Out-of-state real estate investing can seem daunting at first, but it’s one of the best ways to grow your real estate portfolio as it opens up opportunities in stronger housing markets with better rent-to-price ratios and landlord-friendly laws.

In this guide, we will cover everything you need to know about investing in out-of-state real estate. This includes the benefits, helpful investing strategies, the best rental markets for cash flow and home appreciation, common mistakes to avoid, and tools and resources to help you manage from afar.

Quick Answer: Why Invest in Out-of-State Rental Properties?

Out-of-state real estate investing lets you take advantage of diverse real estate markets. This can lead to better cash flow, lower costs, and greater long-term growth potential. Many real estate investors choose this option when local markets are too expensive or do not provide good returns.

- Benefits: Investors can achieve higher returns in landlord-friendly states, diversify across markets, and grow portfolios more affordably than in high-cost cities.

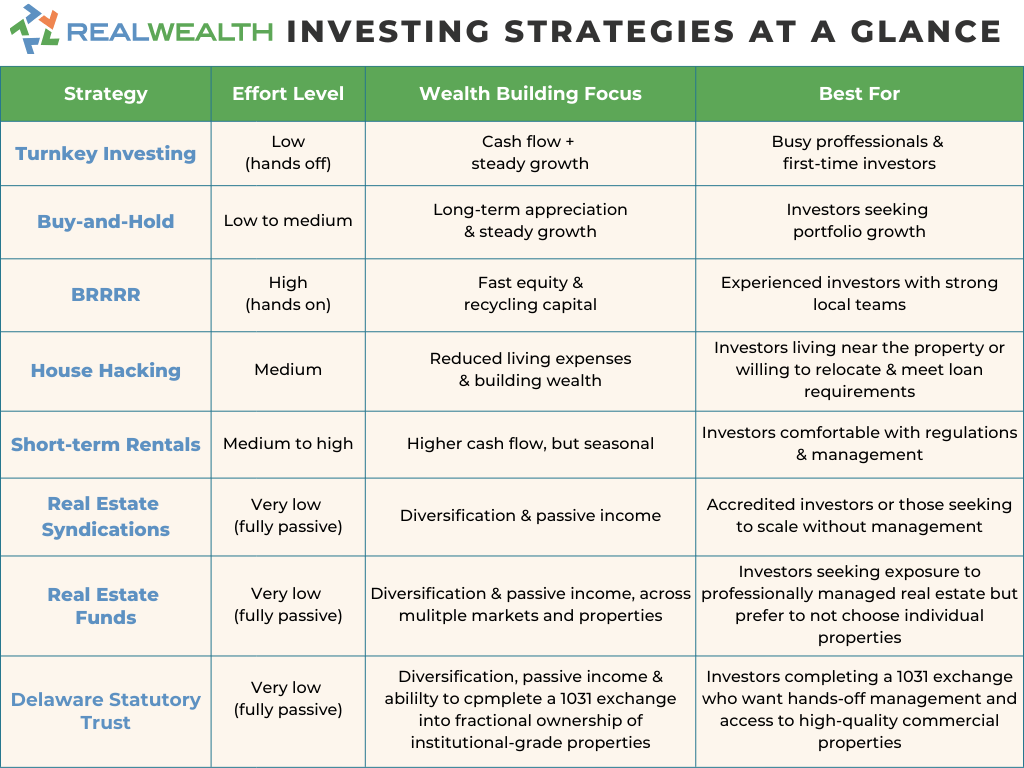

- Strategies: Common investing strategies include turnkey investing, which involves buying renovated or new-build properties with management in place; buy-and-hold for long-term growth; BRRRR (buy, rehab, rent, refinance, repeat) for building equity; short-term rentals in tourist areas; and real estate syndications for passive ownership in larger deals.

- Risks & Pitfalls to Avoid: The biggest mistakes include buying without due diligence, skipping professional property management, chasing appreciation without stable cash flow, ignoring local landlord-tenant laws, and underestimating expenses.

