places to buy rental property for 2026. We’ll also explain why these markets are strong for investors.

Where is the Best Place To Buy Rental Property Today?

25 Cities To Consider in 2026

Please note: The following real estate markets are ranked based on our estimates of their cash flow and appreciation potential. We’ve made this determination based on insights from RealWealth Investment Counselors, who are highly experienced real estate investors with rental properties in many of these markets.

Using our local property team’s networks and expertise, we’ve compiled and analyzed current home value and rental data based on the current inventory, as well as metro-area historical home value and rental data (dating back to 2014) from Zillow’s Housing Data spreadsheets. In addition, we’ve researched and calculated metro population growth over the past 11 years using Census.gov data.

We’ve spent months researching to update this article for 2026. However, please do your due diligence when deciding which real estate market to invest in and which property to purchase. This is the only way to ensure you make the best investment decision for your goals and financial situation.

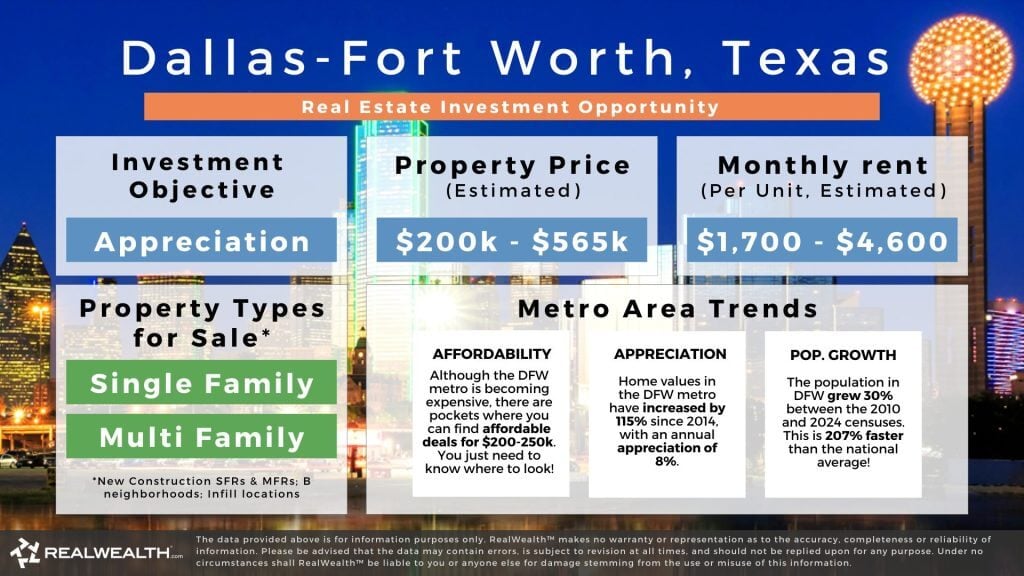

#1 Dallas, Texas

Often referred to as DFW or The Metroplex by locals, the Dallas–Fort Worth–Arlington Metropolitan Statistical Area is the bustling hub of North Texas. With over 8.3 million residents and projected to surpass 10 million by 2030, Dallas ranks among the top metro areas for economic growth and GDP. Its diverse economy, forward-thinking development, and status as one of the top five Sun Belt cities make it one of the best places to buy rental property for appreciation-focused investors.

MSA and Economy

Dallas-Fort Worth covers 12 counties with two main economic centers—Dallas, Plano, Irving, Fort Worth, andArlington. While the area may have roots in cotton and oil, it’s now leading in technology, healthcare, business, financial services, and telecommunications. This economic diversity helps the Dallas real estate market remain stable even during economic uncertainty. Currently ranked in the top ten cities for GDP, Dallas is expected to have a GDP of $770 billion in 2024, with a 3.23% growth rate, positioning it as a business and innovation powerhouse.

Population Growth

The Dallas-Fort Worth Metroplex became home to more than 8.3 million people in 2025. Data from the Kinder Institute for Urban Research projects it will exceed 10 million residents by 2030, placing it in the top five U.S. metros. The area features some of the fastest-growing suburbs in the country, driven by strong migration for job opportunities, business-friendly policies, and quality of life.

Job Growth

Between March 2024 and March 2025, Dallas created more than 59,000 jobs and had a 1-year job growth rate of 1.5%, higher than the national average. The unemployment rate sits around 4%, lower than the national average. Leading sectors include technology, healthcare, financial services, defense, and telecommunications, which together provide diverse employment opportunities that support sustained housing demand.

Investing Through Turnkey Teams In RealWealth‘s Network

The Dallas-based turnkey real estate company in our network sells new-construction investment properties in the Sherman-Denison and Greenville areas. The average price range for a single family home is $200,000 to $250,000. The average price range for a duplex is $365,000 to $565,000. Rents average $1,500 for an SFR and $3,750 for a duplex. The market’s strong appreciation potential, diverse economy, and rapid population growth are major draws for real estate investors seeking the best places to buy rental property. To connect with the team, join RealWealth today.

About the Dallas Housing Market

Dallas-Fort Worth is expected to become more balanced in 2026. From July 2023 to July 2024, the area saw a 13% increase in single-family home building permits, which slightly stabilized housing inventory and rents. While more inventory has entered the market, the area’s strong economic growth and robust population continue to drive housing demand. Home values have appreciated at a consistent 9% annual rate, well above the national average. As one of Texas’s most dynamic real estate markets, Dallas continues to deliver strong long-term appreciation potential for investors.

Dallas Housing Market Statistics

- Median Household Income: $75,220

- Metro Population: 8.3 Million

- 12-Year Population Growth: 30.54%

- Median Home Price: $365,329

- 1-Year Equity Growth: 7.95%

- 10-Year Equity Growth: 114.94%

- Median Rent Per Month: $1,671

- 1-Year Rent Growth: 2.96%

- Job Growth: +59,000 jobs created over the last year

- 1-Year Job Growth Rate: 1.5% (higher than the national average)

- Unemployment Rate: 4% (lower than the national average)

Top 3 Reasons to Invest in the Dallas Real Estate Market in 2026

1. Strong appreciation potential

Dallas home appreciation has consistently exceeded the national average, with an annual appreciation rate of 7.95%. Over the past 10 years, home values have increased 115%, and rent appreciation averaged 2.96% annually. This reliable growth makes Dallas an ideal destination for investors seeking long-term equity growth and wealth accumulation.

2. Rapid Population Growth and Urbanization

Dallas-Fort Worth ranks among the fastest-growing metro areas in the United States and is projected to reach 10 million residents by 2030. People are drawn to the metro for job opportunities, more affordable living than in coastal cities, cultural diversity, and a high quality of life. This rapid urbanization creates sustained housing demand and rental stability.

3. Diversified economic powerhouse

Dallas consistently ranks among the fastest-growing economies in the U.S. and boasts a flourishing, diversified economy beyond any single industry. The metro continues to attract Fortune 500 companies, tech firms, and major employers, driving job creation and supporting housing market growth. This economic diversity reduces investment risk and strengthens long-term market fundamentals.

How To Purchase Investment Property in Dallas

- Research the market: Familiarize yourself with different neighborhoods and their investment potential. Areas like Denison, Greenville, and Sherman offer a range of entry points, from lower-cost options to new construction, each with unique growth drivers.

- Understand the laws: Texas property laws are generally landlord-friendly. However, be aware of specific local regulations regarding property rental and maintenance.

- Financial planning: Texas property taxes are higher than in other states, which could impact your investment’s profitability. Review your real estate pro forma thoroughly and talk with a trusted CPA.

- Work with a local team: Partner with experts who know the Dallas and North Texas market well and can help you find the best properties. Connect with the Dallas Property Team in RealWealth’s network today to view current turnkey rental property inventory.

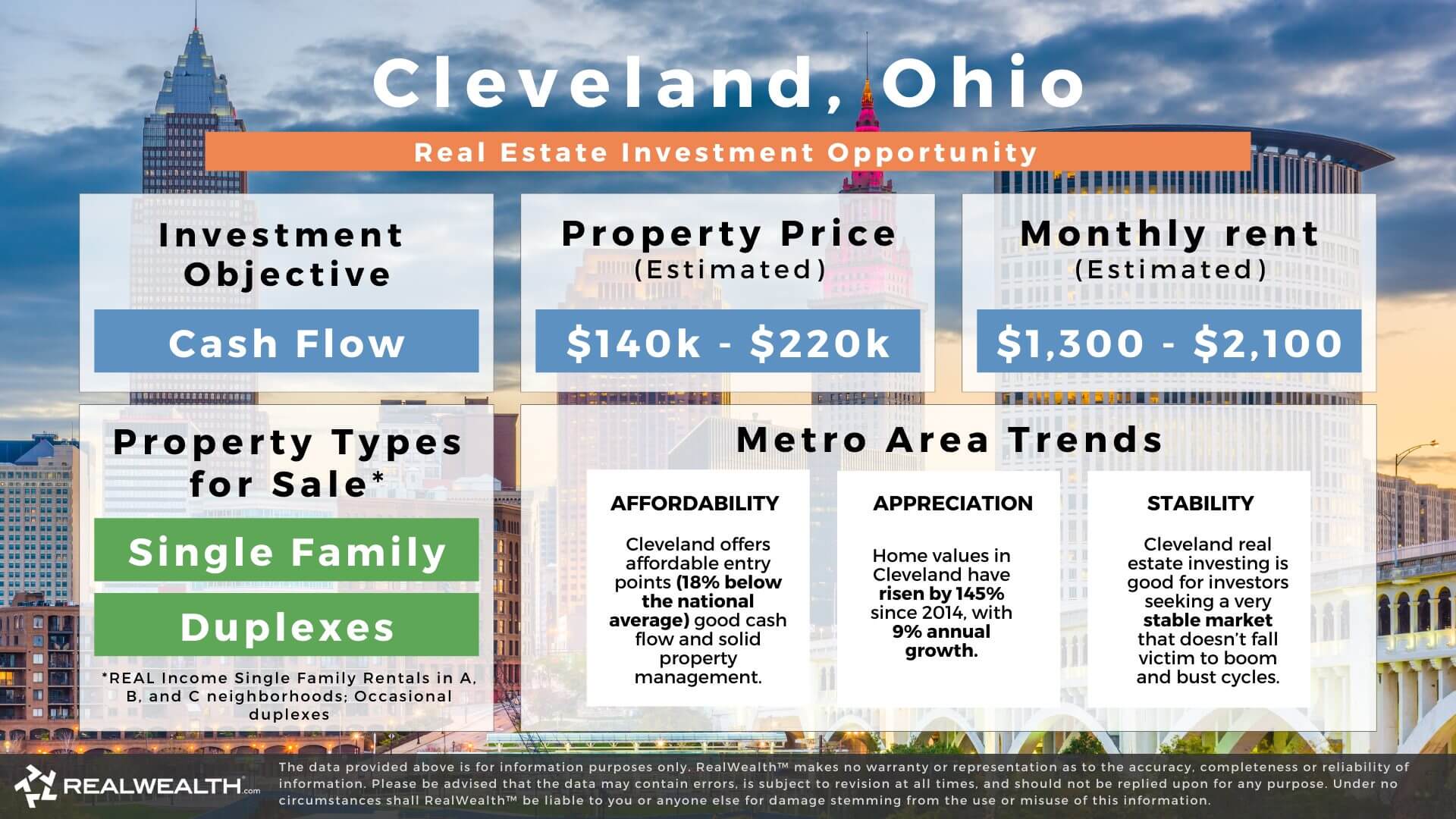

#2 Cleveland, Ohio

Cleveland, Ohio, offers an attractive investment opportunity for investors seeking a real estate market with balanced, sustainable growth rather than the boom-and-bust cycles of some overheated markets. Grounded in a diverse economic landscape across healthcare, manufacturing, and bioscience, it attracts a steady stream of young professionals and families. Although the Cleveland real estate market may not be experiencing rapid population growth like other markets, its population remains stable, providing a stable foundation for long-term investors.

