The apprehension of Florida rental property investing is warranted. Headlines focus on the rising cost of insurance, the impact of hurricanes and tropical storms, and the risks of portfolio saturation in certain parts of Florida. But despite those concerns, the state remains appealing to real estate investors for its mild winter weather, beaches, and tourism. These elements create opportunities for vacation rentals and long-term rentals as people seek refuge from inclement winter weather.

The state as a whole has taken steps to ensure that homes comply with local codes and ordinances, which helps ease concerns for property owners and prospective buyers. When well-maintained, these homes can provide consistent cash flow and financial stability.

Pricing the market and establishing baseline expenses are important tasks when beginning to rent out an investment property. Calibrating the expense per tenant is a necessary and regular task to remain on the profitable side of the investor equation. This article will give some background regarding the use of building codes and factors surrounding costs for a rental property in Florida.

The Post-2002 Game Changer: Florida’s Building Code Revolution

After 2002, the Building Code in Florida evolved to account for older construction methods that were no longer available. Changes included updates in the wind-load resistance requirements for walls, roofs, and other structural tie-ins. Structural elements now include anchors and straps that can withstand the higher winds associated with hurricanes and tropical storms, preventing uplift. This update to building codes helps homes withstand sustained winds of 120 to 160 mph, depending on the region.

Additionally, standards for impact-resistant windows or hurricane shutters have been implemented to limit damage. The hope is that if there are fewer or somewhat less significant claims, carriers will be less likely to move away from the region or increase premium costs since they won’t have to offset significant losses to remain in business.

What Makes New Construction Rental Properties Insurance-Friendly

Florida’s rental construction and code changes have given some carriers more comfort in continuing to write coverage in the state. Many insurers have begun using technology systems that compile data from sources such as the county assessor to evaluate locations. Some systems can determine the specific elements or portions of the property that don’t meet current code requirements, which can drive up premium costs.

Determining the proper use and installation of roof trusses, hurricane straps, and reinforced walls is now an important factor in the total cost of insurance. The more value placed in impact-resistant windows, contemporary roof coverings, and drainage systems, the better. These more modern protections lessen exposure to weather risks and, in turn, lessen the need for higher insurance premiums.

Other elements, such as updated electrical systems, modern plumbing, properly installed HVAC systems, and fire-resistant materials, contribute to a lower insurance risk profile. These mitigation measures pose fewer questions and challenges for a rental to overcome when “selling” the viability of your property to an insurer.

The Numbers: Insuring New Construction

Approximate premium costs for new construction (2023 or newer) with $300K Property & $1MM General Liability, rounded to the nearest whole dollar:

| City in Florida | Monthly Cost | Annual Cost |

| Tampa Bay | $345 | $4,140 |

| Orlando | $240 | $2,880 |

| Jacksonville | $355 | $4,260 |

| Fort Myers | $364 | $4,368 |

Newer-construction homes are often more favorable to insurers because they meet current codes and use modern building materials, reducing the risk of severe damage from a tropical storm. Older rentals are sometimes more expensive to insure because severe damage can be more costly to repair due to outdated systems or materials, or code-compliance issues. In some cases, insurance rates may decrease if the property has undergone significant upgrades, such as a new roof or modernized plumbing, but insurers generally focus on the potential cost to restore the home to its original or code-required condition.

Older properties often require more maintenance, are generally less protected from the weather, and ultimately generate less income. Newer properties that require less maintenance are better protected from the elements and rent at a higher price point, allowing for more profit overall.

Florida Investment Submarkets: Not All Created Equal

When considering the differences between coastal and inland properties, a few things are clear. Inland risks are less challenging to insure, but many recent severe weather events have spanned 150 miles from East to West, making it apparent that investing in the center of the state isn’t always a clear safe haven. That said, Central Florida has historically been affected by severe weather far less than areas such as Tampa Bay, Sarasota, and Panama City. Suburban areas of Orlando or Kissimmee are generally safer, as most hurricanes lose strength once they make landfall.

FEMA provides flood risk maps that help you assess risk and consider what makes sense for your investment strategy, noting that hurricanes can generate storm surge, resulting in flooding even in Central Florida. Wind zones are another factor that investors must consider. Often rated as tiered levels, wind zones are more prominent near coasts, but only a few small regions in Central Florida are considered much less risky.

