Texas is a top state for real estate investors. Why? No state income tax, landlord-friendly laws, and massive job growth; it has the fundamentals investors want. But the Lone Star State is enormous, and not every market works the same way. So, where can you find the best rental properties for sale in Texas?

Below, we share six markets where turnkey rental properties for sale pencil out, so you can easily build your rental property portfolio in Texas.

Quick Answer: Where to Find the Best Rental Properties for Sale in Texas

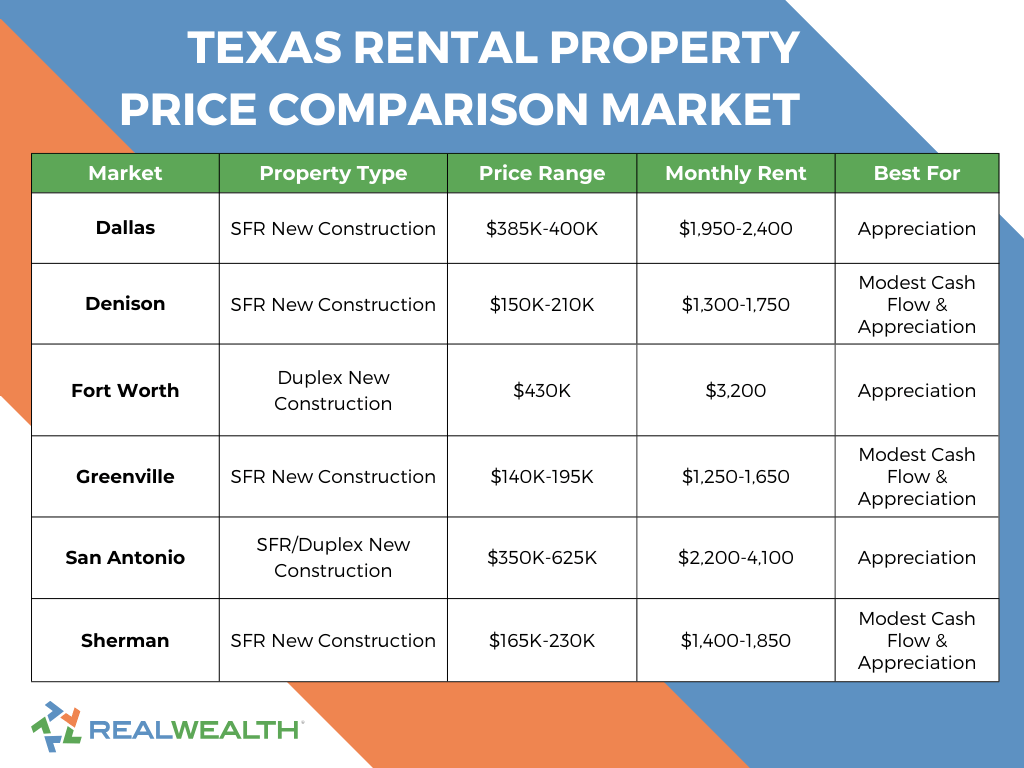

Here’s how Texas’s six strongest real estate markets for investors break down:

- DFW Metroplex:

- Dallas: Major metro with properties $385K-$400K

- Fort Worth: More affordable DFW option at $320K-430K

- Central Texas:

- San Antonio: Military stability, properties $350K-$625K

- North Texas Small Markets:

- Sherman: Affordable entry at $165K-$230K

- Denison: Lake living and cash flow at $150K-$210K

- Greenville: Highest cash flow at $140K-$195K

All prices reflect turnkey rental properties for sale through the vetted property teams in RealWealth’s network. All come with property management in place.

Where can you find investment properties for sale in Texas? RealWealth members can contact property teams directly for available inventory. If you are not a member, join RealWealth →

Why Invest In Texas Real Estate?

The Texas housing market offers real estate investors unique advantages:

- No state income tax on rental income

- Landlord-friendly laws with efficient eviction processes

- 400,000+ annual population growth creates consistent demand

- Major corporate headquarters and Fortune 500 presence

- Diverse economies across DFW, San Antonio, and regional markets

- Strong job growth across multiple sectors reduces risk

Below, we’ve highlighted six of the top markets where you can find rental properties for sale in Texas.

Want to become part of ReaWealth’s network of 80,000+ investor members? Join for free to view available inventory and connect with turnkey providers in Texas →

6 Markets For Your Next Texas Rental Property Investment

1. Dallas, Texas

Dallas is the corporate headquarters capital of Texas—home to AT&T, Southwest Airlines, Texas Instruments, and dozens of Fortune 500 companies that aren’t relocating anytime soon. In addition, DFW Airport employs over 60,000 people, and the area’s financial services, healthcare, and tech sectors provide job diversity that keeps rental demand steady even when individual sectors struggle.