- How to Start: Define your goals (cash flow vs. appreciation), research markets with strong fundamentals like job and population growth, build a trusted local team (property managers, lenders, turnkey providers, maintenance crew), always run the numbers, and have enough cash reserves set aside.

- Tools & Resources: Utilize sites like Zillow, RentCast, NeighborhoodScout, City-Data.com, and RealWealth’s free resources, which connect you with vetted real estate professionals, including turnkey teams offering off-market investment opportunities. Crunch the numbers with pro forma tools like Dealcheck.

- Bottom line: With the right strategy, team, and markets, investing in rental properties for passive income is one of the best ways to build long-term wealth and prepare for a successful retirement. RealWealth can help you find the top markets for rental properties and connect with trusted turnkey teams. Join today!

Out-of-State Real Estate Investing Benefits

For many investors, investment in their local markets may no longer be a viable option. In high-cost areas like California and New York, real estate prices have skyrocketed, making it difficult to buy, tenant-friendly laws make it difficult to be a landlord, and market rents can’t keep pace with inflation. In these situations, property taxes can eat into cash flow, and competition from both homeowners and investors makes it nearly impossible to find solid deals. That’s where investing in rental properties out of state opens the door to more substantial returns, portfolio diversification, and long-term wealth building.

Here are five of the most significant benefits:

1) Higher Returns & Cash Flow

Markets in the Midwest, Southeast, and Sun Belt often offer far better rent-to-price ratios than those in coastal or high-demand metros. Instead of chasing slim margins in your backyard, you can tap into markets with double-digit cap rates and strong rental demand.

2) Diversification Across Economies

When all your rental properties are in the same city or region, your wealth is tied to that single economy. Out-of-state real estate investing allows you to diversify risk across multiple job markets, industries, and housing cycles —a proven investing strategy for weathering economic downturns.

3) Faster Portfolio Growth

Buying a single property in an expensive market like Los Angeles or New York can cost you $1 million or more. With that same capital, you could purchase three or four rental homes in strong cash flow markets like Birmingham, AL, Cleveland, OH, or Columbus, GA. More doors usually mean more rental income, faster equity growth, and better scalability.

4) Access to Professional Property Management

The biggest mental hurdle for many remote investors is figuring out how to manage a property that’s 1,000 miles away. The reality is that technology and real estate professionals, such as property managers and turnkey teams, make it easier than ever to manage rental properties remotely while still staying on top of their performance.

5) Tax Efficiency & Market Advantage

Out-of-state investing allows you to take advantage of landlord-friendly states with lower property taxes, favorable eviction laws, and higher potential for net operating income. Choosing the right market can put thousands of extra dollars in your pocket each year.

Investor Tip: Instead of asking yourself, “Where can I invest near me?” start asking, “Which real estate markets fit my goals best?” Whether you want to focus on cash flow, equity growth, or a combination of both, exploring what markets have to offer beyond your local area can provide you with more opportunities to build wealth.

Out-of-State Real Estate Investing Strategies

There isn’t a one-size-fits-all approach to investing in rental properties out of state. The right strategy for you depends on your goals, risk tolerance, and how hands-on (or hands-off) you want to be. Here are the most common investing strategies that work well for remote investors and how to know if they’re the right fit for you:

Turnkey Investing

With turnkey investing, you buy fully renovated or new-build properties that already have property management in place. Turnkey investing is the most hands-off strategy, making it perfect for busy professionals who want cash flow and appreciation without the day-to-day hassle of being a landlord. At RealWealth, our vetted turnkey teams specialize in off-market opportunities across multiple U.S. markets.

Buy-and-Hold

For this strategy, you acquire single-family or multifamily properties in strong growth markets and hold them for the long term (typically 7 to 10 years or longer), hence the name “buy-and-hold.” This strategy generates wealth through both rental income and long-term appreciation. Out-of-state real estate investing for buy-and-hold works exceptionally well when you diversify across markets with strong population and job growth.