It is worth noting that rental insurance expenses are most stable in Central Florida, provided significant measures are taken to mitigate storm damage. However, locations near the coast could be considered more profitable investments based on potential rental income.

Investor Sweet Spots

- Central Florida: Orlando, Orange, Kissimmee

- Northeast Florida: Jacksonville, Duval County (consider proximity to coast)

- Southeast Florida: Fort Myers (consider proximity to coast)

Additional Cost-Saving Factors in New Construction Rentals

Paying less for coverage inherently lowers the investment property’s overhead and increases the investor’s ROI. Some insurers offer rate credits to acknowledge efforts in mitigating risk. For example, new roofs are more resistant to damage and are sustained better for longer periods. “Fortified Home” designations recognize upgrades that provide structural enhancement to limit storm-related damage, reducing the impact of wind and water. Grouping multiple locations under one account may also be used as a basis for some insurers to review the account for other cost savings.

What Investors Should Verify Before Buying Florida Rental Property

Making assumptions about your estimated insurance expenses could place you in the red right out of the bat. It is important to secure an insurance quote that you can review and verify that the deductibles being offered make sense for your business. Below are some things you should be aware of in the due diligence process:

Due Diligence Checklist

- Request an actual insurance quote before closing (not estimates)

- Quote retained must be for a rental property, not an owner-occupied home

- Verify wind mitigation features and documentation

- Check flood zone designation and requirements- opting for Flood coverage will likely increase premium expense

- Confirm roof rating and installation date

- Ask about the builder’s warranty coverage for the roof or the general construction of the home

- Review HOA requirements – some require specific insurance coverages

- The property manager is insured and available to assist in maintenance, repairs, and property access in the event of a claim

- Obtain a 3-year insurance cost history for the area, but understand costs can change significantly depending on weather patterns

Real Talk: When Florida ISN’T the Right Investment Choice

While Florida has a booming rental and vacation property market, it is not always considered a good business for insurers or investors. Many carriers restrict coverage for barrier islands and high-end coastal investment properties due to expected storm activity. Older construction styles along the coasts and roofs in need of repair are challenging to insure. Consider the following:

- If expenses to complete necessary repairs are not considered in the purchase price, the purchase is not recommended.

- Mobile homes are extremely vulnerable to severe weather and are often difficult to obtain coverage for.

- Cash flow can be significantly impacted if insurance costs exceed 15% of the gross rents.

- Demand for rental and vacation homes exists across the country—review and research opportunities in more than one state to diversify your portfolio.