When evaluating rental properties for sale in Dallas, the suburbs offer investors better cash flow and appreciation while maintaining access to jobs.

- Region: North Texas (DFW Metroplex)

- Median Price for a Turnkey SFR/Duplex: $200,000 to $250,000 / $365,000 to $565,000

- Median Rent: $1,700 to $1,800 / $2,900 to $4,600

- Investor Focus: Moderate appreciation & stability

- Type of Properties for Sale: New Construction SFR & Duplexes

Our network includes two property teams that specialize in the Dallas suburbs, where the fundamentals work for out-of-state real estate investors. Click the buttons below to connect and view available turnkey rental properties.

New to Texas real estate investing? Check out the best places to buy investment property in Texas or catch up on our free webinars about what’s working in Ohio’s markets today.

2. Denison, Texas

Denison is about 75 miles north of Dallas and ten miles northeast of Sherman. While this puts it just outside the easy-commuter range, it remains connected to DFW’s economy and an easy commute to Sherman’s “Silicon Prairie.” The local economy includes manufacturing, healthcare, and lake-related businesses, and Eisenhower’s birthplace brings tourism.

When looking for lower-entry rental properties for sale in Texas, Dension is a good place to start. While the tenant pool may be smaller than in larger cities, its proximity to Lake Texoma creates its own demand for people who want to live near the water.

- Region: North Texas (Texoma Region)

- Median Price for a Turnkey SFR: $150,000 to $210,000

- Median Rent: $1,300 to $1,750

- Investor Focus: Modest Cash Flow & Appreciation

- Type of Properties for Sale: New Construction SFR & Duplexes

Our network includes two property teams that specialize in the Dallas suburbs, where the fundamentals work for out-of-state real estate investors. Click the buttons below to connect and view available turnkey rental properties.

3. Fort Worth, Texas

Fort Worth operates in Dallas’s shadow but can offer better cash flow for investors. While still part of the massive DFW job market, the city has its own identity, anchored by Lockheed Martin, American Airlines, and a growing healthcare sector. In addition, the city has benefited from people and companies moving west from Dallas, seeking more affordable housing and lower congestion.

When looking for rental property for sale in Texas, Fort Worth neighborhoods, particularly those in the south and southeast, offer better opportunities for solid cash flow while staying connected to the broader metroplex job market.

- Region: North Texas (DFW Metroplex)

- Median Price for a Turnkey Duplex: $430,000

- Median Rent: $3,200

- Investor Focus: Moderate Appreciation

- Type of Properties for Sale: New Construction Duplexes

Our network includes property teams focused on Fort Worth areas where rent-to-price ratios work for investors. Click on the buttons below to connect and see available inventory.

4. Greenville, Texas

On the hunt for high cash-flowing investment properties for sale in Texas? Greenville is comparable to Sherman and Denison. Located about 50 miles northeast of Dallas, the city operates as a regional hub for Hunt County with its own manufacturing, healthcare, and agriculture-based economy. It’s far enough from Dallas to be truly affordable but close enough that some people make the commute.

Greenville’s lower acquisition costs let you deploy capital across multiple properties instead of tying it up in one expensive Dallas rental. You’re targeting working-class tenants who need quality housing at reasonable prices.

- Region: North Texas (Hunt County)

- Median Price for a Turnkey SFR: $140,000 to $195,000

- Median Rent: $1,250 to $1,650

- Investor Focus: Modest Cash Flow & Appreciation

- Type of Properties for Sale: New Construction SFR

5. San Antonio, Texas

San Antonio is built on military stability, as Joint Base San Antonio is among the largest military installations in the country, and rental demand holds up when other markets struggle.

Beyond the military presence, San Antonio’s got healthcare (USAA, hospital systems), tourism, and growing tech operations. When comparing rental properties for sale in Texas, the “Alamo City” is significantly more affordable than Austin while offering a similar quality of life, which attracts renters priced out of the capital city.

- Region: Central Texas

- Median Price for a Turnkey SFR / Duplex / Quad: $350,000 / $585,000 to $625,000

- Median Rent: $2,200 / $3,700 to $2,300

- Investor Focus: High Appreciation & Stability

- Type of Properties for Sale: New Construction SFR, Duplexes & Quadplexes

6. Sherman, Texas

Sherman, about an hour north of Dallas, has a growing local economy, spurred by manufacturing operations such as GlobalWafers Co. and Texas Instruments, earning it the nickname “Silicon Prairie.” The healthcare, education, and recreational sectors also help support consistent rental demand.