MSA and Economy

The Cleveland-Elyria metropolitan area consists of six counties, each with a rich history dating back to its industrial heyday. Once a manufacturing powerhouse, the region has evolved, diversifying its economy into thriving healthcare, bioscience, and technology sectors. This economic transformation, combined with the city’s natural amenities, such as Lake Erie, and cultural attractions (Rock and Roll Hall of Fame), has created a dynamic investment climate. Major employers span healthcare systems, manufacturing companies, and tech firms, creating a diversified employment base that supports stable housing demand.

Job Growth

Between August 2024 and August 2025, the Cleveland metro area added 8,200 jobs, with a job growth rate of 0.70%. The unemployment rate is 4%, below the national average. The region’s diverse economy across healthcare, manufacturing, bioscience, and technology provides stability. This economic diversity helps maintain steady employment levels and supports consistent housing demand, making Cleveland a reliable market for long-term rental property investors.

About the Cleveland Housing Market

At the heart of Cleveland’s appeal for real estate investors is its affordability. The median home price in the broader Cleveland-Elyria metropolitan area is $294,281, 17.96% lower than the national average. The annual appreciation rate is 9.01%, and over the past 10 years, home values have increased by 136.89%. Average rents stand at $1,530, with a 4.45% annual growth rate and a 10-year growth rate of 54.61%. Approximately 59% of households in the metro area choose to rent rather than own, creating a consistent tenant pool.

Investing Through Property Teams In RealWealth‘s Network

The Cleveland turnkey real estate company we work with sells single-family investment properties and occasionally multifamily properties. The average price is $125,000, 65.20% lower than the national average. Rents average $1,200, offering excellent cash flow opportunities. The market’s exceptional affordability, strong appreciation potential, and high rental demand are major draws for real estate investors seeking the best places to buy rental property. To connect with the team, join RealWealth today.

Cleveland Housing Market Statistics

- Median Household Income: $73,000

- Metro Population: 2.34 Million

- 12-Year Population Growth: 10.95%

- Median Home Price: $294,281

- 1-Year Equity Growth: 9.01%

- 10-Year Equity Growth: 136.89%

- Median Rent Per Month: $1,530

- 1-Year Rent Growth: 4.45%

- 10-Year Rent Growth: 54.61%

- Job Growth: 8,200 jobs created

- 1-Year Job Growth Rate: .70% (higher than the national average)

- Unemployment Rate: 4% (lower than the national average)

Top 3 Reasons to Invest in the Cleveland Real Estate Market in 2026

1. Affordable real estate market

In 2025, the average home price in Cleveland was $294,281, 18.06% below the national average. Investment properties are available at even lower price points, with the average around $125,000—65.20% below the national average. Neighborhoods such as North Collinwood and South Broadway offer attractive investment opportunities, with median sale prices under $100,000. This affordability delivers excellent cash-on-cash returns for investors seeking monthly income.

2. High rental yield potential

Fifty-nine percent of households in Cleveland are renter-occupied, creating strong, consistent rental demand. Over the past 10 years, rent has increased by 54.61%, with an annual growth rate of 4.45%. Cuyahoga County, which includes Cleveland-Elyria, ranked among the top three counties in Attom’s 2025 rankings for buying single-family rentals, with a median sales price of $172,199 and an annual gross rental yield of 10.1%. The combination of high rental occupancy, affordable entry prices, and strong rental yields presents excellent opportunities for real estate investors.

3. Steady home prices and rent appreciation

Cleveland’s real estate isn’t just affordable; it also comes with strong appreciation potential. The Cleveland metro area has averaged a 9.01% annual home appreciation rate, totaling 136.89% over the past 10 years. This demonstrates steady, reliable appreciation that outpaces many markets. Unlike boom-and-bust cycles in overheated markets, Cleveland offers measured, sustainable growth that supports long-term wealth building through real estate.

How To Purchase Investment Property in Cleveland

Cleveland offers real estate investors a solid rental market, with strong rental areas and relatively low property prices, making it an attractive location for buying rental properties. The city has been experiencing urban revitalization, which has contributed to property value appreciation.

How to Purchase:

- Research: Understand neighborhood dynamics, with a focus on revitalization areas. Neighborhoods like North Collinwood and South Broadway offer entry points under $100,000, while other areas provide different price points and tenant profiles.

- Property taxes: Taxes vary significantly between neighborhoods, so do your due diligence. Understanding property tax rates in your target areas will help you accurately project cash flow and returns. Taxes vary significantly between neighborhoods; do your due diligence.

- Financing: Local banks and credit unions offer competitive mortgage rates for investment properties. Building relationships with local lenders can provide access to better terms and faster closings.

- Legal considerations: Be aware of Ohio tenant laws, which tend to favor landlords. Understanding these laws will help you operate your rentals effectively and avoid potential issues.

- Networking: Connect with local real estate agents and investors with experience in the Cleveland market. Connect with the Cleveland Property Team in RealWealth’s network today to view current turnkey rental property inventory.

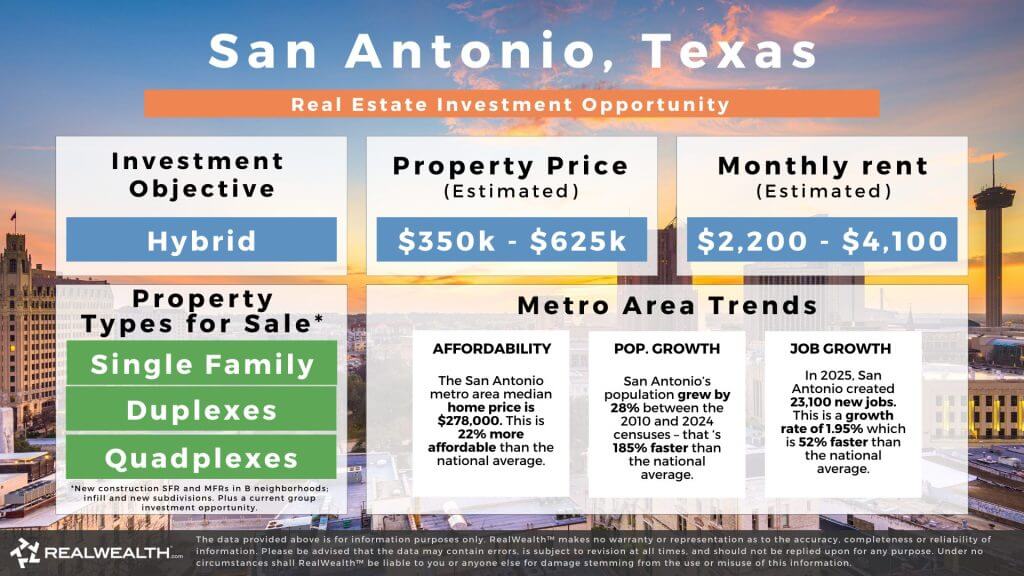

#3 San Antonio, Texas

San Antonio and the surrounding New Braunfels area have experienced significant growth, with a population increase of 34,000 residents from 2024 to 2025. What makes San Antonio stand out is its diverse economy, which includes healthcare, tourism, tech, and a large military presence (it’s nicknamed “Military City, U.S.A.” for a reason). Add a rich cultural heritage and affordability (a housing market that is 22.50% lower than the national average), and you’ve got a market that continues to attract new residents and investors alike.

MSA and Economy

The San Antonio-New Braunfels metro area has one of the most stable and diversified economies in Texas. The military is the city’s top employer, creating over 242,000 direct and indirect jobs. Healthcare is another primary sector, along with finance, tourism, and a growing cybersecurity hub supported by UTSA and other local universities. About 40 million tourists visit annually, generating significant revenue for the local economy. This economic diversity means the market can handle ups and downs better than cities dependent on just one or two industries, which is precisely what you want as a long-term real estate investor.

Population Growth

San Antonio’s population grew 28.33% from July 2010 to July 2024, well ahead of the national average. The metro is home to 2.8 million people and growing at 1.94% annually. The population is expected to continue increasing and exceed 3 million by 2030. People are moving here for the jobs, affordability, and quality of life. Sustained population growth drives housing demand, supporting long-term appreciation.

Job Growth

San Antonio added 23,100 new jobs with a job growth of 1.95%—well above the national average. The unemployment rate sits at 4.2% (Sept 2025), slightly lower than the national average. The city’s economy is anchored by major employers in healthcare, military installations, finance, and tourism. The cybersecurity sector is expanding, and the city continues investing in infrastructure ($46.5 million in public improvements). This job growth and economic stability are what drive housing demand and property value appreciation over time.

About the San Antonio Housing Market

Here’s what matters for rental property investors: San Antonio has a history of stability and resilience. As the seventh-largest city in the U.S., it’s attracted a diverse population for decades. The military foundation protects it from major market volatility, positioning it for a long-term investment strategy with steady appreciation. With an annual appreciation rate of 4.70% and 10-year equity growth of 58.36%, San Antonio delivers the consistent returns that buy-and-hold investors seek.

Investing Through Property Teams at RealWealth

The San Antonio turnkey real estate company we recommend sells new construction single-family homes, duplexes, and quadplexes. The average price for duplexes is $487,500, with rents averaging $3,150 (55.10% above the national average). To connect with the team, join RealWealth today.