BRRRR (Buy, Rehab, Rent, Refinance, Repeat)

Popular with more experienced investors, BRRRR allows you to force appreciation and recycle your capital. While this can be a powerful way to scale, it’s harder to execute remotely unless you have a reliable local team of contractors, property managers, and lenders.

House Hacking

For this strategy, you buy a small multifamily property, such as a duplex, triplex, or fourplex, and live in one unit, while renting out the others. In the past, house hacking has typically been used as a local strategy; however, remote work has created opportunities for out-of-state investing, with investors eager to capitalize on low down payment options (3.5%) for FHA loans and live in a new area for a year to meet the loan requirements.

Short-Term Rentals

Investors leverage platforms like Airbnb or VRBO for short-term rentals in tourist-friendly or business-travel-heavy markets. These can deliver strong returns, but they come with added management complexity, local regulations, and risks associated with seasonality. It can be especially challenging if you’re remote and don’t have a strong co-host or property manager.

Real Estate Syndications

Instead of buying and managing property yourself, you can invest passively in larger multifamily or commercial properties that experienced operators manage. Real estate syndications allow accredited investors to pool funds, diversify at scale, and benefit from professional management. You can choose from real estate syndications in a variety of real estate markets nationwide, depending on your goals.

Real Estate Funds

One of the best ways to passively invest and diversify your real estate portfolio into many out-of-state markets at once is to invest in a real estate fund. RealWealth’s multi-family fund, for example, offers open-ended investments and is focused on buying and improving Class A/B apartment communities in growing U.S. markets. When investing in a fund, you can receive steady cash flow, long-term equity growth, and built-in diversification over a set number of years. Unlike a DST (highlighted below), funds typically do not qualify for 1031 exchanges and are best for those investing new capital.

Delaware Statutory Trusts (DSTs)

A Delaware Statutory Trust (DST) operates similarly to a real estate fund. Both options allow you to invest in large, high-quality properties and diversify your investment across different states. The key difference is that DSTs qualify for 1031 exchanges, allowing you to defer capital gains taxes when reinvesting, unlike most funds. Also, the “Delaware” part just refers to the legal structure, not where the properties are located.

Investor tip: If you are new to out-of-state real estate investing or are a busy professional with a packed work/life schedule, turnkey investing is one of the simplest ways to start investing without overwhelming yourself.