When it comes to researching investment properties for sale in Texas, you’ll find that Sherman delivers better cash flow than Dallas or Fort Worth and at significantly lower entry points. The trade-off is you’re in a smaller market without the job diversity of major metros.

- Region: North Texas (Texoma Region)

- Median Price for a Turnkey Duplex: $165,000 to $230,000

- Median Rent: $1,400 to $1,850

- Investor Focus: Modest Cash Flow & Appreciation

- Type of Properties for Sale: New Construction SFR

Our network includes property teams specializing in Sherman’s growth areas. Click on the buttons below to connect and see available properties.

Why Purchase Property Through Teams in the RealWealth Network?

Here’s the thing about buying rental properties for sale in Texas when you live in a different state: you’re trusting people you’ve never met with hundreds of thousands of dollars. That’s where RealWealth can help.

We’ve spent years vetting the property teams in our network so you don’t have to figure out who’s legit and who’s running a dressed-up wholesaling operation. Every team meets our R.E.A.L. Income Property™ Standards, which means they’re selling actual, high-quality properties in neighborhoods that make sense, with rent projections based on reality and property management already in place.

Whether you’re looking at rental properties for sale in Dallas, Fort Worth, San Antonio, or the smaller North Texas markets, you’re getting access to teams that have closed hundreds of deals with RealWealth members. They know the questions you’ll ask, the concerns you’ll have, and what out-of-state investors need to succeed in these markets.

We’ve been advising investors in Texas long enough to know which neighborhoods hold up and which ones just look good in photos. The teams understand what works for landlords who aren’t local and want to build long-term relationships.

Investor tip: We always recommend that our members do their own due diligence and double-check all numbers and potential investment properties to ensure they meet the R.E.A.L. Income Property™ Standards. The teams in our network are solid, but you’re still responsible for your own investment decisions.

Ready to Explore Rental Properties For Sale in Texas?

RealWealth members can view current inventory, pro formas, and connect directly with vetted property teams in our network. Our investment counselors, who help guide all of our members for free, can help you determine which Texas market aligns best with your goals—whether that’s the corporate stability of Dallas, the affordability of Fort Worth, San Antonio’s military stability, or the cash flow of Sherman, Denison, and Greenville.

Not a member yet? Joining takes about two minutes, and membership is 100% free. Join RealWealth→

Frequently Asked Questions About Rental Properties for Sale in Texas

Zillow and Realtor.com show Texas listings, sure, but good luck figuring out which ones actually work as rentals. You’ll waste hours clicking through houses that look like a good deal until you realize the neighborhood can’t support decent rents. RealWealth helps you skip that headache by connecting you directly with property teams in Dallas, Fort Worth, San Antonio, Sherman, Denison, and Greenville that specialize in turnkey rental properties with property management in place. Join RealWealth →

RealWealth is different than a typical online real estate platform. We reduce your research and guesswork by spending months vetting property teams. We assess everything they do, so you know that when you choose to work with a property team in Texas, they actually know the Dallas, Fort Worth, or San Antonio markets inside and out. These teams work only with real estate investors. They’ve closed hundreds of deals with our members (a growing community of 80,000 investors), and understand what out-of-state buyers need. Search for turnkey properties for sale→

Texas has investment properties everywhere—but investor-ready properties with numbers that actually work? Way harder to find. RealWealth members have access to teams selling turnkey rental properties that meet our R.E.A.L. Income Property™ Standards. That means renovated homes in neighborhoods where the numbers work and with property management you can trust. Your investment counselor (complimentary for RealWealth members) can match you with teams based on your goals. Schedule a strategy session→

Whether you are looking for traditional financing or unconventional loans, such as DSCR, RealWealth members get access to a list of recommended lenders who can help you determine which option is best for your situation.

rs. Learn how to buy your first rental property →

If you are looking for higher rental yields, locations such as Sherman, Denison, and Greenville offer investors more affordable entry points with moderate cash-flow potential. View properties for sale →

Figure on 20-25% down plus closing costs and reserves. Greenville ($170K property): about $43K all-in. Fort Worth ($235K property): around $60K. Dallas ($270K property): closer to $69K. DSCR loans typically require 25% down payment, so plan accordingly.

