If you’ve ever wondered how to buy rental property but felt overwhelmed by the process, you’re not alone. Many aspiring investors are eager to create passive income through real estate, but they don’t know how to buy their first rental property.

To help you avoid mistakes and create a strategy that works for you, we’ve created a 12-week roadmap that shows you the key accomplishments you need to make each week and the basics of what to expect when buying a property within 90 days.

Quick Answer: How to Buy a Rental Property

Want to earn passive income while you sleep? We’ve created a week-by-week guide, outlining the steps you need to take to buy your first rental property in 90 days. You’ll learn how to:

- Define your financial goals

- Choose an investing strategy

- Evaluate your finances

- Find a real estate mentor

- Pick a real estate market

- Choose the right property type

- Get pre-approved

- Analyze available inventory

- Submit your offer

- Finalizing your financing

- Do your due diligence

- Get insurance quotes

- Close on your property

- Transition to ownership

Understanding the steps you need to take and what to expect about the process will help you set yourself up for a successful real estate investing transaction and experience. You may also like “The Busy Person’s Guide to Buying Your First Rental Property in 90 Days.” Download the free guide here.

How to Buy Rental Property: Your Guide to Earning Passive Income

As you’ll soon discover, there are a lot of steps you need to take when learning how to get into rental properties. To make the process easier, we’ve broken the basics down into weeks, so you can more easily digest what you need to do. Remember, this is your real estate investing journey, so take the time you need before confidently moving on to the next step.

Phase 1: Get Ready (Weeks 1-4)

Week 1: Define Your Investment Goals

Begin by defining what you want your investment property to accomplish. Is your goal to create monthly cash flow, capitalize on home appreciation, or a mix of both? Do you want tax advantages like deductions for mortgage interest and depreciation? Is the goal to diversify and protect against inflation? Defining your why helps shape your entire strategy.

Week 2: Choose An Investing Strategy

The next step is to determine the best real estate investing strategy for you. Here is a breakdown of the strategies you may want to consider.

- Flipping: You purchase an undervalued or distressed property, renovate it, and resell for a profit. Best suited for investors with renovation skills and sufficient time availability. Risks include high holding costs and budgeting errors.

- House Hacking: You buy a duplex or single-family home. You live in one unit, and rent out the other unit(s) or room(s). This strategy helps cover the mortgage and lowers living costs while you build equity. Great for first-time investors.

- BRRRR (Buy, Rehab, Rent, Refinance, Repeat): You buy a fixer-upper, renovate it, rent it out, refinance to pull equity, then use the funds for the next deal. Ideal for investors who are knowledgeable about renovations or have an established reno team.

- Turnkey Investing: You purchase fully rehabbed or new build property that is ready for tenants and managed by professional providers. Ideal for first-time investors and busy professionals who prefer not to manage the day-to-day responsibilities of a landlord.

- Long-Term Rentals: You buy properties and rent to tenants with long-term leases, and hold for the long term. The goal is to generate monthly cash flow while building equity and benefiting from appreciation and tax deductions. Requires either property management or strong personal discipline to be a landlord.

- Short-Term (Vacation) Rentals: You list properties on platforms like Airbnb or VRBO for nightly or weekly stays. This strategy offers higher potential income but demands more management, customer service, furnishing, and market oversight.

- Real Estate Syndications: You pool capital with others to invest in large development projects that a syndication manager manages. Participants usually need to be an accredited investor. Offers passive income, portfolio diversification, and access to larger investment opportunities. Investments are illiquid and depend heavily on sponsor performance.

Take a good, hard look at your skill set and available time, so you can determine how you can make money in real estate. If you have ample time and consider yourself a handy fix-it person, you may be well-suited for flipping, as that requires time and renovation skills. If you are super organized, enjoy customer service, and have time to spare, you may be well-suited for short-term rentals, as these properties typically have a stream of rotating customers and properties that need to be refreshed and upkept. If you are a busy professional with limited time, you’d be well-suited for turnkey investing.

Investor tip: If you decide the best strategy for you is turnkey investing, we encourage you to join RealWealth. Membership is free and provides you with invaluable resources like investor education, connections to vetted turnkey property teams, and an investment counselor.