Out-of-State Investing Strategies at a Glance

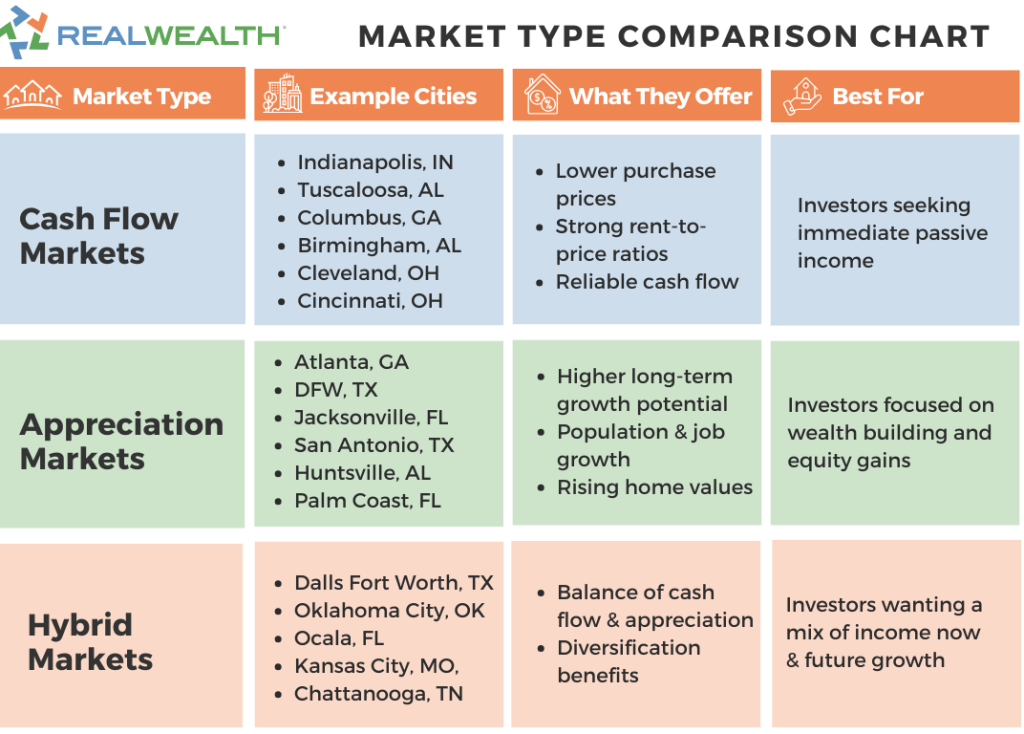

Best Out-of-State Real Estate Investing Markets

Not all markets are created equal. At RealWealth, we categorize them into Cash Flow Markets, Appreciation Markets, and Hybrid Markets. Here is a list of the markets we recommend:

Cash Flow Markets (steady income, affordable prices)

- Indianapolis, IN – Affordable homes, strong rental demand

- Tuscaloosa, AL – Anchored by the University of Alabama and the medical sector

- Columbus, GA – Military presence (Fort Moore) drives stable rental demand

- Birmingham, AL – Affordable properties, reliable rent-to-price ratios

- Cleveland, OH – Robust medical sector, steady rental demand

- Cincinnati, OH – Diverse economy with steady rental demand and affordable housing

Appreciation Markets (long-term equity growth)

- Atlanta, GA – Population boom, strong job growth

- Dallas–Fort Worth, TX – Business-friendly hub with rapid expansion

- Jacksonville, FL – Population growth and a diverse economy

- San Antonio, TX – Military, tech, and healthcare growth

- Huntsville, AL – Aerospace and tech hub with strong job creation

- Cape Coral, FL – Lifestyle-driven growth near Florida’s coast

Hybrid Markets (balance of cash flow + appreciation)

- Dallas-Fort Worth, TX – Certain suburbs offer both stability and substantial growth

- Ocala, FL – Affordable entry point plus growth potential

- Oklahoma City, OK – Consistent cash flow with room for appreciation

- Kansas City, MO – Affordability, diverse and growing economy

- Chattanooga, TN – Tech investment and affordable housing blend both worlds

Best Out-of-State Real Estate Investing Markets at a Glance

RealWealth Advantage: Many of the recommended turnkey property teams we work with are in these markets. They offer newly built or rehabbed, single-family, and multifamily off-market rental properties. To see what types of rental properties are available, join RealWealth.

5 Common Mistakes to Avoid With Out-of-State Investing

Out-of-state real estate investing offers tremendous opportunities to diversify your portfolio and access strong markets, but it also has unique risks. Many investors make avoidable mistakes that can waste time, money, and peace of mind. Here are the most common problems and how to avoid them:

1. Buying Blind

One of the biggest mistakes is purchasing a property without proper due diligence. Photos and pro formas can look great on paper, but only inspections, rental comps, and trusted boots on the ground can confirm the real condition and value.

Investor Tip: Work with vetted local teams and always request third-party inspections and rent verifications before closing.

2. Skipping Property Management

Managing tenants, maintenance, and local compliance remotely can quickly turn into a second job. Some investors try to save money by self-managing, but end up with late payments, extended vacancies, and costly headaches.

Investor Tip: A professional property manager is worth their fee. Interview multiple managers and ensure they have strong tenant screening and clear communication practices.