San Antonio Housing Market Statistics

- Median Household Income: $88,500

- Metro Population: 2.8 Million

- 12-Year Population Growth: 28.33%

- Median Home Price: $278,002

- 1-Year Equity Growth: 4.70%

- 10-Year Equity Growth: 58.36%

- Median Rent Per Month: $1,404

- 1-Year Rent Growth: 3.34%

- 10-Year Rent Growth: 38.86%

- Job Growth: 23,100 jobs created over the last year

- 1-Year Job Growth Rate: 1.95% (higher than the national average)

- Unemployment Rate: 4.2% (slightly lower than the national average)

Top 3 Reasons to Invest in the San Antonio Real Estate Market in 2026

1. Steady appreciation in a stable market

San Antonio is built for long-term wealth building through appreciation. Home values have grown 4.70% year over year and 58.36% over the past decade. Rents have climbed 3.34% annually over 10 years. In addition, the market’s military foundation and diverse economy keep it stable even when other markets get shaky. For investors focused on building equity over time, that stability is gold.

2. Population growth with staying power

When a city grows 28.33% over 12 years and is projected to double by 2040, you know demand isn’t going anywhere. San Antonio gained 34,000 residents in just one year and ranks among the top 10 cities for population growth. People are moving here for jobs, affordability, culture, and quality of life. That kind of sustained migration means consistent rental demand and the property value growth that comes with it.

3. An economy that can weather storms

San Antonio’s economy is diverse and recession-resistant. The military creates over 242,000 jobs and provides a stable foundation that doesn’t disappear during downturns. Healthcare, finance, cybersecurity, and tourism round out the economy. The city is investing heavily in infrastructure and attracting businesses. When you’re making a long-term real estate investment, you want an economy that can handle market volatility.

How To Purchase Investment Property in San Antonio

- Market research: Different neighborhoods offer different opportunities, so be clear bout your investment strategy. In the Eastside, you’ll find more young professionals, while West San Antonio offers more budget-friendly entry points near major military employers.

- Legal considerations: Texas property taxes are higher than in some states; factor that into your calculations. Make sure you understand state laws around landlord rights and tenant protections. If you’re considering short-term rentals, research the local regulations as they vary by area.

- Investment strategy: The military presence is a double-edged sword. It creates consistent rental demand, but military relocations can impact vacancy rates. Build that into your planning. Also, if you’re looking at short-term rentals near tourist areas, understand the rules and make sure the numbers still work.

- Networking: Local real estate professionals and investor groups can give you insights you won’t find online. Connect with the San Antonio Property Team in RealWealth’s network today to view current turnkey rental property inventory, including single-family homes, duplexes, and quadplexes.

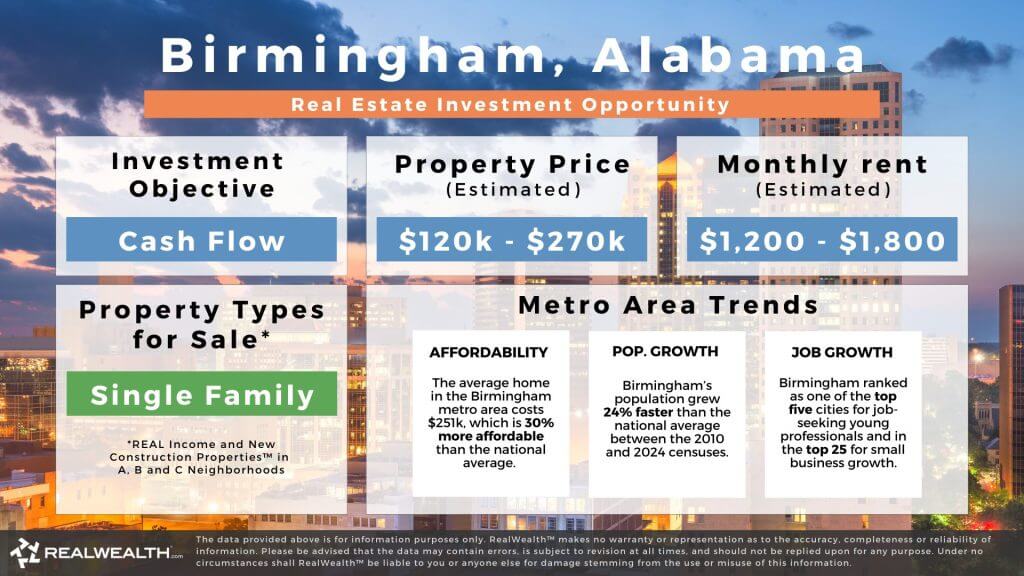

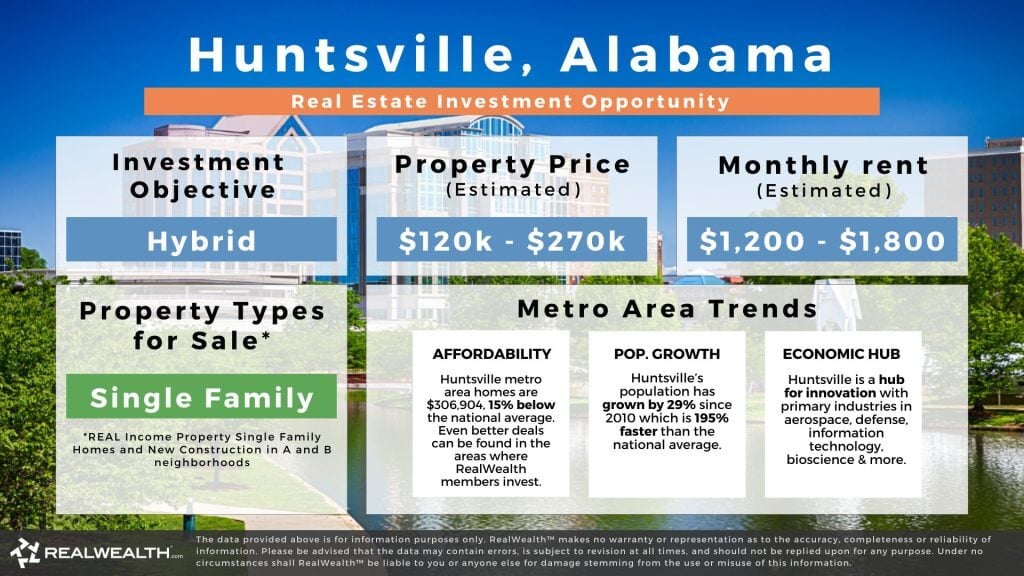

#4 Birmingham, Alabama

Birmingham, Alabama, is deeply tied to industries like iron and steel production, earning it the nickname “Pittsburgh of the South.” Over time, however, the city shifted away from these ctors and key industries now include aerospace, distribution, manufacturing, bioscience, healthcare, education, financial services, and technology. This transformation has brought economic stability and increased interest in Birmingham’s housing market. Adding to its appeal, the city boasts remarkable affordability, ranking third in cost of living out of 50 states. It has also been undergoing a renaissance with a forward-looking approach to urban development, making it one of the best places to buy rental property for cash flow investors. This change has brought economic stability and increased interest in Birmingham’s housing market.

MSA and Economy

The Birmingham-Hoover MSA has a diversified economy with aerospace, distribution, manufacturing, bioscience, healthcare, education, financial services, and technology. The Greater Birmingham Region actively attracts business development through incentives such as job credits, investment credits, and tax abatements. The Birmingham metro area’s GDP is projected to reach $90 billion in 2025. The city ranked 5th nationally for job growth from 2022 to 2023 and eighth in the “2024 Top States for Doing Business” report. This economic diversity and business-friendly environment support steady housing demand and create opportunities for rental property investors.

Population Growth

The Birmingham-Hoover MSA has experienced steady population growth, with 1.19 million residents in 2024, up 12.33% from 2010. For 2025, population estimates are expected to reach 1.2 million, with continued gradual growth reaching 1.3 million by 2030. This measured, stable growth creates a consistent demand for housing without the rapid price appreciation that can make markets volatile.

Job Growth

For 2025, forecasters predict that the Birmingham-Hoover MSA will add between 3,700 and 8,100 new jobs. The unemployment rate is 2.8%, below the national average. The area’s key industry sectors, combined with business incentives and a growing reputation as a business-friendly destination, drive the city’s robust job market and low unemployment. This job growth supports rental demand and provides stability for long-term investors.

About the Birmingham Housing Market

The Birmingham real estate market‘s affordability and cash flow opportunities make it one of the best places to buy rental property. The median home price is $251,416, approximately 30% less than the national average. Birmingham’s real estate market has demonstrated steady appreciation, with prices growing 83.22% over the last decade at an annual rate of 6.24%. Average rents stand at $1,366, up 39.89% over ten years at an annual rate of 3.41%. With 54% of households renting, Birmingham offers strong cash-flow potential and modest appreciation. In 2024, the metro saw a surge in new construction, creating opportunities for investors to access both renovated and new properties. Experts forecast steady growth in property values over time, free from the ups and downs experienced by more volatile markets.

Investing Through Turnkey Teams In RealWealth‘s Network

The Birmingham turnkey real estate companies in our network sell single-family and multi-family investment properties across Birmingham, Huntsville, and Tuscaloosa. The average price is $195,000, 45.71% lower than the national average. Rents average $1,500, providing solid cash-flow opportunities. The market’s affordability, potential for modest appreciation, and strong cash flow are major draws for real estate investors seeking the best places to buy rental property. To connect with the team, join RealWealth today.

Birmingham Housing Market Statistics

- Median Household Income: $69,284

- Metro Population: 1.18 Million

- 12-Year Population Growth: 12.33%

- Median Home Price: $251,416

- 1-Year Equity Growth: 6.24%

- 10-Year Equity Growth: 83.22%

- Median Rent Per Month: $1,366

- 1-Year Rent Growth: 3.41%

- 10-Year Rent Growth: 39.89%

- Job Growth: 3,700+ jobs created

- 1-Year Job Growth Rate: .16% (lower than the national average)

- Unemployment Rate: 3.1% (lower than the national average)

Top 3 Reasons to Invest in the Birmingham Real Estate Market in 2026

1. Strong cash flow opportunities

Birmingham creates an environment conducive to generating consistent passive income. With reasonable property prices (median home price of $251,416, 30% less than the national average), moderate operating costs, steady rent growth, and low state income taxes, investors can achieve strong cash-on-cash returns. The area’s cost of living is 9% lower than the national average, and housing expenses are 24% lower. With 54% of households renting, there’s solid demand for rental properties. For investors focused on monthly cash flow, Birmingham delivers.