Week 3: Evaluate Your Finances

Before buying rental property, you need to understand your financial situation and how much money you have on hand for a down payment. Unlike a 3-5% down payment for a primary home loan, an investment property down payment is typically 20 to 25%.

Many investors have set aside $40,000 to $80,000 to cover a 20% down payment, closing costs, and reserves. If you’re not there yet, focus on increasing your income, lowering expenses, and saving, while you continue to learn how to buy rental property.

Week 4: Join an REI Group or Find A Real Estate Mentor

Being around like-minded investors or having a real estate mentor can help you level up more quickly. Consider joining a group like REIA (Real Estate Investors Association), which has local chapters all over the U.S. They charge an annual membership fee and offer monthly classes and webinars on various real estate investing topics. Members are investors at all levels, so you’ll likely be able to find a mentor.

If you are looking for a 100% free option with a turnkey focus, RealWealth membership gives you access to educational webinars, connections to vetted property teams, and support and guidance from expert investors.

Investor tip: Boost your real estate knowledge without spending a dime by listening to podcasts. Kathy Fettke, RealWealth’s co-founder and an expert investor, hosts The Real Wealth Show, one of the first real estate investing podcasts, and Real Estate News for Investors, and co-hosts the Bigger Pockets On the Market podcast.

Phase 2: Explore Markets + Properties (Weeks 5–7)

Now that you’ve built a foundation, it’s time to look at real estate markets, the property types available, and get pre-approved so you can buy your first rental property.

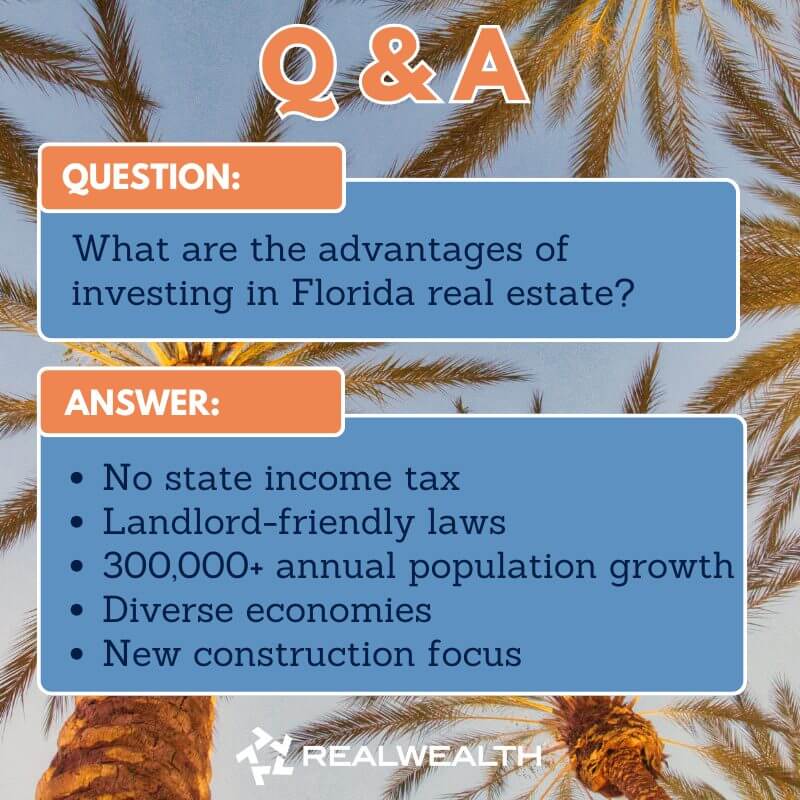

Week 5: Pick A Strong Investor Market

Learning how to buy your first rental property starts with choosing the best market for your goals. Key factors for selecting an investor-friendly market are:

- Location

- Job growth

- Population growth

- Affordability

- Landlord-friendly laws

Spend some time using tools like Niche.com and City-Data.com to dive deeper into the market and learning about neighborhood crime rates, school scores, and rental demand. Before you narrow down the best rental markets for you, go back to the questions you answered in week one.

