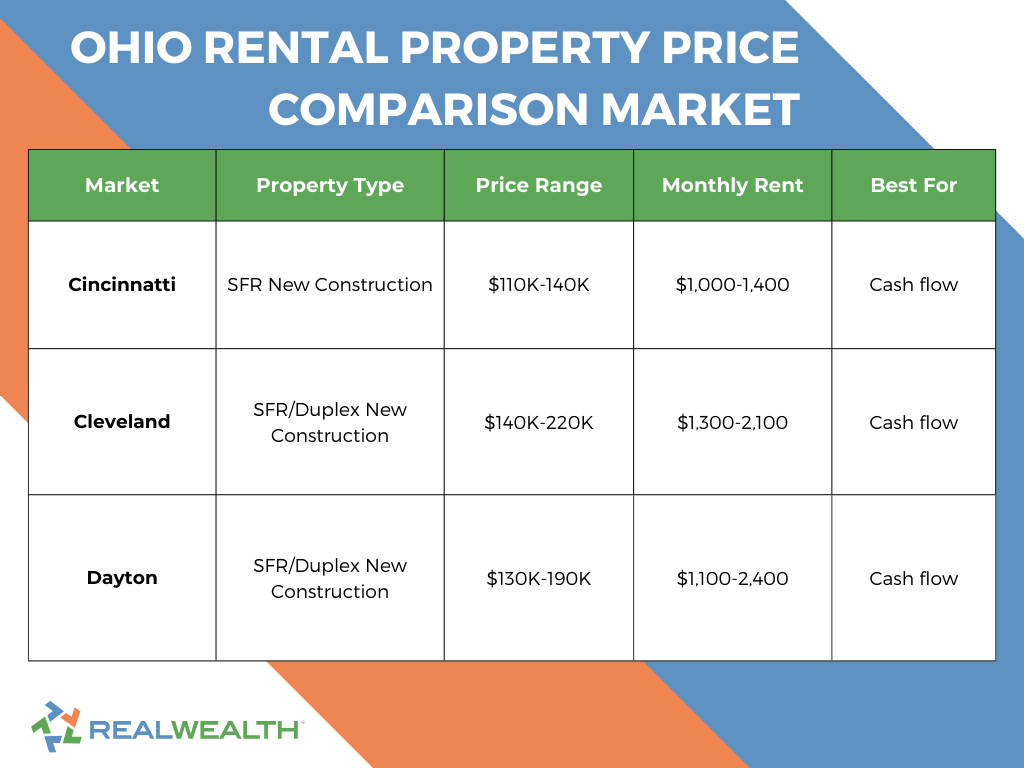

Ohio doesn’t get as much attention as Florida or Texas in investor circles, but maybe that’s a good thing. While everyone’s chasing the same real estate markets, you can still find rental properties for sale in Ohio at prices that actually make sense for cash flow. We’re talking turnkey rental properties in the $110K-$220K range—the kind of numbers that let you build your rental property portfolio without depleting your entire savings account.

Where should you actually look for investment properties in Ohio? Below, we break down three major players in Ohio’s real estate market.

Quick Answer: Where to Find the Best Rental Properties for Sale in Ohio

Ohio’s rental property opportunities vary by region:

- Northeast Ohio: Cleveland: Urban revitalization with properties $140K-$220K

- Southwest Ohio: Cincinnati: Stable growth with properties $110K-$140K

- West-Central Ohio: Dayton: Most affordable entry points at $130K-$190K

All prices reflect turnkey rental properties for sale through the vetted property teams in RealWealth’s network. All come with property management in place.

Where can you find investment properties for sale in Ohio? RealWealth members can contact property teams directly for available inventory. If you are not a member, join RealWealth →

Why Invest In Ohio Real Estate?

The Ohio housing market offers real estate investors unique advantages:

- Affordable entry points with median prices typically below national averages.

- Landlord-friendly laws with efficient eviction processes.

- Stable, diversified economies across healthcare, manufacturing, and logistics.

- Major corporate presence, including Fortune 500 headquarters.

- Growing rental demand from growing job markets.

- Strong cash flow potential with better rent-to-price ratios than coastal markets.

- Section 8 rental properties for sale for stable income and consistent cash flow.

Below, we’ve highlighted three of the top markets where you can find rental properties for sale in Ohio.

Want to become part of ReaWealth’s network of 80,000+ investor members? Join for free to view available inventory and connect with turnkey providers in Ohio →

3 Markets For Your Next Ohio Rental Property Investment

1. Cleveland, Ohio

Cleveland’s ongoing downtown revitalization, world-class healthcare sector, and strong manufacturing base make it an attractive market for real estate investors. The city’s medical corridor, anchored by the Cleveland Clinic and University Hospitals, drives consistent rental demand.