2. Exceptional affordability

Birmingham is known as one of the most affordable housing markets in the country, with an average home price of $251,416, 30% below the national average. This affordability creates opportunities for investors to acquire multiple properties and build their real estate portfolios faster than in higher-priced markets. Alabama ranks third in cost of living, making Birmingham attractive to renters seeking affordability and investors seeking value.

3. thriving job market

Birmingham-Hoover MSA is a hub of economic growth, ranking 5th nationally for job growth (2022 to 2023) and eighth in the “2024 Top States for Doing Business” report. While recent job growth has been modest (estimated at 3,700 jobs added in 2025), the unemployment rate remains low at 3.1%, below the national average. The metro’s diverse industry sectors, business incentives, and landlord-friendly laws contribute to economic stability and consistent demand for rental properties. This stable economic environment supports reliable rental income for long-term investors.

How To Purchase Investment Property in Birmingham

- Identify growth areas: Look for properties in neighborhoods with new business development and employment opportunities. The Birmingham metro area offers options across Birmingham, Huntsville, and Tuscaloosa, providing diverse investment opportunities at various price points.

- Renovated vs. new construction: Birmingham offers both renovated properties and new construction options. Renovated single-family homes and duplexes typically range from $120K-$160K, while new construction single-family homes range from $240K-$270K. Choose based on your investment strategy and cash flow goals.

- Tax considerations: Learn about Alabama’s property taxes to see how they’ll affect your investment costs. Alabama has some of the lowest property taxes in the country, which helps improve cash flow.

- Work with a local team: Work with Birmingham-based real estate agents, property managers, and contractors knowledgeable in rehabilitating properties for high rental yields. Connect with the Birmingham Property Team in RealWealth’s network today to view current turnkey rental property inventory for single-family homes and duplexes.

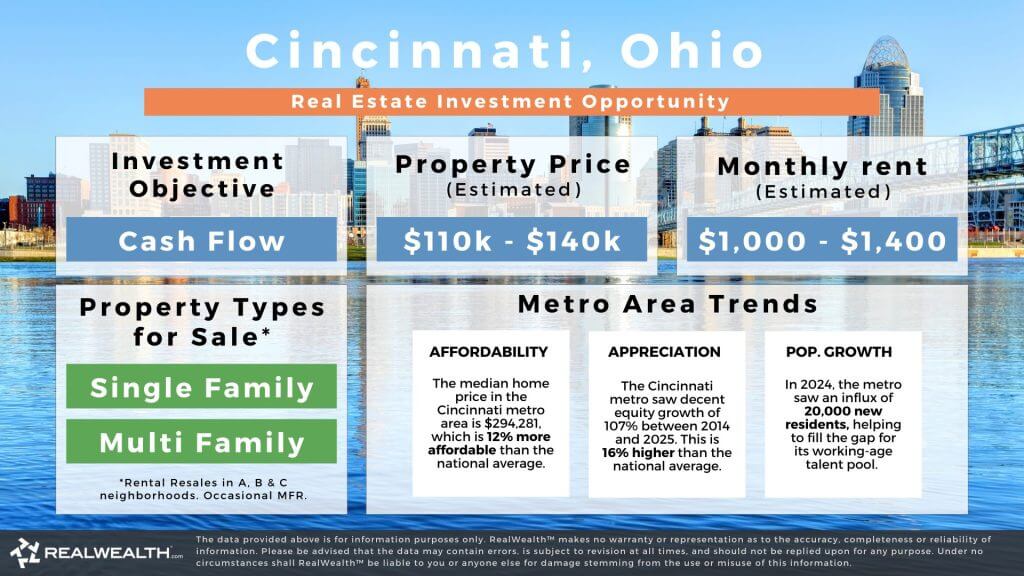

#5 Cincinnati, Ohio

Cincinnati, Ohio, is known for its beer, baseball (Cincinnati Reds), and historic architecture. Many neighborhoods and downtown are pedestrian-friendly, and the Cincinnati Metro bus route is estimated to bring at least 20% of the workforce into downtown. Across the Ohio River in Kentucky is the Cincinnati/Northern Kentucky International Airport, which is 13 miles from downtown. The established infrastructure in the Cincinnati, OH-KY-IN MSA enhances its livability and sustains real estate demand. With steady appreciation, affordability, and a diverse economy, Cincinnati is one of the best places to buy rental property.

MSA and Economy

The Cincinnati MSA has a stronghold on exports in aerospace ($4.25 billion), medical instruments ($1.35 billion), and chemical analysis instruments ($376 million). In regional exports per capita, the city often outperforms other top metros, including Detroit, Indianapolis, and Dallas. Its strategic location along the Ohio River and the presence of major companies, including 8 Fortune 500 headquarters, have established this Midwest city as an economic powerhouse. Transportation, warehousing, consumer goods, and healthcare have also been crucial to Cincinnati’s economy. The GDP for 2025 is expected to be $198 billion. The Cincinnati Regional Chamber reports that, over the past five years, the region’s GDP has been 24% higher than the rest of the state.

Population Growth

The current population of the Cincinnati, OH-KY-IN MSA is 2.33 million. In 2024, the metro added over 20,000 residents. Counties leading the way for population growth are Hamilton and Butler, with Boone, Kentucky, coming in third. By 2050, projected population growth is expected to reach 2.9 million. This steady population growth, combined with Connected Communities zoning legislation that fosters strategic business and housing developments, supports the increase in the affordable housing supply.

Job Growth

Between August 2024 and August 2025, the Cincinnati metro area added 8,200 jobs, with a job growth rate of 0.70%. According to the Federal Reserve Economic Data (FRED), jobs in Cincinnati have grown steadily since 1990, with only brief declines during the COVID-19 pandemic and the 2008 market crash. The unemployment rate is 3.9%, below the national average. The diverse economy spans manufacturing, logistics, healthcare, and financial services, creating stable employment that supports rental demand and property values.

About the Cincinnati Housing Market

In 2026, the Cincinnati real estate market is poised for moderate growth and steady appreciation. Job creation and the constant influx of professionals seeking long-term residences provide opportunities for investors seeking a stable, profitable real estate market with balanced cash flow and appreciation. The area’s affordability helps real estate investors leverage appreciation gains over time. The average home price is $294,281, 17.96% lower than the national average. Over the last ten years, home appreciation has increased by 107.11%, with an annual rate of 7.55%. Rents have also increased steadily, with a 10-year growth of 54.29% and a yearly rate of 4.43%. Average rents stand at $1,530. Inventory remains low, and sought-after neighborhoods may be more competitive than others.

Investing Through Turnkey Teams In RealWealth‘s Network

The Cincinnati turnkey real estate company we recommend sells single-family investment properties, and occasionally duplexes. The average price is $125,000, 65.20% lower than the national average. Rents average $1,200. The market’s exceptional affordability, steady appreciation, and diverse economy are major draws for real estate investors seeking the best places to buy rental property. To connect with the team, join RealWealth today.

Cincinnati Housing Market Statistics

- Median Household Income: $81,489

- Metro Population: 2.33 Million

- 12-Year Population Growth: 7.57%

- Median Home Price: $294,281

- 1-Year Equity Growth: 7.55%

- 10-Year Equity Growth: 107.11%

- Median Rent Per Month: $1,530

- 1-Year Rent Growth: 4.43%

- 10-Year Rent Growth: 54.29%

- Job Growth: +8,200 jobs created

- 1-Year Job Growth Rate: .07% (slightly higher than the national average)

- Unemployment Rate: 3.9% (16% lower than the national average)

Top 3 Reasons to Invest in the Cincinnati Real Estate Market in 2026

1. Strong home price and rent appreciation

Cincinnati’s real estate market has shown substantial growth. Over the past ten years, home prices rose by 107.11%, with an annual rate of 7.55%. During that same period, rents grew by 54.29%. The 2025 State of the Region Report noted that Cincinnati reported a 3.2% increase in home values, outpacing cities such as Indianapolis, St. Louis, and Atlanta. Rents also grew by 4.5% between May 2024 and May 2025, outpacing cities like Cleveland, Kansas City, and Pittsburgh. The numbers point to a market with healthy growth in both the housing and rental sectors.

2. Stable and diverse employment growth

Cincinnati’s economy is strong in several areas: exports, manufacturing, logistics, healthcare, and financial services. According to the 2025 State of the Region Report, healthcare is the largest employer in the Cincinnati region, followed by government, manufacturing, and retail. Over the next decade, 69,362 jobs are projected to be added to the economy. This economic diversity and stability support consistent rental demand and reduce investment risk.

3. Affordability

Cincinnati is known for its affordability, with a cost of living 3% lower than the national average. The average home price is $294,281, 17.96% lower than the national average. Investors can find a range of investment opportunities, including turnkey properties at $125,000. This affordability extends across the entire market, making it one of the best places to buy rental property. A lower cost of living attracts young professionals and families, driving demand for homes. The affordability of Cincinnati’s properties, combined with strong appreciation potential, makes it a smart choice for real estate investors seeking both cash flow and equity growth.

How To Purchase Investment Property in Cincinnati

- Market research: Monitor Cincinnati’s neighborhood revitalization efforts and invest accordingly. The Connected Communities zoning legislation approved in 2024 is fostering strategic business and housing developments that will create opportunities.

- Financing: Explore Ohio’s first-time investor loan programs and urban development incentives, including the Ohio Opportunity Zones Tax Credit program. These programs can improve your returns and reduce barriers to entry.

- Work with a local expert: Engage with Cincinnati real estate professionals who understand the local market dynamics. Connect with the Cincinnati Property Team in RealWealth’s network today to view current turnkey rental property inventory.