If your goal is to create passive income, consider markets with higher cash flow and lower appreciation. If you want long-term appreciation, consider markets with lower cash flow but higher appreciation. If you want a mix of both, consider hybrid markets that offer cash flow and appreciation. If you are unsure about what market to choose, the experts at RealWealth can help.

While learning how to buy a rental property, you’ll realize it isn’t necessary to travel to the market, as you can find data and insights online. However, you may still want to visit the market in person. Keep in mind that the strategy you select (flipping, BRRRR, turnkey, etc) may influence this decision, as some may require more on-the-ground research than others.

Investor tip: One of the benefits of a RealWealth membership is that we do a lot of the heavy lifting. Our investor experts spend months researching and analyzing our recommended markets and vetting turnkey property providers. In addition, many of the teams we recommend offer in-person property tours, allowing our members to walk the properties, meet the team, and network with other investors.

Week 6: Choose A Property Type

When buying rental property, you’ll soon find there are a variety of property types to choose from, such as:

- Single family homes

- Duplexes

- Triplexes

- Fourplexes

- Multi-family/Apartments

- Condos/townhomes

- Commercial/retail

- Real estate syndications

When learning how to buy your first rental property, many new investors choose to start with single family homes. Then, they may add different property types as their knowledge and portfolio grow. But, like we’ve said earlier, it all depends on your investing strategy and goals.

For example, someone who chooses flipping as their investment strategy is looking to add value and increase the selling price, so they’ll want a property that needs some work. A turnkey investor, however, is looking for a rent-ready property and will be looking at fully renovated or new build rental properties.

Investor Tip: As you progress from newbie to experienced real estate investor, your real estate goals may change. That’s normal. Like stocks, many investors choose to diversify their portfolios across markets and even property types (SFRs, duplexes, multifamily), so they can reduce risk and improve returns over time.

Week 7: Get Pre-Approved

The next step is to start talking to lenders about finance options like conventional loans, DSCR (Debt Service Coverage Ratio) loans, hard money loans, or private financing. If you joined a local REIA group, they’ll likely have lenders who are part of the organization, or you can review our list of vetted resources here.

When buying rental property with a traditional or DSCR loan, it’s a good idea to get a pre-approval letter. To do this, simply submit all of your financial documents to the lender, and from that information, they’ll determine how much of a loan they can offer.

Provide your lender with:

- Tax returns (two years)

- W2s (two years)

- Two months of:

- Bank statements

- Mortgage Statements

- Investment fund statements

- Stock account statements

- And any other financial documents they request

Sometimes, this process can feel cumbersome. All you can do is be patient and provide your lender with the necessary documents. Once they have everything, they’ll send you a preapproval letter, showing you how much of a property you can shop for. With this in hand, it’s officially time to start searching for investment properties.

Investor tip: When new investors buy their first rental property, many don’t realize that loan officers will consider IRAs and 401(k)s as part of the reserves. Just be aware that if you withdraw money from these types of accounts, you may incur penalties based on the fund type

Phase 3: Make Your Move & Close the Deal (Weeks 8–12)

With your real estate market and financing for your rental property in place, it’s time to start analyzing properties and putting in an offer.

Week 8: Analyze Available Inventory

The next step for buying rental property is to become familiar with the available inventory, price points, and pro forma information. Use tools like DealCheck.io to calculate cash-on-cash return, cap rate, net operating income, and ROI.

To get comfortable with this process, play around with the numbers and see how different scenarios impact your return on investment (ROI). Understanding what makes a deal work or not is a crucial step when learning how to get into rental properties. The more familiar you become, the more likely you’ll be able to act fast when a good deal comes along.

Investor tip: When you receive a pro forma from the seller, it’s a good practice to double-check line items like rental rates, vacancy rates, property management fees, property taxes, and maintenance costs for accuracy. Sometimes the original pro forma calculations are off, so it’s up to you to verify the data provided.

Week 9: Submit Your Offer

Once you’ve identified a property, it’s time to submit a formal offer. The process may differ slightly if you are working directly with the seller, wholesaler, a real estate agent, or a turnkey provider. Basically, you’ll submit a letter of intent or a standard purchase agreement. Be sure to thoroughly review the details of the documents, noting items like purchase price, escrow amounts, closing date, and contingencies.