3. Chasing Only Appreciation

Many new investors focus exclusively on markets with skyrocketing values, hoping to “time” appreciation. But appreciation-driven markets can cool quickly, leaving you with low or negative cash flow.

Investor Tip: Balance your portfolio with cash-flowing markets that provide steady income today, alongside markets with strong long-term growth potential in equity.

4. Ignoring Landlord Laws

Not all states are landlord-friendly. Some areas have rent control, lengthy eviction timelines, or strict tenant protections that can significantly impact profitability.

Investor Tip: Research landlord laws before investing in out-of-state real estate. States in the Southeast and Midwest often have more favorable laws for property owners.

5. Underestimating Expenses

From vacancies to maintenance surprises, many investors underestimate the actual costs of owning rental property. This is especially dangerous when you’re hundreds or thousands of miles away and need to hire trustworthy professionals for repairs and maintenance.

Investor Tip: Always budget conservatively. Factor in 5–10% vacancy loss, 8–10% property management fees, and 5–8% for maintenance and cash reserves.

RealWealth Perspective

As investors ourselves, we know that many investors fall prey to these costly traps when they begin investing in rental properties. That’s why we provide people with the resources and connections they need to be successful when investing in out-of-state real estate.

RealWealth membership is 100% free and includes:

- Investor education (webinars, guides, articles, live events)

- Connections to vetted turnkey teams

- Free strategy sessions with an expert investor

- Investor resources (real estate professionals, checklists)

Whether you’re buying your first rental property or expanding into multiple markets, our mission is to help you build wealth wisely and confidently.

Myth vs. Reality in Out-of-State Investing

Myth 1: You need to live near your rental properties.

Reality: With vetted property managers, investor-friendly lenders, and modern tech tools, you can successfully invest from anywhere. Many RealWealth members own properties in markets they’ve never visited. This can lead to better cash flow, lower costs, and greater long-term growth potential. Many real estate investors choose this option when local markets are too expensive or do not provide good returns.

Myth 2: Out-of-state investing is too risky.

Reality: All real estate has risk, but spreading your portfolio across multiple states actually reduces your exposure to one local economy. Due diligence, inspections, and conservative underwriting keep risks manageable.

Myth 3: Only wealthy investors can buy properties out of state.

Reality: Many strong rental markets have properties in the $100,000–$250,000 range, meaning you could get started with as little as $20,000–$50,000 down.

Myth 4: Managing remote properties is impossible.

Reality: Professional property managers and turnkey providers take care of daily tasks. You maintain control by reviewing reports and making important decisions, without having to be available for tenants.

How to Invest in Out-of-State Real Estate

Out-of-state real estate investing may feel overwhelming, but breaking it down into smaller chunks makes it more manageable. Here’s a roadmap first-time remote investors can follow:

1. Define Your Goals

Decide what you want your real estate portfolio to achieve. Are you investing for steady monthly cash flow, long-term appreciation, or building retirement income? Knowing this will shape your market selection, property type, and financing strategy.

2. Research Strong Markets

Look beyond your local area. Study population trends, job growth, economic diversity, and rent-to-price ratios. Tools like U.S. Census data, Niche.com, and City-Data.com can help you evaluate markets. Focus on places with both demand for rentals and landlord-friendly laws.

3. Assemble Your Team

Investing in out-of-state real estate requires a local presence. Build a network that includes a lender familiar with investor loans, a property manager with a strong track record, and regional real estate experts who are knowledgeable about the neighborhoods. For a more hands-off approach, team up with trusted turnkey providers who manage acquisition, renovation, or building, as well as property management.

4. Run the Numbers

Never buy a rental property based on emotion; use the deal numbers as your guide. Calculators like DealCheck help you analyze key metrics, like cash flow, cap rate, cash-on-cash return, ROI, and the property’s long-term appreciation potential. Always take the time to verify amounts for property taxes, management fees, and vacancy assumptions.