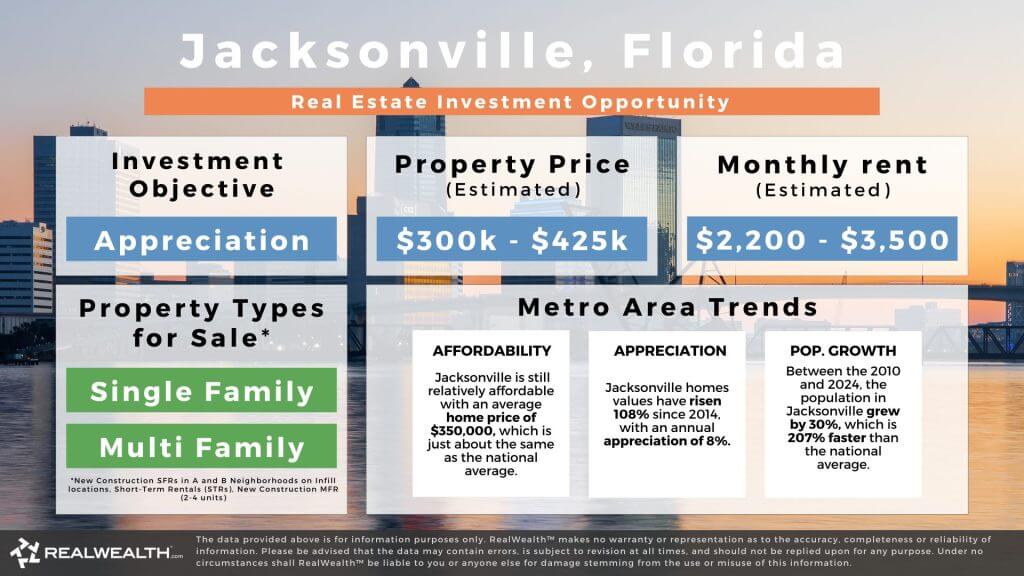

#6 Jacksonville, Florida

Jacksonville, Florida, is the 11th-largest city in the United States, with a population of 1.4 million. A key driver of its growth is affordability. The cost of living is 9% below the national average, which is a significant draw for people relocating from higher-cost regions, especially the Northeast. Add in economic stability, beautiful beaches, and year-round warm weather, and you’ve got a city that keeps attracting new residents, which means strong demand for rental properties.

MSA and Economy

Jacksonville’s economy isn’t tied to just one industry, which is good news for real estate investors. The city has a strong presence in finance, healthcare, logistics, manufacturing, and tech. It’s also home to multiple military facilities and three Fortune 500 companies. Downtown alone has over 2,400 businesses and a daytime workforce of 53,450 people. This economic diversity helps keep the market stable even when certain sectors slow, making it a solid choice for long-term rental property investments.

Population Growth

Jacksonville has been growing. The metro reached 1.76 million residents and has grown 30.52% over the past 12 years—that’s more than triple the national average. The city added more than 130,000 residents over the last decade and now ranks as the sixth most popular city for relocation. People are drawn here for the lower cost of living, warm weather, proximity to beaches, and job opportunities. This kind of sustained population growth is exactly what creates consistent demand for rental housing.

Job Growth

Jacksonville added 10,500 jobs in 2025. Its job growth is at 1.3%, higher than the national average, and the unemployment rate is 4.3% (Sept 2025). The city’s strategic location has turned it into a major hub for logistics and distribution. Other strong sectors include advanced manufacturing, aviation and aerospace, finance, IT, and life sciences. This diverse job market means the economy can handle ups and downs better than cities dependent on just one or two industries.

About the Jacksonville Housing Market

The Jacksonville real estate market is stabilizing and shifting to a buyer’s market, which is actually good news for investors. The median home price is $350,687, 2.23% below the national average, with average rent at $1,672. Homes are appreciating at 7.62% yearly, with 10-year equity growth of 108.34%, and rents are growing at 4.15% annually, with 10-year rent growth of 50.15%. People continue to move to Jacksonville for the job market, affordability, and quality of life. That steady demand keeps market fundamentals strong and makes Jacksonville one of the best cities in Florida for buying rental property.

Investing Through Turnkey Teams In RealWealth‘s Network

The Jacksonville turnkey real estate company we recommend sells single-family and duplex investment properties. The average price is $367,500, 2.45% higher than the national average. Rents average $2,850, 40.32% higher than the national average. The market’s strong appreciation potential, rapid population growth, and diverse economy are major draws for real estate investors seeking the best places to buy rental property. To connect with the team, join RealWealth today.

Jacksonville Housing Market Statistics

- Median Household Income: $87,378

- Metro Population: 1.76 Million

- 12-Year Population Growth: 30.52%

- Median Home Price: $350,687

- 1-Year Equity Growth: 7.62%

- 10-Year Equity Growth: 108.34%

- Median Rent Per Month: $1,672

- 1-Year Rent Growth: 4.15%

- 10-Year Rent Growth: 50.15%

- Job Growth: +10,500 jobs created over the last year

- 1-Year Job Growth Rate: 1.5% (higher than the national average)

- Unemployment Rate: 4.3% (slightly lower than the national average)

Top 3 Reasons to Invest in the Jacksonville Real Estate Market in 2026

1. Population growth that won’t quit

When a city grows 30.52% in 12 years—three times the national average—you know demand for housing isn’t going away. Jacksonville added over 130,000 residents in the last decade and ranks as the sixth most popular city where people move to. They’re coming for the affordability, the weather, the beaches, and the jobs. That kind of sustained migration creates the rental demand and property value growth investors need.

2. A job market built to last

Jacksonville isn’t dependent on one industry, and that matters when you’re making a long-term investment. The city added 12,400 jobs last year, with unemployment at 3.6%. It’s a major logistics hub with strong sectors in manufacturing, aviation, finance, and tech. When the economy dips, cities with diverse job markets handle it better. That translates to more stable rental income and property values for real estate investors.

3. Steady appreciation & Affordability

Jacksonville has been delivering consistent appreciation—7.62% year-over-year—while keeping entry prices reasonable. Over the past decade, home values jumped 108.34%, and rents climbed 50.15%. What makes this special is you’re getting strong long-term equity growth without the sky-high purchase prices you’d find in other Florida markets. For investors focused on building wealth through real estate, that’s a winning combination.

How To Purchase Investment Property in Jacksonville

- Market research: Different neighborhoods offer different opportunities. Downtown Jacksonville and Orange Park tend to be higher-end investments, while Inverness gives you more affordable entry points. Know what fits your budget and strategy.

- Insurance costs: Florida does not have a state income tax, which can benefit rental income. But here’s something you need to factor in: hurricane insurance. Properties close to water can have higher insurance costs, so make sure you’re running the numbers correctly.

- Build a network: Connecting with local real estate agents and investors can provide valuable insights into the market and help you find good deals. Connect with the Jacksonville turnkey team in RealWealth’s network today to view current turnkey rental property inventory for both single-family homes and duplexes.

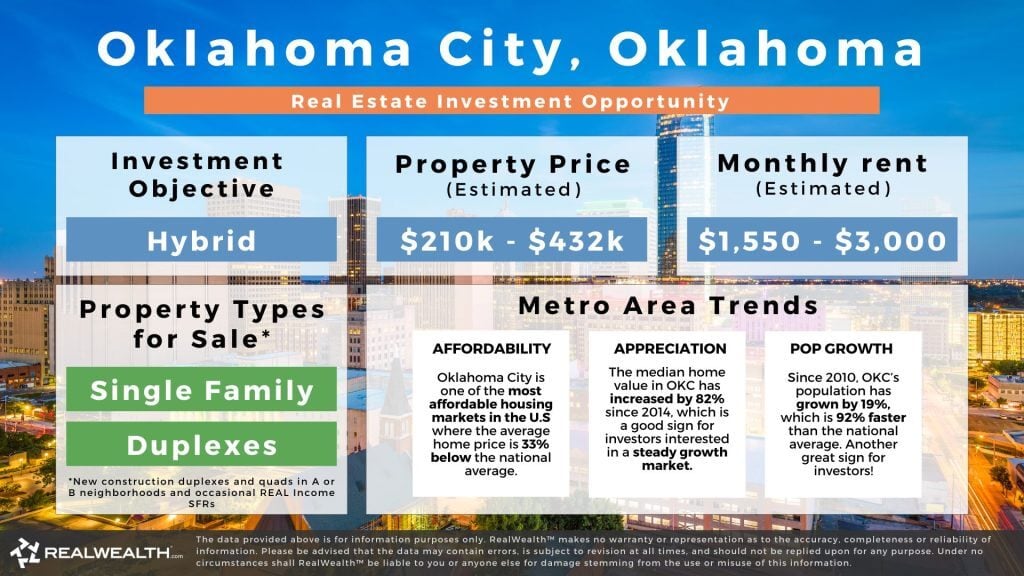

#7 Oklahoma City, Oklahoma

Oklahoma City is the capital of Oklahoma and the state’s largest city. Known as OKC, the city offers affordable living, a family-friendly environment, outdoor recreation, a vibrant downtown, and a growing economy. It has an established, extensive transportation network, including Will Rogers World Airport (averaging 150 commercial flights daily) and three major interstates (I-35, I-40, and I-44) that pass through the city. Businesses appreciate its tax credits, incentives, and tax packages. With steady appreciation and affordability, Oklahoma City is one of the best cities to buy rental property in today’s market.

MSA and the Economy

In the 1980s, Oklahoma City started diversifying its economy, and that diversification has paid off. Primary industries include aerospace, advanced manufacturing, biotech, tech, education, and healthcare. The city’s major employers include the State of Oklahoma (37,000 employees), Tinker Air Force Base (26,000 employees), Oklahoma State University (13,940 employees), and INTEGRIS Health (11,000 employees). This economic diversity creates stability and consistent job growth, which supports housing demand and property values.

Population Growth

The Greater Oklahoma City Chamber reports the area continues to experience population and economic growth. Since 2010, the population has increased by 19%, reaching 1.54 million residents in 2025. The metro is expected to reach 2 million by 2040. People are drawn to the area for its low cost of living, outdoor spaces, entertainment, and affordable housing. A report projects the market will need more than 70,000 new housing units by 2030, signaling continued growth to support housing demand.

Job Growth

Between August 2024 and August 2025, Oklahoma City added 8,600 jobs, with a job growth rate of 1.22%—higher than the national average. The unemployment rate is 3.5%, below the national average. With continued business development and expansion, job growth shows no signs of slowing down. Leading the way are aerospace, healthcare, tech, and hospitality. The city appeals to young professionals with career opportunities, short commute times, and affordable housing, three key factors that drive rental demand.

About the Oklahoma City Housing Market

The Oklahoma City housing market benefits from a stable, highly diversified economy and is among the most affordable places to invest. The median sale price is $238,751, significantly below the national average. Together with Tulsa, Oklahoma City has a higher percentage of reasonably priced homes than many other cities nationwide. Even though home prices have risen in line with general U.S. housing trends, investors can still find homes priced under $150K here. The annual appreciation rate is 6.18%, and over the past 10 years, home values have increased by 82.18%. Average rents stand at $1,334, with yearly growth of 3.67% and 10-year rent growth of 43.37%. The city’s affordability and steady appreciation make it attractive to investors focused on long-term value creation.

Investing Through Turnkey Teams In RealWealth‘s Network

The Oklahoma turnkey real estate company we recommend sells single-family and duplex investment properties. The average price is $321,000, 10.51% lower than the national average. Rents average $2,275, 12.01% higher than the national average. The market’s exceptional affordability, steady appreciation, and diverse economy are major draws for real estate investors seeking the best places to buy rental property. To connect with the team, join RealWealth today.