The market offers investors strong cash flow potential at lower acquisition costs than in many markets. The diverse economy spanning healthcare, manufacturing, and professional services provides stability, while ongoing neighborhood revitalization creates appreciation opportunities.

- Region: Northeast Ohio

- Median Price for a Turnkey SFR: $140,000 to $220,000

- Median Rent: $1,300 to $2,100

- Investor Focus: Cash Flow

- Type of Properties for Sale: Renovated Single-Family Homes & Duplexes

Our network includes property teams that specialize in Cleveland’s strongest rental neighborhoods.

New to Ohio real estate investing? Check out the best real estate markets in the Midwest for investors or catch up on our free webinars about what’s working in Ohio’s markets today.

2. Cincinnati, Ohio

Backed by Fortune 500 companies like Procter & Gamble, Kroger, and Fifth Third Bank, Cincinnati offers investors economic stability and job growth. The city’s affordable cost of living and strong employment base create consistent rental demand across multiple neighborhoods.

Investors are drawn to rental properties for sale in Ohio’s “Queen City” because of the city’s diverse economy, major corporate headquarters, ongoing urban development, and opportunities for cash flow and long-term appreciation.

- Region: Southwest Ohio

- Median Price for a Turnkey SFR: $110,000 to $140,000

- Median Rent: $1,000 to $1,400

- Investor Focus: Cash Flow

- Type of Properties for Sale: Renovated Single-Family Homes

Our network includes property teams that specialize in Cincinnati’s strongest rental neighborhoods.

3. Dayton, Ohio

If you are looking for rental properties for sale in Ohio with the highest cash flow potential, Dayton is your best choice. With the state’s most affordable entry points and strong fundamentals from Wright-Patterson Air Force Base and major logistics operations, Dayton offers investors excellent rent-to-price ratios.

Dayton’s affordability doesn’t mean sacrificing quality. The city benefits from stable government employment, growing logistics and healthcare sectors, and strong tenant demand. Lower acquisition costs mean investors can build portfolios faster while achieving strong cash-on-cash returns.

- Region: West-Central Ohio

- Median Price for a Turnkey SFR: $130,000 to $190,000

- Median Rent: $1,100 to $1,450

- Investor Focus: Cash Flow

- Type of Properties for Sale: Renovated Single-Family Homes

Our network includes property teams that specialize in Dayton, Ohio.

Why Purchase Property Through Teams in the RealWealth Network?

Here’s what makes these opportunities different: every property team in RealWealth’s network has been thoroughly vetted. They meet our R.E.A.L. Income Property™ Standards, meaning they’re selling quality properties in solid neighborhoods with realistic rent projections and established property management.

Whether you’re looking at rental properties for sale in Cleveland, Cincinnati, Dayton, or any of the other markets we serve, you’re getting access to teams with proven track records with our members. We’ve been investing in the Midwest and advising investors for years, and we understand what makes these markets work for out-of-state investors.

Investor tip: We always recommend that our members do their due diligence and double-check all numbers and potential investment properties to ensure they meet the R.E.A.L. Income Property™ Standards.

Ready to Explore Rental Properties For Sale in Ohio?

RealWealth members can view current inventory, pro formas, and connect directly with vetted property teams in our network. Our investment counselors, who help guide all of our members for free, can help you determine which Ohio market aligns best with your goals. Join RealWealth→

Frequently Asked Questions About Rental Properties for Sale in Ohio

Sites like Zillow and Realtor.com show Ohio listings, but they also show properties that don’t actually work as rentals. You’ll spend hours sorting through listings that look cheap until you realize the neighborhood doesn’t support decent rents.

For turnkey rental properties, RealWealth’s network connects you directly with vetted property teams in Cleveland, Cincinnati, and Dayton. These aren’t MLS listings—they’re off-market Oho properties that are renovated, come with property management in place, and feature realistic rent projections. Join RealWealth → to access current inventory with actual pro formas.

Dayton delivers the highest cash-on-cash returns at 7-10% year one. Properties run $130K-$190K with rents around $1,100-$1,450. Lower prices mean you scale faster. Wright-Patterson Air Force Base provides employment stability.

Cleveland balances cash flow with modest appreciation. Expect returns of 8-10% cash on cash returns on properties priced at $140K-$220K. The healthcare sector keeps demand steady, and some neighborhoods are appreciating.

Cincinnati offers 8-10% year-one returns with the most economic stability, thanks to its Fortune 500 headquarters. Properties cost more ($110K-$140K), but you’re betting on a market that’s weathered downturns without cratering.