The contract should include contingencies for appraisal, inspection, and financing, as they protect you in case something unexpected comes up during the due diligence process. You’ll also want to note items that may be included in the sale, such as appliances, fencing, sheds, and garage door openers.

Once both parties agree on the price and terms of the agreement, you’ll need to provide an earnest money deposit, typically between 1 and 2% of the purchase price. A third party holds the money in an escrow account. You’ll also want to provide a copy to your lender.

Insider tip: If you are going through this process for the first time, it may feel overwhelming. This is where having a real estate mentor or expert investor in your corner comes in handy.

Week 10: Finalize Your Financing

Ensure that you have all necessary documents to meet your lender’s requirements and lock in your interest rate.

Week 11: Schedule a Property Appraisal & Home Inspection & Get Insurance Quotes

When buying rental property for most real estate strategies, it’s a good idea to get a home inspection and a property appraisal. Please note this is an out-of-pocket expense, and typically costs around $500 each.

Home Inspection

For the home inspection, a professional home inspector will thoroughly examine the property’s structure and systems to identify defects and other concerns. They’ll inspect things like the foundation, roof, electrical and plumbing systems, and look for areas of water damage, mold, broken windows, etc.

What they find will be given to you in a multi-page report. After receiving the report, we recommend discussing any questions with them and obtaining feedback on items that require immediate attention versus those that can wait. This report can be hugely beneficial for investors, as it not only provides you with a thorough review of all aspects of the property, but it may also provide you with some leverage.

For example, suppose your strategy is turnkey investing and the inspection brings to light some pressing issues. In that case, you can give the turnkey provider a fix list (in writing) that will need to be addressed before the property is purchased. Once the items on your list are addressed, you can have the home inspector go back to verify that the fixes were made. In addition, if major repairs need to be addressed, like structural issues or safety hazards, you have some negotiating leverage.

Home Appraisal

A licensed appraiser performs a home appraisal and provides an unbiased assessment of the home’s current value, using factors like neighborhood, property condition, and comparable sales. In most cases, you’ll want to get a home appraisal. However, for a flipping strategy, you may want to forgo an appraisal, as you’ll be renovating the property to boost its current value. Before you purchase the property, it’s a good idea to do a comparative market analysis, so you understand the potential value of the property after renovations are complete.

Insider tip: If you decide to invest in turnkey rental properties, RealWealth is the only company that has developed established turnkey property standards, which we call the Real Income Property Standards. Feel free to use these standards, and our Investor Checklist, as you go through this process to determine if the property’s value and condition meet expectations.

Get Insurance Quotes

When getting a mortgage through a lender, they’ll require that home insurance be in place as part of the process. Obtain insurance quotes from insurance companies that specialize in landlord coverage. To get a quote, provide them with property details like:

- Address

- Age

- Condition

- Square footage

- Property type

Once you’ve chosen a policy, make sure it’s in place before you close.

Insider tip: Before you close on your first deal, it’s a good idea to speak with a qualified real estate attorney about how to hold title, LLC, trust, or in your name, and a CPA on how to plan for reserves, liability, and taxes.

Week 12: Close on Your Rental Property

You’ve made it! All your hard work of learning how to buy rental property has brought you to closing day. Sign all documents and transfer the remaining downpayment funds to finalize your purchase of the rental property. Signing can take some time, so be sure not to be in a rush and give it your full attention.

Insider tip: Lenders typically send a mobile notary to your home to sign documents. Sometimes questions arise during this time, so be sure that your lender is available to answer them.

Week 12+: Transition to Ownership

Congratulations—you now own a rental property! Based on your investment strategy (flip, BRRR, turnkey, house-hack, etc), you’ll want to act accordingly to protect your investment. For example, a flipper will want to monitor the renovation projects, ensuring they meet deadlines, make quality updates, and don’t go over budget. A turnkey investor will want to keep track of rents and expenses every month, as well as overall performance annually.

Final Thoughts: How to Buy Rental Properties with a Smarter Strategy

Learning how to buy your first rental property doesn’t have to be stressful or time-consuming. If you read this article and want a step-by-step roadmap, join RealWealth to download The Busy Person’s Guide to Getting Your First Rental in 90 Days. Download the guide now.