Oklahoma City Housing Market Statistics

- Median Household Income: $75,229

- Metro Population: 1.54 Million

- 12-Year Population Growth: 19.08%

- Median Home Price: $238,751

- 1-Year Equity Growth: 6.18%

- 10-Year Equity Growth: 82.18%

- Median Rent Per Month: $1,334

- 1-Year Rent Growth: 3.67%

- 10-Year Rent Growth: 43.37%

- Job Growth: +8,600 jobs created

- 1-Year Job Growth Rate: 1.22% (higher than the national average)

- Unemployment Rate: 3.3% (lower than the national average)

Top 3 Reasons to Invest in the Oklahoma City Real Estate Market in 2026

1. Affordability for Investors

Oklahoma City’s real estate market is one of the most affordable in the country. The cost of living is 16% lower than the national average, with housing expenses 41% lower. Oklahoma City ranks as the #1 city with the lowest cost of living among large populations exceeding 500,000. While the median price is $238,751, investors can still find homes priced under $150K. This affordability maximizes buying power and portfolio growth.

2. Steady appreciation driven by revitalization

Oklahoma City’s real estate market has appreciated steadily over the past decade, with the average home price increasing by more than 82%. While growth hasn’t been as explosive as some other U.S. metros, it’s been consistent and sustainable. Part of this can be attributed to the city’s commitment to revitalization through its Metropolitan Area Projects (MAPs) program, which has led to over $7 billion in investments to revitalize the downtown area and attract new businesses. This ongoing investment in infrastructure and development supports continued property appreciation.

3. Strong rental demand and job growth

Oklahoma City has strong rental demand, with 43% of households renting (in Tulsa, 49%). The combination of affordability and growing job opportunities attracts young professionals and families seeking a high quality of life. The Oklahoma Employment Security Commission projects 10.4% job growth between 2020 and 2030. The city’s vibrant arts scene, including the entertainment hub of Bricktown, and outdoor activities along the Oklahoma River, enhance its appeal. This combination of job growth, affordability, and quality of life creates consistent rental demand.

How To Purchase Investment Property in Oklahoma City

- Focus on economic hubs: Look for properties near job centers and areas with infrastructure developments. Areas like Downtown OKC and Edmond are popular economic hubs. Properties are also available in nearby areas, such as Lawton (duplexes) and Perry (single-family homes), offering different price points and investment opportunities.

- Understand state and local laws: Familiarize yourself with Oklahoma’s landlord-tenant laws, including details on security deposits and eviction procedures. This knowledge is vital for all property investors and will help you operate your rentals smoothly.

- Tax incentives: Research state and local programs that offer tax breaks for property rehabilitation, particularly in districts earmarked for revitalization projects. These incentives can improve your investment returns and support the city’s ongoing development efforts.

- Property management: Consider partnering with a property management company familiar with the Oklahoma City market to handle day-to-day operations. Connect with the Oklahoma City Property Team in RealWealth’s network today to view current turnkey rental property inventory for both single-family homes and duplexes.

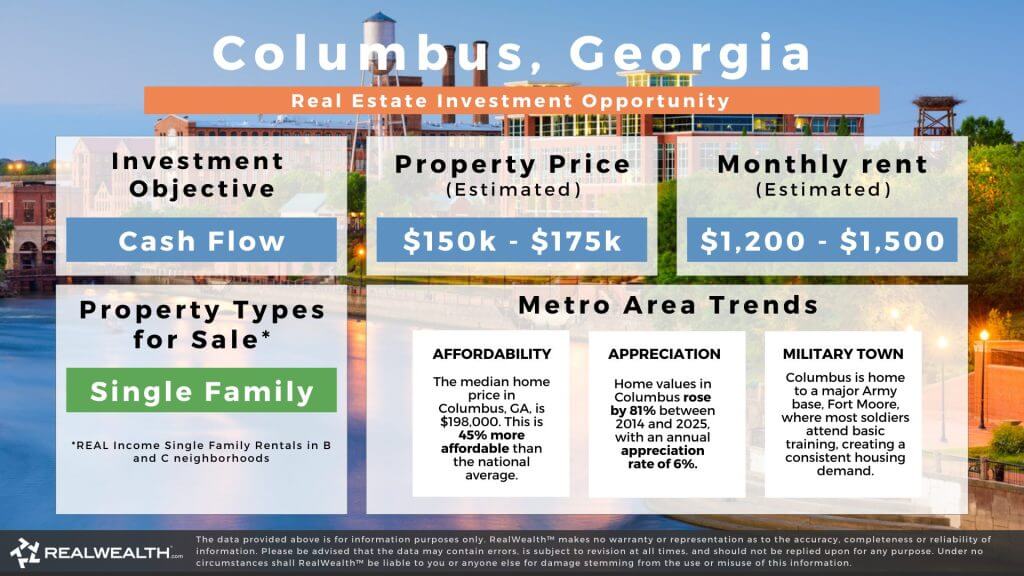

#8 Columbus, Georgia

Columbus is Georgia’s second-largest city, 109 miles south of Atlanta. The Chattahoochee River is a prominent feature, and the popular 15-mile riverwalk stretches from downtown to Bibb City Historic District. The river features the world’s longest whitewater rafting course, making it a popular destination for tourists. The town has a vibrant restaurant scene, unique historical sites, museums, and outdoor activities. Its lower cost of living, especially compared to Atlanta, job opportunities, the military base, outdoor activities, and overall quality of life attract residents and a steady stream of visitors. In addition, just minutes from neighboring Phenix City, Alabama.

MSA and the Economy

The Columbus, GA-AL Metro is Georgia’s fourth-largest metro area, consisting of six counties in Georgia and one in Alabama. The city attracts new businesses and development thanks to its low cost of doing business, easy access to water, electricity, rail transportation, and zoning designed for business growth. Columbus’s main industries include defense, aerospace, financial services, automotive, technology, robotics, hospitality, education, healthcare, and leisure. It’s also home to Fortune 500 companies like Aflac and Coca-Cola. Fort Moore supports more than 120,000 active-duty military personnel and their families. The area’s 11 educational institutions, such as Columbus State, Troy University, and Columbus Technical College, help build a highly skilled workforce that supports and attracts businesses and entrepreneurs.

Population Growth

The Columbus, GA-AL MSA has a total population of 326,693. Over the past decade, the population grew by 4.80%. The population is expected to reach 330,000 by 2029. Currently, most residents are of working age. This steady population base, combined with the military presence at Fort Moore, creates consistent housing demand.

Job Growth

With its business-friendly climate, Columbus continues to attract new businesses and business developments. This past year (2025) saw a boom in business growth with several significant investments totalling $408 million, creating 1,230 jobs. The town’s proximity to Fort Moore gives it an edge, particularly in the aviation sector. Each year, approximately 700 soldiers choose to remain and work in the area after leaving Fort Moore. The unemployment rate sits at 4.1%, slightly below the national average. Growing employment opportunities, anchored by the military base and defense and aerospace sectors, support consistent rental demand.

About the Columbus Housing Market

The Columbus, Georgia, housing market has experienced notable growth and activity. The median home price is $198,208, 44.74% below the national average. This exceptional affordability attracts real estate investors seeking lower entry points and cash flow opportunities. The annual appreciation rate is 6.11%, and over the past 10 years, home values have increased by 80.90%. Average rents stand at $1,283, with a 5.29% annual growth rate and a 10-year growth rate of 67.37%. Half of households are renter-occupied, and a steady stream of military personnel, working professionals, and students sustains housing demand. For investors seeking strong cash flow with modest appreciation in an affordable market, Columbus delivers.

Investing Through Turnkey Teams In RealWealth‘s Network

The Columbus turnkey real estate company we work with sells single-family investment properties. The average price is $150,000, 58.18% lower than the national average. Rents average $1,250, providing excellent cash flow. The market’s exceptional affordability, modest appreciation potential, and strong cash flow are major draws for real estate investors seeking the best places to buy rental property. To connect with the team, join RealWealth today.

Columbus Housing Market Statistics

- Median Household Income: $56,622

- Metro Population: 326,693

- 12-Year Population Growth: 4.80%

- Median Home Price: $198,208

- 1-Year Equity Growth: 6.11%

- 10-Year Equity Growth: 80.90%

- Median Rent Per Month: $1,283

- 1-Year Rent Growth: 5.29%

- 10-Year Rent Growth: 67.37%

- Job Growth: +1,230 jobs created

- 1-Year Job Growth Rate: 1.1% (higher than the national average)

- Unemployment Rate: 4% (lower than the national average)

Top 3 Reasons to Invest in the Columbus, GA Real Estate Market in 2026

1. Exceptional Affordability

The cost of living in Columbus, GA-AL MSA is 13% lower than the national average. The average home value is $198,208, 44.74% below the national average, with investment properties available for around $150,000. This lower entry point attracts real estate investors seeking more affordable opportunities and strong cash-flow potential. The combination of low acquisition costs and solid rents creates excellent cash-on-cash returns for investors focused on monthly income.

2. Steady appreciation

Columbus has delivered consistent appreciation over the past decade. Homes have appreciated 80.90% over the past 10 years, at an annual rate of 6.11%. For buy-and-hold investors, a low entry point combined with steady appreciation can boost long-term equity gains. While appreciation may not be as explosive as in some markets, Columbus’s stability and affordability make it an attractive option for investors seeking to build wealth through real estate.

3. Increasing rents and housing demand

The average rent in Columbus is $1,283, with a yearly appreciation rate of 5.29%. Over the past 10 years, rents have increased by 67.37%. Half of households are renter-occupied, and a steady stream of military personnel from Fort Moore, working professionals, and students sustains consistent housing demand. This diverse tenant base, combined with the area’s affordability, creates stable occupancy rates and reliable rental income for long-term investors.

How To Purchase Investment Property in Columbus

- Research the market: Familiarize yourself with the different counties and neighborhoods and their investment potential. Understanding the areas near Fort Moore and the various employment centers will help you identify properties with the strongest rental demand.

- Evaluate your strategy: Know the why behind your investing strategy. If your strategy is to buy and hold, Columbus may be a good market for your goals.

- Work with a local team: Our nationwide network of resources and professional property teams can help you find a property that fits your needs. Connect with the Columbus turnkey team in RealWealth’s network today to view available turnkey rental property inventory.