Texas is solid if you want cash flow and steady appreciation without the drama. No state income tax means you actually keep your rental income instead of watching 5-13% disappear. Laws favor landlords, 400,000+ people move here every year, so tenant demand stays strong. Property taxes run 1.5-2.5% which stings a bit, but you’re not paying income tax on top of that. Most markets appreciate 3-6% yearly, and you are collecting real cash while equity builds.

Like with any investment, you’ll need to determine your investing strategy and risk tolerance. Investors favor Dallas for its corporate presence and steady job growth. Others, like Fort Worth for its access to the DFW Metro and slightly lower price points, and San Antonio for its military presence, which provides economic stability and rental demand. Smaller towns like Sherman, Denison, and Greenville offer investors lower entry points and growing industry sectors, with potential for appreciation. Your RealWealth Investment Counselor can help you narrow down a market based on your goals. Schedule a strategy session→

Yes. Many investors choose Texas for their 1031 exchange replacement properties because of its no-income state tax, landlord and business-friendly laws, and job and population growth. Teams in RealWealth’s network deal with 1031 buyers all the time, and have experience working with investors who need to identify properties within 45 days and close within 180 days. Always use a qualified intermediary. Find 1031 properties →

Forgetting about property taxes, which range from 1.5 to 2.5% in Texas. Underestimating insurance costs. Skipping due diligence. Not keeping enough money in reserves. Learn about more common mistakes →

Texas sits in the middle with moderate cash flow and appreciation. Florida has higher appreciation and similar cash flow, but hurricane-zone insurance costs could eat into your margins. Compared to Ohio, Texas costs more but appreciates better. The no-income-tax policy means you keep much more cash than in states with 5-13% income taxes. Read about our top 25 best places to buy rental properties →

No, tons of successful investors never set foot in Texas. What you choose to do all depends on your comfort levels. When you purchase through the turnkey teams in RealWealth’s network, the properties are newly built or fully renovated, and they provide photos and video tours upon request, with management ready to go. Some members choose to take a property tour before buying to see neighborhoods and meet the property team and manager in person. Others attend our live event, Passive Wealth Expo, to meet several teams in one place. After that first initial visit or connection, everything is remote once they trust the team. Either way works, just don’t let “I haven’t been there” get you stuck in analysis paralysis. View our upcoming events→

If you’re buying turnkey properties, which are rent-ready, you can start earning income on day one. If you are buying something that needs renovations, add 2-6 months to the timeline. Compare this to BRRRR strategies, where you might wait 6-12 months, or new construction, where you might need to wait for the property to be built or completed. Turnkey’s advantage is immediate cash flow.

Join RealWealth (it’s free) to access vetted teams and speak with an investment counselor about what matters to you—cash flow, stability, hybrid markets. Review the pro formas and verify the numbers yourself. Get pre-approved by lenders who specialize in investment properties (RealWealth members get our recommended lenders). Connect with property teams and ask about their track record with RealWealth members. Do your homework—verify rents, check crime stats, and read the inspection report. New to this? Start here: First Rental Property Guide. Join when ready.

Investors earn returns from four primary sources: monthly cash flow, property appreciation, principal loan paydown, and tax benefits. We break these down in How to Make Money from Rental Properties Today.

Yes, with the right roadmap. Many busy professionals successfully close on their first property in three months or less by following a proven process. See the plan here: How to Buy Rental Property in 90 Days to Start Earning While You Sleep.

The best strategy depends on your goals and risk tolerance. Options include turnkey investing, BRRRR, house hacking, short-term rentals, and long-term buy-and-hold. Explore strategies in How to Invest in Rental Properties and Actually Build Wealth: 10 Proven Tips.

Yes. With just four well-performing rental properties, many investors create enough monthly income to retire comfortably. Learn how in Rental Properties for Retirement: How Four Rentals Can Set You Up for Success.

The answer depends on cash flow per property, location, and financing. On average, investors may need anywhere from 5 to 15 rentals. Find a full breakdown in How Many Rental Properties Do You Need To Make $100k Annually?

Yes, investors build long-term wealth through rental properties by combining cash flow, appreciation, loan paydown, and tax advantages. Over time, these factors compound, making investing in rental properties a proven strategy for achieving financial freedom and building generational wealth. Read our full guide on How To Build Wealth By Investing In Rental Properties.

Getting started is simple. Join RealWealth for free to access vetted turnkey teams, investment counselors, and sample property pro formas. Your RealWealth Investment Counselor can help tailor your investing strategy to a market that best meets your goals, connect you with trusted teams, and guide you through your purchase—so you can confidently grow your real estate portfolio and build long-term wealth.