5. Perform Due Diligence

Protect yourself by conducting thorough inspections, reviewing neighborhood comps, verifying rent estimates, and checking crime rates. A strong appraisal and inspection report will give you confidence before closing.

6. Close with Confidence

With financing lined up, due diligence completed, and a reliable team in place, you can close on your first out-of-state rental property knowing you’ve minimized risk.

For an in-depth guide, check out our article, “How to Buy Rental Property & Earn Income While You Sleep.”

Investor tip: Start small, be patient, and seek help from other experts or a real estate mentor. There is a lot to learn about real estate investing, and growing your portfolio one property at a time can help you transition from newbie to expert. Choosing to invest in out-of-state rental properties helps diversify your portfolio and gives you access to markets with greater growth potential.

Tools & Resources for Out-of-State Investors

There are a plethora of online tools and resources for investors interested in out-of-state real estate investing. They make researching and analyzing markets easier than ever. By leveraging the right mix of platforms and services, you can minimize risk and make smarter, data-driven decisions from anywhere.

- Zillow.com & Realtor.com: Go-to platforms for property searches, neighborhood comps, and pricing trends. They’re handy for spotting market patterns and evaluating how affordable a market is compared to rental demand. Please note that the properties listed here are market prices. Many investors prefer off-market deals, such as those offered by RealWealth’s recommended turnkey providers.

- RentCast.com: When investing in out-of-state real estate, it’s essential to gather information on rental rates so you can better estimate your expected cash flow. This tool helps you avoid overestimating or underestimating rents and ensures your property’s numbers are realistic before you make a purchase.

- NeighborhoodScout.com: Offers deep data on demographics, crime rates, and school quality. Understanding the tenant base and safety of an area is crucial for long-term success, especially if you’re investing remotely.

- Niche.com: Great for evaluating schools and a neighborhood’s quality of life. Strong school districts often correlate with higher tenant demand and stable long-term renters.

- City-Data.com: A comprehensive resource with statistics on schools, neighborhoods, income, employment, and crime rates. This is a powerful tool for understanding an area.

- DealCheck.io: A robust deal analysis tool that helps investors quickly calculate ROI, cap rates, cash flow, and long-term projections. It’s an essential tool for stress-testing out-of-state real estate investing deals before making offers.

- RealWealth: Investors benefit from community and personalized guidance and support. RealWealth offers free education, vetted turnkey providers, live events, and one-on-one strategy sessions with experienced investors to help you avoid costly mistakes and get into strong markets confidently.

- Download “The Busy Person’s Guide to Getting Your First Rental in 90 Days” to get a step-by-step roadmap.

Investor tip: Use at least 2 or 3 tools for every deal. No single platform provides the whole picture. By combining property data with rental comps, neighborhood insights, and demographic stats, you can make significantly better out-of-state investing decisions.

Out-of-state real estate investing is a great way to enter more affordable, growth markets and diversify your portfolio as you work towards building long-term wealth. By investing in rental properties in leading U.S. markets, you can create streams of passive income no matter what part of the country you live in. The key to success is to always do thorough research, work with experienced property managers or turnkey providers, and follow a proven investing strategy. This will help you make sure your out-of-state investments generate consistent returns and reduce risk.

Final Thoughts

Out-of-state real estate investing is one of the fastest ways to grow your portfolio, diversify across markets, and achieve financial freedom. With the right strategy, the right markets, and the right partners, it’s possible to build wealth without being tied to your local market.

Next step: Join RealWealth for free to access vetted property teams in 12+ U.S. markets, schedule a strategy session, and start building your real estate portfolio today.

Frequently Asked Questions

Yes, especially if your local market is too expensive or yields are low. Investing in rental properties out of state can unlock higher returns and diversification. For example, many California and New York investors turn to Midwest or Southeast markets where homes are more affordable and rental yields are stronger. The key is to do your due diligence and work with trusted teams on the ground.