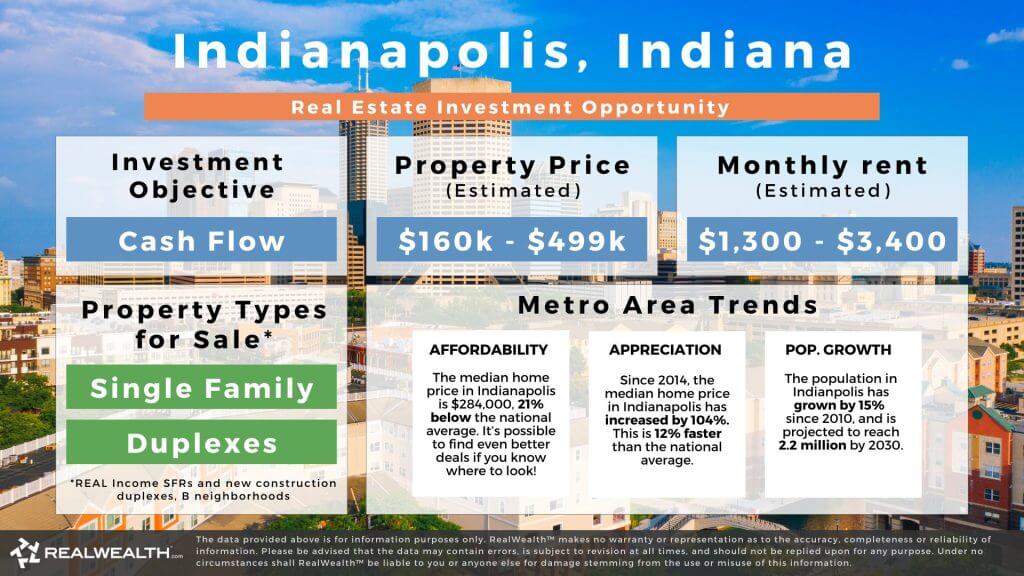

#9 Indianapolis, Indiana

The Indianapolis real estate market offers investors strong economic growth and affordability in America’s heartland. The Indianapolis-Carmel-Anderson metro area has experienced steady population growth, with suburban counties such as Hancock and Boone leading the way. Despite the national housing market’s price surge, Indianapolis remains relatively affordable, with a median home price of $272,161—24% lower than the national average. This affordability, combined with positive cash flow opportunities and the region’s robust economic growth, makes Indianapolis one of the best places to buy rental property.

MSA and Economy

The Indianapolis-Carmel-Anderson diversified economy sets it apart from other Midwest markets and provides a solid foundation for the local housing market. In addition, its GDP is projected to grow by 2.1% in 2025. Several factors are driving this increase, including new capital projects, like the Traction Yard redevelopment project ($600 million investment), a new Hilton hotel ($780 million investment), and completion of the new IU Health campus ($4.3 billion investment), sports and entertainment convention business, manufacturing expansions, and population growth. The city is a hub for healthcare, manufacturing, and education sectors. Major employers include IU Health (the region’s largest employer, with over 32,000 employees), leading logistics and transportation companies such as FedEx Express and CSX, and pharmaceutical companies such as Eli Lilly and Roche Diagnostics.

Population Growth

The Indianapolis metro area has grown consistently, with 2.22 million people in 2025 and projections to reach 2.2 million by 2030. The population has increased by 14.91% over the past 12 years, outpacing the U.S. average. This steady influx of new residents creates reliable demand for housing in the city and surrounding suburbs, supporting both rental occupancy and property values.

Job Growth

Between August 2024 and August 2025, the Indianapolis metro area created 12,500 jobs, with a 1.05% annual job growth rate, higher than the national average. As of September 2025, the unemployment rate is 3.7%, below the national average. The city’s job market is anchored in healthcare (led by IU Health), manufacturing, logistics, transportation, and pharmaceuticals. This diverse employment base helps maintain housing demand and provides stability for real estate investors.

About the Indianapolis Housing Market

For investors seeking cash flow with modest appreciation, Indianapolis offers a balanced opportunity as the housing market has risen consistently in recent years. In 2025, the median sales price for single-family homes was $284,099, with an annual appreciation rate of 7.39%. Over the past 10 years, home values have increased by 104.02%. Average rents stand at $1,492, with an annual growth rate of 3.84% and a 10-year growth rate of 45.79%. The city often ranks among the top investment markets, and in 2026, it made the National Association of REALTORS®’ list of 10 Home Buy Hot Spots to Watch.

Investing Through Turnkey Teams In RealWealth‘s Network

The Indianapolis turnkey real estate company in our network sells single-family and duplex investment properties in outlying cities like Muncie, Anderson, Elwood, and Rockport. The average price is $329,500, 8.14% lower than the national average. Rents average $2,350, 15.71% higher than the national average. The market’s affordability, strong rental demand, and steady appreciation are major draws for real estate investors seeking the best places to buy rental property. To connect with the team, join RealWealth today.

Indianapolis Housing Market Statistics

- Median Household Income: $69,477

- Metro Population: 2.2 Million

- 12-Year Population Growth: 14.91%

- Median Home Price: $284,099

- 1-Year Equity Growth: 7.39%

- 10-Year Equity Growth: 104.02%

- Median Rent Per Month: $1,492

- 1-Year Rent Growth: 3.84%

10-Year Rent Growth: 45.79% - Job Growth: +12,500 jobs created over the last year

- 1-Year Job Growth Rate: 1.05% (higher than the national average)

- Unemployment Rate: 3.8% (lower than the national average)

Top 3 Reasons to Invest in the Indianapolis Real Estate Market in 2026

1. Cash Flow & Affordability

Indianapolis offers a more accessible real estate market compared to the national average. The median home price is $284,099, 20.80% lower than the national average. This lower entry point means better cash-on-cash returns for investors.

2. Steady population growth driving demand

The Indianapolis metro area has grown steadily over the last 12 years, reaching 2.22 million residents, and is projected to add 383,000 people between 2020 and 2060. This steady influx of new residents creates reliable demand for housing in the city and surrounding suburbs. Consistent population growth supports stable occupancy rates and rental demand, which are essential for cash-flow investing.

3. Appreciating Home Prices and Rents

The Indianapolis real estate market also delivers modest annual appreciation, averaging 7.39%, outpacing the national average. Over the past decade, home values have grown 104.02%. Rent appreciation has also been strong at 3.84% per year, with 45.79% growth over 10 years. This consistent growth in property values and rental income provides investors with both monthly cash flow and long-term equity growth, making this Midwest market a balanced investment opportunity. investors.

How To Purchase Investment Property in Indianapolis

- Identify the best areas: Familiarize yourself with different areas and their investment potential. New Castle and Muncie offer affordable entry points with solid cash flow, while areas closer to Indianapolis proper may offer more appreciation potential. Understand which neighborhoods align with your investment strategy.

- Legal framework: Indiana’s laws are generally considered favorable to landlords. However, be mindful of local ordinances in Marion County or specific Indianapolis city regulations.

- Research: Revitalization efforts in specific neighborhoods and monitor potential property tax changes. Understanding local development trends can help you identify areas with growth potential.

- Investment strategy: Given relatively low property prices, investors may consider acquiring multiple properties to diversify their portfolios and maximize cash flow. Lower entry costs make it easier to scale your rental portfolio in Indianapolis compared to higher-priced markets.

- Get assistance: Partner with experts who know the Indianapolis market and surrounding areas well. Connect with the Indianapolis turnkey team in RealWealth’s network today to view current turnkey rental property inventory for both single-family homes and duplexes.

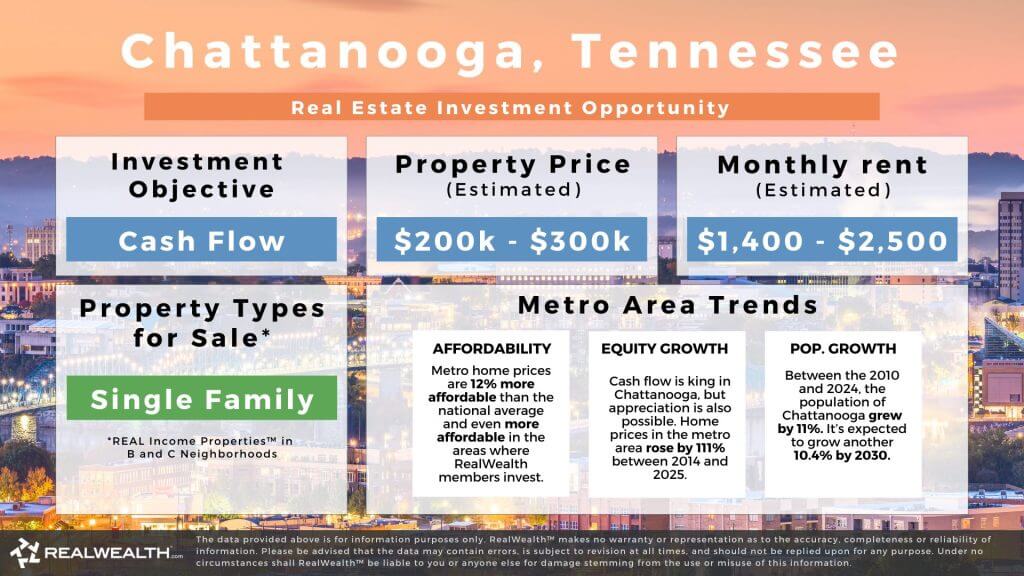

#10 Chattanooga, Tennessee

Tucked along the Tennessee River at the foot of the Appalachians in Southeast Tennessee, Chattanooga is known for its natural beauty and vibrant arts, entertainment, and cultural scene. Small businesses and start-ups are drawn to the city’s innovative thinking, which brought gigabit-speed internet to the community, earning it the nickname “Gig City.” All of this has helped attract professionals and young families to the area, making it one of the best places to buy rental property.

MSA and the Economy

The Chattanooga, TN-GA metropolitan statistical area covers two states, Tennessee and Georgia, with three counties in each. The Chattanooga Area Chamber reports that the top industry sectors include finance, insurance, real estate, manufacturing, education, and healthcare. The GDP is $42.83 billion, a 5.2% increase from 2022 to 2023. Major employers include BlueCross BlueShield of Tennessee, Erlanger Health System, and Volkswagen Group of America. This economic diversity, combined with the manufacturing sector boom, provides a solid foundation for the local housing market.

Population Growth

The Chattanooga, TN-GA MSA has been growing steadily. For 2025 estimates, the population is 597,679 residents. The Boyd Center for Business and Economic Research projects the population to increase by 10.4% by 2030. This consistent population growth and the area’s cost of living drive housing demand, supporting both rental occupancy and property values.