FAQs

The best cities for rental property investing strike a balance between affordability, job growth, population increases, and strong rent-to-price ratios. Many investors are finding great opportunities in the Midwest, Southeast, and parts of Texas and Florida. See the complete list in our guide, 25 Best Places To Buy Rental Property.

Common mistakes include underestimating expenses, skipping due diligence, selecting the wrong market, or failing to have property management in place. Learn from other investors’ missteps in the Top 18 Biggest Mistakes When Buying Rental Property.

Investors earn returns from four primary sources: monthly cash flow, property appreciation, principal loan paydown, and tax benefits. We break these down in How to Make Money from Rental Properties Today.

Yes, with the right roadmap. Many busy professionals successfully close on their first property in three months or less by following a proven process. See the plan here: How to Buy Rental Property in 90 Days to Start Earning While You Sleep.

The best strategy depends on your goals and risk tolerance. Options include turnkey investing, BRRRR, house hacking, short-term rentals, and long-term buy-and-hold. Explore strategies in How to Invest in Rental Properties and Actually Build Wealth: 10 Proven Tips.

Yes. With just four well-performing rental properties, many investors create enough monthly income to retire comfortably. Learn how in Rental Properties for Retirement: How Four Rentals Can Set You Up for Success.

The answer depends on cash flow per property, location, and financing. On average, investors may need anywhere from 5 to 15 rentals. Find a full breakdown in How Many Rental Properties Do You Need To Make $100k Annually?

Yes, investors build long-term wealth through rental properties by combining cash flow, appreciation, loan paydown, and tax advantages. Over time, these factors compound, making investing in rental properties a proven strategy for achieving financial freedom and building generational wealth. Read our full guide on How To Build Wealth By Investing In Rental Properties.

While you can stress test a property using the 1% rule and 2% rule, many investors use online deal analysis calculators to evaluate if a deal pencils out and to run different scenarios. One of the most popular platforms for analyzing cash flow, cap rates, and return on investment is DealCheck. Learn exactly how to use it in our free training: How to Analyze Your Real Estate Investment Deals. RealWealth members receive a special discount.

If you’re just getting started, we recommend beginning with proven education from experienced investors. All our members start with our Investor Core Curriculum Series. This step-by-step series shows you how to begin your real estate investing journey with RealWealth and sets you up for success so you can build wealth through rental properties without the common mistakes.

You’ll find additional free resources on our website, including our free weekly webinars, learning center articles, and links to Kathy Fettke’s podcasts, The RealWealth Show and Real Estate News for Investors. We also suggest reading Kathy’s best-selling book Retire Rich with Rentals and attending a live event.

Choosing the right landlord insurance can protect your investment and your peace of mind. The key is understanding what coverage you actually need versus what’s optional. Get expert guidance on comparing providers and policies in our free webinar: Landlord Insurance for Rental Properties.

Not all lenders understand investment properties, and working with the wrong one can slow down your deal or cost you thousands. RealWealth members have access to our vetted network of lenders specializing in rental property financing and understanding investors’ unique needs.

RealWealth connects investors with vetted turnkey rental properties in some of the nation’s strongest markets for cash flow and appreciation. Whether you’re looking for properties in landlord-friendly states with no income tax or growing Midwest markets with affordable entry points, our members get access to off-market opportunities with property management already in place. Explore available properties in Florida, Texas, and Ohio.

Finding quality rental properties that actually cash flow can be challenging on your own. RealWealth connects members with vetted property teams selling single-family rental properties for sale, which come with property management already in place, so you can start earning passive income right away.

Passive investors need insurance that protects their investment without adding unnecessary complexity or cost. RealWealth works with insurance providers who understand rental properties and can tailor coverage for investors who prefer a hands-off approach to property management.

Turnkey properties let you invest without the hassle of rehabs, finding tenants, or coordinating repairs. RealWealth specializes in connecting investors with vetted turnkey real estate companies offering off-market opportunities in high-performing markets. You can see how we compare here, and become a member to access rental properties ready to generate income from day one.