Florida’s Investment Upside: Why Investors Still Choose It

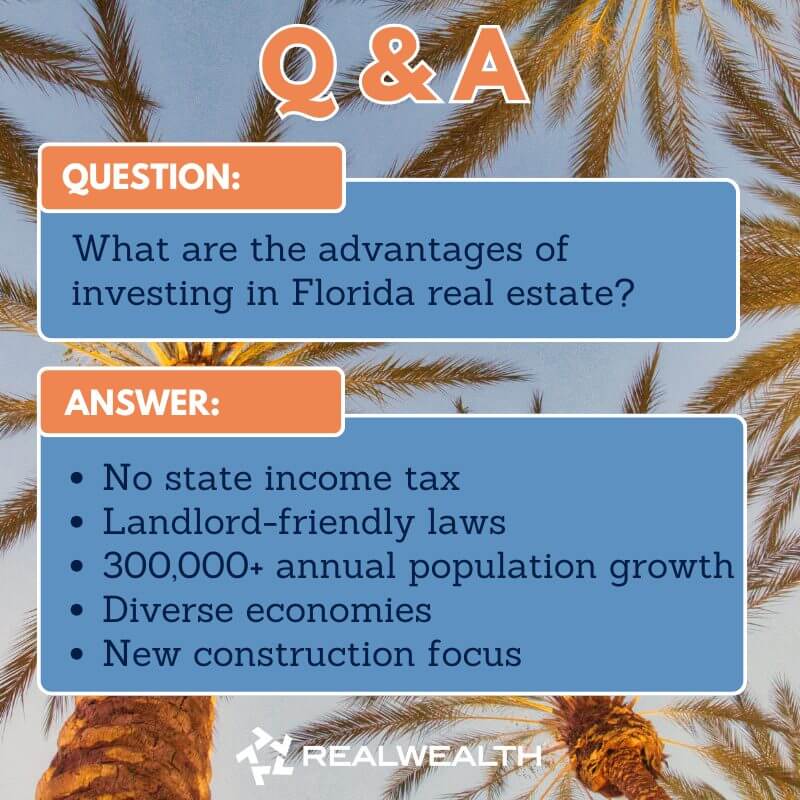

Growth and expansion in the suburbs of major Florida cities provide optimism that the rental demand will continue. Steady job opportunities and tourism continue to contribute to population growth. No state income tax and further property appreciation really move the needle for an investor’s cash flow. Similarly, turnkey provider networks and landlord-friendly laws provide greater flexibility in handling evictions and other legal matters as they arise. While other areas can provide some stability, much of Florida’s housing market growth can be found in suburban areas where businesses and new builds are being constructed.

Property management is a key component of successful investment properties, and Florida locations are no exception. If you do not opt to manage the location yourself, there are many experienced property managers for hire. But do not underestimate the importance of vetting potential candidates and providing clear expectations.

Case Study: Comparing Florida New Construction Insurance to Other Markets

Average Cost of Insurance for New Builds Across Comparable Markets (Approximately $300,000 in Coverage)

| Location | Monthly Cost |

| Orlando, FL | $237 |

| Dallas, TX | $240 |

| San Diego, CA | $251 |

| Raleigh, NC | $234 |

| Kansas City, MO | $230 |

Despite Florida’s reputation for extreme weather risk, this comparison shows that newer homes built with modern materials designed to withstand heavy wind and rain can be insured at rates comparable to, or even lower than, similar properties in other states.

The Bottom Line for Real Estate Investors

If managed effectively, Florida rental properties can be profitable, even in a hard insurance market. Choosing the right property, management company, tenants, and insurance coverage are all important pieces in growing your portfolio. New or recently built properties provide greater assurance regarding code requirements and materials. While new construction offers many advantages, it is equally important to select the right market. Taking time to review the rental property, the region’s loss history, and the potential for growth is also important to the development of your investment business. Generalized insurance prices shouldn’t be the only component in deciding whether a property is a good fit for your business. Florida offers strong potential for real estate investors willing to do the hard work of identifying a home that aligns with their business strategy.

Looking to invest in Florida real estate. Get a FREE quote from NREIG today!

Frequently Asked Questions

The type of property being constructed does have some bearing on the insurance expense. That stated, with a $10,000 deductible and Named Storm included, the average cost is approximately $584/month. Without Named Storm, the average cost is approximately $350/month.

Named Storm coverage includes coverage for wind, hail, tornadoes, tropical storms, and hurricanes. This coverage does not extend to storm surge, which often accompanies a hurricane. Flood coverage would assist in managing damage caused by storm surge and is a separate policy. Storm surge can be generally termed as flooding associated with a Named Storm. Learn more about the different coverages you may need for Florida properties.

Given the common occurrence of hurricanes in Florida, it is advisable to secure coverage for wind with a Named Storm policy as well as Flood coverage. Wind with Named Storm provides coverage for the wind-related damage associated with a hurricane. Flood coverage would address the storm surge tied to the rising water that could potentially damage your property.

Yes, it is possible that the annual expense of insurance can limit financial growth, but as an investor, you have the ability to manage these expenses to maintain profitability. Ensuring your lease amount is appropriate for the property and the area is one path. Tenant screening for prior challenges, along with property maintenance, is important in limiting losses, deductible payments, and risks that could increase your premiums. Additionally, NREIG can assist with customizing your coverage to ensure the coverage needed is in place and allow for further discussion as needed.

Insurance is in place to assist with a covered loss. The coverage investigation would be completed by a carrier to assess the extent of damage associated with the covered loss. Annually, the state of the market is reviewed by a given carrier to determine if increases or changes are warranted for the individual location, account, or master policy group.

Overall, Florida rental property insurance costs are typically much higher for comparable insurance coverage, sometimes more than 100%, due in large part to the frequency and likelihood of severe weather, including hurricanes, and the lack of sufficient building materials within the structure.

Yes, rates for investment properties are often higher in any state. This is primarily tied to the additional risk of the property not being a primary residence and occupied by a tenant. Liability rates and maintenance are historically managed differently, which adds to the risk and threat of additional damage.