Job Growth

The Center for Regional Economic Research (CRER) reports that the Chattanooga MSA has experienced higher-than-average employment growth over the past ten years, driven primarily by the manufacturing sector. In 2026, job growth is expected to be slightly slower, with a projected 6,700 jobs added. The unemployment rate is 3.3%, well below the national average. Manufacturing, government, education, healthcare, and professional services are the top employment sectors.

Investing Through Turnkey Teams In RealWealth‘s Network

The Chattanooga turnkey real estate company in our network specializes in selling single-family and multifamily investment properties. The average price is $250,000, 30% lower than the national average. Rents average $1,950, 1.5% higher than the national average. Market affordability, potential for appreciation, and strong cash flow are major draws for real estate investors seeking the best places to buy rental property. To connect with the team, join RealWealth today.

Chattanooga Housing Market Statistics

- Median Household Income: $68,600

- Metro Population: 597,679

- 12-Year Population Growth: 11.14%

- Median Home Price: $317,604

- 1-Year Equity Growth: 7.75%

- 10-Year Equity Growth: 111%

- Median Rent Per Month: $1,496

- 1-Year Rent Growth: 5.47%

- 10-Year Rent Growth: 70.37%

- Rental Vacancy Rate: 4.9%

- Job Growth: +3,000 jobs

- 1-Year Job Growth Rate: .47% (higher than the national average)

- Unemployment Rate: 3.3% (lower than the national average)

Top 3 Reasons to Invest in the Chattanooga Real Estate Market in 2026

1. Affordability

The cost of living in Chattanooga is 12% lower than the national average, and the median home price of $317,604 is 12% below the national average. This lower entry point allows investors to achieve better cash-on-cash returns. With average rents at $1,496, 5.47% higher than the national average, investors can secure positive cash flow while building equity. The affordability attracts both renters and investors, creating a solid foundation for rental property investments.

2. Strong Home Appreciation

From 2014 to 2025, Chattanooga delivered consistent home appreciation with a 111% increase. For 2026, prices are expected to stabilize; however, home inventory levels remain limited, and appreciation and cash flow are expected to remain steady, making Chattanooga a balanced investment opportunity.

3. Increasing Demand and Rents

Census Reporter notes that 31% of Chattanooga households are renter-occupied. The average rent is $1,496, with an annual appreciation rate of 5.47%. The job market added 3,000 jobs last year and is expected to add 6,500 more in 2026. This will help drive housing demand, while the limited supply will keep the market somewhat competitive. This combination of job growth, limited inventory, and rising rents supports consistent rental income for investors.

How To Purchase Investment Property in Chattanooga

- Market research: The MSA covers both Tennessee and Georgia; review neighborhoods, landlord laws, and property taxes for the specific location where you’re considering investing. Laws and tax structures can vary between the two states, so understanding these differences is important for your investment planning.

- Local laws and regulations: Be aware of local laws, including the short-term vacation rental reform limiting STR in neighborhoods, the new zoning code that provides flexibility to housing types in the same zone, and the new pilot program for building affordable housing units. These regulations can impact your investment strategy and rental approach.

- Financial planning: Review your real estate pro forma carefully. Factor in property taxes, insurance, and property management costs. Ensure your projections account for all operating expenses and that the cash flow projections align with your investment goals.

- Build a network: Partner with experts who know both the Tennessee and Georgia sides of the market well, including the best neighborhoods and new build development opportunities. Connect with the Chattanooga Property Team in RealWealth’s network today to view current turnkey rental property inventory for sale.

#11 Fort Worth, Texas

Fort Worth is the fourth-most populous city in Texas and consistently ranks among the top 10 fastest-growing metro areas in the U.S. The city has something for everyone: arts, culture, outdoor activities, good schools, nightlife, affordable housing, and career opportunities. The metroplex is a business powerhouse, with multiple Fortune 500 headquarters. Fort Worth’s combination of rapid growth, economic diversity, and strong appreciation makes it one of the best places to buy rental property.

MSA and the Economy

The Dallas-Fort Worth-Arlington MSA area includes 11 counties, with Dallas and Fort Worth as its two core cities. It consistently ranks among the largest metropolitan areas in the U.S. and has a GDP of $744 billion. Fort Worth’s economy has a history of resilience and growth, dating back to its origins as a hub of the cattle trade. Over the decades, the city’s industrial base expanded to include aerospace and technology, healthcare, manufacturing, logistics, energy, and financial services. Its pro-growth business environment offers robust infrastructure, a strong talent pool, a low cost of doing business (3% below the national average), and state and local incentives. This economic diversity and growth attract new residents and businesses, supporting strong housing demand.

Population Growth

Fort Worth is the 11th largest city in the U.S. In January 2024, the city had a population of 990,000, an increase of 21,365 people. It is estimated to reach 1.2 million by 2030. The metroplex area has 8.1 million residents, with projections indicating it will likely reach 9 million by 2030. This ongoing population growth creates high demand for housing, creating substantial investment opportunities for real estate investors.

Job Growth

While Texas experienced lower-than-expected overall job growth, Fort Worth’s job growth rate was 1.5%, one of the highest among the state’s largest metros. In 2025, the city added 17,700 jobs. The unemployment rate is 3.9%, below the national average. Major players are transportation, education, manufacturing, and health care. Growing sectors include information technology and skilled trades. The DFW area also boasts the nation’s largest industrial development pipeline, with over 62 million square feet of industrial space under construction. The area’s career opportunities, affordability, and thriving economy continue to attract people to Fort Worth and boost housing demand.

About the Fort Worth Housing Market

The Fort Worth housing market is stabilizing. While current inventory has risen, supply still remains limited. From 2020 to 2024, the average home sale price in Fort Worth increased from $234,900 to $369,000, highlighting a rapidly growing market. The median home price is $365,329, with an annual appreciation rate of 7.95% and a 10-year equity growth rate of 114.94%. Average rents stand at $1,671, with yearly growth of 2.96% and 10-year rent growth of 33.89%. The growing popularity of build-to-rent models further underscores the market’s adaptability, offering real estate investors a range of investment opportunities. For investors focused on appreciation and long-term equity building, Fort Worth delivers strong returns.

Investing Through Turnkey Teams In RealWealth‘s Network

The Fort Worth turnkey real estate company we recommend sells duplex investment properties with an average price of $465,000, 29.64% below the national average, and rents for an average of $3,750. These properties offer investors the opportunity to benefit from Fort Worth’s strong appreciation while generating rental income from multiple units. The market’s rapid growth, strong appreciation potential, and expanding job market are major draws for real estate investors seeking the best places to buy rental property. To connect with the team, join RealWealth today.

Fort Worth Housing Market Statistics

- Median Household Income: $77,909

- Metro Population: 8.3 Million (Dallas-FW metro)

- 12-Year Population Growth: 30.54%

- Median Home Price: $365,329

- 1-Year Equity Growth: 7.95%

- 10-Year Equity Growth: 114.94%

- Median Rent Per Month: $1,671

- 1-Year Rent Growth: 2.96%

- 10-Year Rent Growth: 33.89%

- Job Growth: +17,700 jobs created

- 1-Year Job Growth Rate: 1.5% (higher than the national average)

- Unemployment Rate: 3.4% (lower than the national average)

Top 3 Reasons to Invest in the Fort Worth Real Estate Market in 2026

1. Exceptional home value appreciation

Over the past decade, Fort Worth’s housing market has grown substantially, with home values increasing by 114.94%. The region has consistently outpaced the national average, with an annual growth rate in home values of 7.95%. This trend demonstrates the market’s stability and resilience, making Fort Worth ideal for investors focused on long-term wealth building through real estate appreciation.

2. Dynamic job market

The diverse and robust economy of the DFW metro, with sectors like aerospace, aviation, healthcare, manufacturing, logistics, and tech, provides a stable job market that attracts and retains residents. This economic strength supports sustained housing demand and property value growth.

3. Rapid population growth

Fort Worth is growing rapidly and will likely reach 1.2 million people by 2030, with the broader metroplex area projected to hit 9 million. This rapid population growth creates a strong demand for housing. In addition, the city’s economic plan focuses on developing core areas, including downtown, historic neighborhoods, and locations poised for business growth. This focus on future development makes Fort Worth a prime destination for real estate investors seeking to capitalize on the region’s long-term potential.

How To Purchase Investment Property in Fort Worth

- Identify growth areas: Look for neighborhoods that are expanding or undergoing revitalization. These areas are likely to see property values increase.

- Evaluate property taxes: Texas has higher property taxes, which could affect your investment’s profitability. Factor these in and review your pro forma carefully to ensure the numbers align with your investment goals.

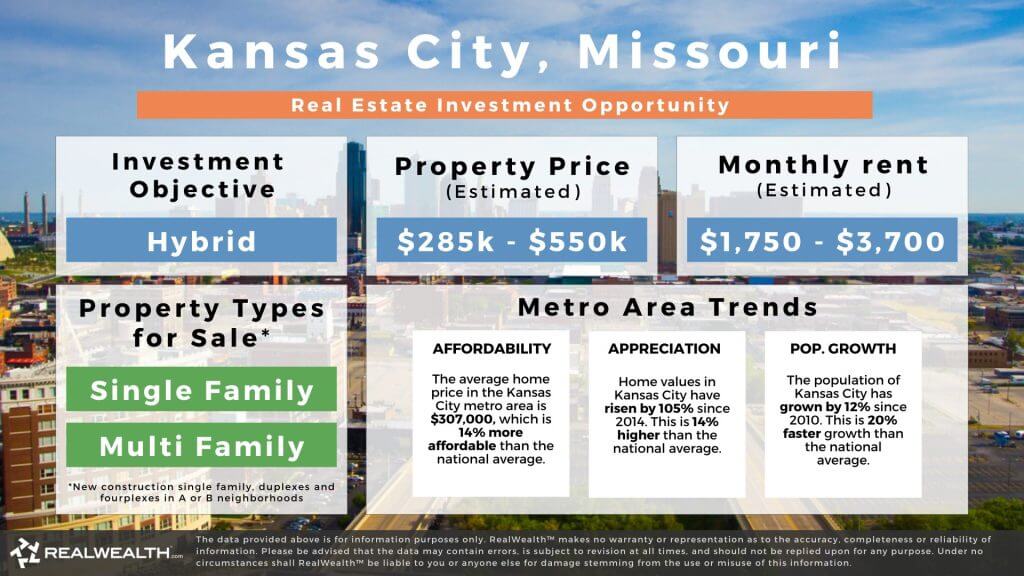

- Utilize local financing options: Texas has numerous investment-friendly financing options. Explore local banks and credit unions for competitive mortgage rates and build relationships with lenders who understand the Fort Worth market.