The best way to build a team you can count on is to work with a turnkey real estate company, such as RealWealth, or a real estate network that already has established relationships with property managers, lenders, and contractors. RealWealth members gain access to trusted local teams in multiple markets, making it easier to invest remotely with confidence. Join RealWealth to find your next out-of-state turnkey rental property.

Many investors choose to buy rental properties in another state to achieve better returns, geographic diversification, and more affordable entry points. To help you figure out if buying rental property in another state is right for you, read Is Investing in an Out-of-State Rental Property Right for You?

The best property management companies for out-of-state investors have strong local expertise, transparent processes and fees, and proven systems for tenant placement and maintenance. At RealWealth, we spend months vetting property management teams to ensure they are experienced and set up for success with our investor members. For tips on how to find a good property manager, read Why Property Management Is Important & How to Find A Good One.

When you join RealWealth, you’ll get access to a network of trusted real estate attorneys who specialize in working with real estate investors. These professionals understand the unique legal considerations of out-of-state ownership and can help ensure your transactions are structured securely and efficiently. Members can connect with other recommended resources, including lenders, 1031 exchange facilitators, accountants, and additional real estate professionals.

The key factors to research are job growth, population trends, affordability, rent-to-value ratio, local landlord laws, and economic diversity. If you are ready to start analyzing markets, we’ve outlined helpful steps in How to Do a Real Estate Market Analysis Like an Expert.

Common risks include poor property management, rent defaults, unreliable contractors, high repair costs, tenant damage, and being unfamiliar with local regulations. The best way to mitigate them is to work with trusted, vetted teams who specialize in helping remote investors. Learn more about what to look out for in Five Types of Real Estate Investing Risks & How to Reduce Each.

Discuss the property management company’s operations and systems with key personnel. Ask about their local market experience and whether they also invest there. Research reviews from other investors. Find out the vacancy rate, management fees, rent collection process, maintenance response times and fees, and communication practices. At RealWealth, our vetting process typically takes about 90 days, though it may take longer. We look at every aspect of the business, including background checks, to ensure they meet our high standards. Learn 5 Tips on How to Manage Out-of-State Rental Property.

Key metrics include cash-on-cash return, cap rate, rent-to-value ratio, and long-term appreciation potential. If you are a RealWealth member, you’ll gain access to real estate pro formas and discounted tools, such as DealCheck, that can help you accurately analyze potential cash flow and ROI before making a purchase.

The answer depends on your comfort level and whether you have property management in place or if you are self-managing. Some investors with property management visit their investment property once or twice a year. Others may never set foot on their property. With technology at our fingertips, like video calls and digital photos, staying updated has become easier. However, this does require a level of trust with your local property management team.

RealWealth has been connecting investors with vetted turnkey real estate opportunities for over 20 years. We offer free education through weekly webinars, articles, and podcasts, and we thoroughly vet property teams and resources so you can invest remotely with confidence. Learn more about what sets us apart in Who Are the Best Turnkey Real Estate Companies?

Smart investors rely on a combination of economic data, local market research, and expert guidance to identify strong out-of-state opportunities. Understanding what makes a location attractive for rental property investing is essential before you commit capital. Start by reading our guide on How to Determine If a Real Estate Location is Good.

Comparing markets means looking at job growth, population trends, rent-to-price ratios, and landlord-tenant laws to find the best opportunities for your investment goals. We recommend using both comparative market analysis and neighborhood-level research to make informed decisions. Learn the process in How to Do a Comparative Market Analysis and How to Do a Neighborhood Analysis in Real Estate.

We highly recommend working with a CPA and tax specialist who is knowledgeable about real estate investing, its tax benefits, and understands the rules and regulations for both the state where you live and the state where your property is located. Typically, you’ll report rental income on your federal and state returns, if applicable, as some states have no income tax. Our list of investor resources includes CPAs experienced in multi-state real estate tax strategies to help you maximize deductions and manage compliance. Find a CPA.