Which Ohio market is best for you? RealWealth’s Investment Counselors help our members narrow down a market based on their goals. Schedule a strategy session for free →

Every property team in RealWealth’s network includes property management as part of the turnkey package. The management company already knows the property, handles tenant screening, and works with out-of-state investors. You’re not interviewing managers from 1,000 miles away or hoping you picked the right one.

Management fees typically run 8-10% of monthly rent. For Cleveland, Cincinnati, and Dayton properties, all teams meet our R.E.A.L. Income Property™ Standards, which include proven property management. Explore available turnkey rental properties →

Most Ohio properties qualify for conventional financing with a 20-25% down payment. But you can also use DSCR (Debt Service Coverage Ratio) loans that are eligible based on the property’s income, not your personal income.

Conventional financing requires 20-25% down, good credit (680+), and a debt-to-income ratio that includes rental income. For a $180K Dayton property, expect ~$45K down plus closing costs and reserves.

DSCR loans qualify based on property cash flow, not W-2 income. Useful if you’re self-employed or own multiple properties. Slightly higher rates but way easier approval.

RealWealth’s network includes our list of recommended lenders specializing in investor financing. Some property teams also offer financing incentives for RealWealth members. Learn how to buy your first rental property →

Here’s what you’re typically looking at with 20% down:

Dayton: $160K property = $32K down + $4,800 closing + $6,600 reserves = ~$43,400 total

Cleveland: $185K property = $37K down + $5,550 closing + $7,800 reserves = ~$50,350 total

Cincinnati: $200K property = $40K down + $6,000 closing + $8,400 reserves = ~$54,400 total

DSCR loans might require 25% down, but skip income verification. Some property teams offer incentives that reduce out-of-pocket costs for RealWealth members. Reserve requirements vary by lender—we recommend a minimum of 6 months.

Ohio works really well if you want cash flow now, not quick appreciation. It’s perfect for building a portfolio that generates monthly income without needing six figures per property.

What works: Landlord-friendly laws, affordable entry points (build a 5-property portfolio for what one rental costs in San Diego), stable employment from healthcare and Fortune 500 companies, and decent rent-to-price ratios.

What Ohio doesn’t offer: massive appreciation. You’re not buying here thinking values will double in five years. Most neighborhoods appreciate 2-5% annually, so the strategy is mainly for cash flow. Compare the best places to buy rental property →

Rental properties for sale in Ohio cities like Cleveland and Dayton have higher Section 8 demand, particularly in lower-priced neighborhoods ($80K-$150K range). The property teams in RealWealth’s network offer some of these property types. Connect with them directly about Section 8 rental properties for sale. To learn more about this strategy, start here: Section 8 Properties for Sale & Why Buy Now→

Choose Dayton if: You want high cash flow, a low entry point, and need to scale quickly. Year-one returns matter more than long-term appreciation.

Choose Cleveland if: You want a balance between cash flow and modest appreciation. Healthcare sector stability appeals to you, and you like a city that’s actually improving.

Choose Cincinnati if: Economic stability matters most. You’re okay with slightly lower cash-on-cash returns for better fundamentals and a market that has proven to weather recessions.

Not sure? Talk to a RealWealth investment counselor who can match your goals, capital, and timeline to the right market. Join RealWealth to get matched for free.

Yes! Many of our members have high-equity properties in California, Seattle, and New York, and exchange them for multiple properties, diversifying their risk and expanding their real estate portfolio. In addition, they are moving their assets into a more landlord-friendly state.

Property teams in RealWealth’s network work with 1031 buyers regularly and understand the 45-day identification and 180-day closing deadlines. Book a strategy session with your RealWealth investment counselor to connect with teams who have inventory available now.

Key requirements: Use a qualified intermediary, identify properties within 45 days, close within 180 days, and exchange like-kind property. Find 1031 exchange rental properties →

Buying based on price alone: That $80K property is cheap for a reason. Either the neighborhood doesn’t support decent tenants, or it needs major repairs.

Not factoring in property management: Budget 8-10% of monthly rent for management if buying turnkey with management included.

Underestimating vacancy and maintenance: Budget 5-10% vacancy and $1,500-$2,000 annually for maintenance, even on renovated properties.

Skipping due diligence: Verify rent comps, check crime stats, get a home inspection, and verify property taxes. Don’t just trust the numbers.

Not having adequate reserves: Have $10K-$15K in reserves per property minimum. Stuff breaks, especially with older properties.

Learn from other investors: Top 18 Biggest Mistakes When Buying Rental Property→

Ohio offers stronger year-one cash-on-cash returns than coastal states but typically underperforms on appreciation.