Yes! Investors can complete 1031 exchanges and legally avoid paying capital gains taxes when buying like-kind properties in different states, provided both properties are in the U.S. RealWealth partners with qualified intermediaries who can help you defer taxes while upgrading into stronger out-of-state markets. Learn more and get help with a 1031 exchange.

Markets with strict tenant laws, high taxes, or slow job growth, such as California, New York, and Washington, can make investing in and managing properties more challenging. The markets RealWealth recommends focus on landlord-friendly, high-growth markets with strong fundamentals—such as Texas, Florida, and certain states in the Midwest, among others—where investors can find better cash flow and appreciation. Start researching where to invest out of state in the Best Places to Buy Rental Property.

Most investors rely on professional property management or turnkey providers. These teams handle everything from leasing and tenant screening to maintenance and rent collection. Many also provide detailed reporting, allowing you to track performance remotely. With the right team, you can be a passive investor without sacrificing control.

For new investors, turnkey single-family rentals in landlord-friendly, cash flow markets are often the best entry point. These properties are already renovated, rented, and professionally managed, so you can start earning income from day one. Starting small (with one property) also allows you to learn the process of how to buy your first rental property before scaling.

You’ll pay property taxes in the state where you invest, and you’ll report rental income on your federal return. You may also need to file a non-resident tax return in the state where the property is located. The good news is that rental properties come with valuable tax benefits, including depreciation, mortgage interest deductions, and write-offs for expenses, like property management and maintenance fees. A real estate–savvy CPA can help you maximize these benefits.

Focus on fundamentals such as job growth, population trends, affordability, and landlord regulations. A market with rising demand and stable employment is far more likely to deliver consistent cash flow and appreciation. Use tools like Niche.com, RentCast.com, and RealWealth’s education and market guides to compare areas. By becoming a RealWealth member you’ll also have access to complimentary Strategy Sessions where you can discuss markets and strategies one-on-one with an expert investor.

The 1% rule and 2% rule are quick guidelines investors use to evaluate whether a rental property may generate strong cash flow.

1% Rule: A property should rent for at least 1% of its purchase price per month. For example, if you buy a property for $200,000, the rent should be at least $2,000/month. Meeting this benchmark suggests that the property may cover expenses such as mortgage, taxes, and insurance, while still leaving room for profit.

2% Rule: This is a stricter version, stating that the monthly rent should equal 2% of the purchase price. For example, a $100,000 property should rent for $2,000/month. While rarer in today’s market, the 2% rule can often be found in lower-cost, high-cash-flow markets.

Please note that these rules are screening tools, not guarantees. They don’t factor in expenses like property management, maintenance, or vacancies. At RealWealth, we recommend using these rules as a starting point, then running a pro forma analysis with all metrics before deciding if a property truly meets your investing goals.

Unexpected repairs or vacancies can happen, which is why property management and cash reserves are critical. A strong local team can handle issues on your behalf, and keeping at least 3–6 months of expenses in cash reserves provides you with a financial safety net.

Yes. Conventional loans, DSCR loans, and portfolio lenders work with out-of-state investors. And, if you do some on-the-ground research, you can often find local banks that will work with real estate investors. Typically, the underwriting for the loans will focus on your personal finances and the property’s ability to generate rental income. At RealWealth, our recommended lenders work with investors nationwide.

The answer to this will vary based on your investing strategy (cash flow, equity growth, or hybrid). To find a state that may suit your goals, we suggest starting your research by reading “The Top 25 Best Places to Buy Rental Property in 2025” and attending our webinars.

RealWealth members get access to turnkey rental properties in carefully selected markets, complete with pro formas, projected ROI, and property management already in place. Once you connect with a turnkey property provider at RealWealth, they will send you their available inventory of off-market rentals, which may include single family homes, multi-family homes, and new construction homes. These listings are ideal for investors seeking passive income real estate opportunities in landlord-friendly states. Join RealWealth.