Ohio vs. Florida: Ohio’s cash flow wins at 6-10% vs. Florida’s 4-7%. Florida wins on appreciation (6-10% annually vs. Ohio’s 2-5%). Ohio wins on landlord laws and lower insurance costs.

Ohio vs. Texas: Similar landlord-friendly laws. Texas has no state income tax; Ohio does. Texas properties cost more ($200K-$350K vs. Ohio’s $110K-$220K). Both offer good cash flow.

Ohio vs. California: Ohio destroys California on cash flow (California’s lucky to hit 3-4%). California wins on appreciation, but you’re betting on price growth, not income. Ohio’s landlord laws are way more favorable.

Bottom line: If you’re building for cash flow and want to scale quickly, Ohio is a strong choice. If you’re betting on massive appreciation, look elsewhere. Compare the best places to buy rental property →

No. Plenty of successful investors build entire portfolios in Ohio without ever visiting the state. They rely on vetted property teams, third-party inspections, and trusted property managers.

If you’re buying turnkey through RealWealth’s network in Ohio, the properties are already renovated and include professional photos. Video tours show what you’re getting. Inspections verify the condition, and management is in place. You’re working with teams who’ve closed hundreds of deals with out-of-state investors.

Some investors visit before their first purchase, then buy remotely once they trust the team. Others never visit and just lean on due diligence. Either approach works—don’t let “I haven’t been there” stop you if the numbers work.

If you’re buying turnkey properties, which are rent-ready, you can start earning income on day one. If you are buying something that needs renovations, add 2-6 months to the timeline. Compare this to BRRRR strategies, where you might wait 6-12 months, or new construction, where you might need to wait for the property to be built or completed. Turnkey’s advantage is immediate cash flow. In addition, the Ohio property teams in RealWealth’s network are selling properties with tenants already in place.

Start by figuring out your SMART goals. Your real estate investment strategy determines which Ohio market makes sense.

Fastest path to your first Ohio rental:

1) Join RealWealth (free) to access vetted property teams, current inventory, and investment counselors. Join here →

2) Talk to an investment counselor about your goals, capital, and timeline. They’ll match you with the right market.

3) Review actual pro formas from available properties. Verify the numbers—don’t just trust them.

4) Get pre-approved through lenders who specialize in investment properties. RealWealth members access our recommended lenders.

5) Connect with property teams and start analyzing available turnkey properties for sale.

6) Do your due diligence even with vetted teams and properties. Verify rent comps, review crime stats, and always get professional inspections. Your investment counselor is here to help support you throughout this process, so schedule conversations as needed.

New to rental property investing? Start here: How to Buy Your First Rental Property→

Ready to take action: Start here: Learn How to Buy Your First Rental Property in 90 Days→

When you become a free RealWealth member, you get access to a network of vetted property teams across Ohio’s best investment markets. These teams know their local markets inside and out. Plus, you’ll work with your investment counselors who can help you figure out which market and property type makes the most sense for your goals. No pressure, just real guidance from people who’ve been there. If you haven’t already, join RealWealth.

Investors earn returns from four primary sources: monthly cash flow, property appreciation, principal loan paydown, and tax benefits. We break these down in How to Make Money from Rental Properties Today.

Yes, with the right roadmap. Many busy professionals successfully close on their first property in three months or less by following a proven process. See the plan here: How to Buy Rental Property in 90 Days to Start Earning While You Sleep.

The best strategy depends on your goals and risk tolerance. Options include turnkey investing, BRRRR, house hacking, short-term rentals, and long-term buy-and-hold. Explore strategies in How to Invest in Rental Properties and Actually Build Wealth: 10 Proven Tips.

Yes. With just four well-performing rental properties, many investors create enough monthly income to retire comfortably. Learn how in Rental Properties for Retirement: How Four Rentals Can Set You Up for Success.

The answer depends on cash flow per property, location, and financing. On average, investors may need anywhere from 5 to 15 rentals. Find a full breakdown in How Many Rental Properties Do You Need To Make $100k Annually?

Yes, investors build long-term wealth through rental properties by combining cash flow, appreciation, loan paydown, and tax advantages. Over time, these factors compound, making investing in rental properties a proven strategy for achieving financial freedom and building generational wealth. Read our full guide on How To Build Wealth By Investing In Rental Properties.

Getting started is simple. Join RealWealth for free to access vetted turnkey teams, investment counselors, and sample property pro formas. Your RealWealth Investment Counselor can help tailor your investing strategy to a market that best meets your goals, connect you with trusted teams, and guide you through your purchase—so you can confidently grow your real estate portfolio and build long-term wealth.