Thinking about doing a 1031 exchange from California to another state? You’re not alone. Thousands of California landlords are exchanging high-priced, low-cash-flow properties for multiple rental properties in landlord-friendly states—often tripling or quadrupling their passive monthly income in the process.

Understanding how to create passive income with real estate investing and becoming job optional was one of the fist things that stood out to me when I started working for RealWealth who has centered its company culture around building a life of real wealth. I remember watching a success story that members Claudia and Julian recorded.

They did a 1031 exchange from California to another state and it paid off big time. They were able to exchange one San Francisco rental property for 20 rental properties in three states, all of which had property management in place.

In doing so, they were able to increase their cash flow six times, bringing in over $15,000 in purely passive income!

Imagine having $15,000 a month in your bank account for doing absolutely nothing. That would be pretty nice, right?

If you own rental property in California that isn’t producing enough cash flow, this could potentially happen to you, too. Because the truth is, money goes so much further outside of California. Understanding how to do a 1031 exchange and working with a qualified intermediary can help you make this transition successfully.

In markets like Jacksonville, for example, you can purchase a rental property for around $200,000 that’ll generate over $1,000 in passive income every month if you pay in cash.

If that’s not incentive enough, continue reading below to learn about the variety of other benefits to 1031 exchanging your California rental property for turnkey rental properties in other states.

Quick Answer: Can You Do a 1031 Exchange from California to Another State?

Yes, you can do a 1031 exchange from California to another state. There are no special IRS restrictions on exchanging California property for out-of-state replacement properties. However, California requires you to file Form FTB 3840 annually to track deferred gains, even after you move out of state.

Is it a good idea?

For many California landlords, exchanging to another state can significantly increase cash flow. For example, a $1 million California property might exchange for 3-5 rental properties in landlord-friendly states, potentially 3-6x higher monthly income.

What should you know before exchanging?

- Follow standard 1031 rules: 45 days to identify, 180 days to close

- California tracks your gain: File FTB 3840 annually until property is sold or donated

- Choose landlord-friendly states: Look for states without rent control and easier eviction processes

- Tax advantages: No California exit tax, but state will recoup deferred gains on eventual sale

Top cities California investors exchange to:

Jacksonville/Ocala, Dallas-Fort Worth, Chattanooga, Birmingham, and Atlanta offer higher cash flow, lower property taxes, and landlord-friendly laws.

Ready to find cash-flowing replacement properties outside California? Join RealWealth to talk with an investment counselor and find the best market for you →

Why California Landlords Are Doing 1031 Exchanges to Other States

California is hard on landlords. I know this firsthand because my family owns 130 units in the Los Angeles area and self-manages them. While it makes sense for us to stay in California financially (for now), there are many hoops to jump through. So many that my husband, who is the company’s general counsel, often works every day of the week. You can imagine how happy this makes me ;).

Here are a few of the biggest difficulties of being a California landlord, which may be enough of a hindrance to make you consider exchanging your California property for properties in another state:

- Most properties in California are under some form of rent control

- It’s incredibly difficult to evict problem tenants

- A lot of people are leaving California, which raises the question of whether the demand for rental properties will decrease in the coming years

You may also like: How To Identify 1031 Exchange Replacement Properties To Boost Cash Flow

Reason #1: California Has Rent Control

One of the most significant issues California landlords face is rent control. While this isn’t necessarily a deal-breaker for all California landlords, it can make life difficult for those who own four to six-unit properties. These types of properties, along with single-family homes owned by LLCs, real estate trusts, or corporations, are not exempt from rent control, and their size makes it difficult for them to cash flow if they can raise rents at most 5% per year (depending on the city and county).

Owning your single-family investment property personally, rather than in an LLC, real estate trust, or corporation, would solve the “rent control problem,” however, doing that would create a whole new host of problems since you and your bank account would be personally liable for anything that occurs at the property.

Understanding how to identify replacement properties that cash flow is essential when moving from rent-controlled California markets to landlord-friendly states.

Reason #2: California Makes It Incredibly Hard To Evict Problem Tenants

One of the most challenging parts of having a landlord husband is hearing about all the problem tenants he can’t evict. Like the man who refuses to wear a mask (even though the city mandates it due to COVID) in the common areas and throws his cigarette butts in the planters out front. Or the guy who lets his Golden Retriever (an Emotional Support Animal according to an internet doctor) run around the property without a leash, defecating in the hallways.

Reason #3: People are Leaving California for More Affordable States

It’s not hard to understand why so many people are leaving California. It’s expensive here, which makes it almost impossible for the typical person to afford to rent a nice apartment in a good part of town (let alone buy a home). So, people are leaving for states like Texas, Florida, and Tennessee.

And it’s likely this trend will only continue as more people work from home post-COVID. For those who are now only tied to a laptop instead of a desktop computer in a cubicle in a San Francisco or Los Angeles office building, moving may sound really nice.

Investor tip: When choosing replacement properties, focus on markets with strong population growth, job creation, and landlord-friendly regulations to maximize your investment returns.

1031 Exchange Rules When Exchanging California Property for Out-of-State Property

According to Joe Torre, one of our Investment Counselors, there are no specific 1031 exchange rules to follow when you exchange from California to another state beyond the standard IRS requirements. However, you’ll need to work with a qualified intermediary and follow the critical 1031 exchange timeline of 45 days to identify and 180 days to close on replacement properties.

Learn more about the general rules: 1031 Exchange Rules, Tips & Strategies for Success in Real Estate

Important Considerations When Doing a 1031 Exchange from California to Another State

California’s Tax Tracking Requirements

One thing to note when exchanging California property for another state is that California “aggressively tracks” the ultimate sale of a replacement property. When you eventually sell, they want to recoup the gains. This is true even if you no longer live in California. For the state to track you, they require that you complete form FTB 3840 in the year you initiate the exchange and every year thereafter.

According to the California Franchise Tax Board, you must continue to file FTB 3840:

- “As long as you defer the gain or loss

- If you exchange the out-of-state replacement property with another out-of-state property as part of another exchange

- Until you report and pay tax to California on your deferred gain or loss

- Until the owner of the replacement property dies, eliminating the deferred California source gain or loss

- Until you donate the replacement property to a non-profit organization”

Be sure to keep these requirements in mind if you choose to do a 1031 exchange from California to another state.

Strategies to Minimize California Tax Liability

As an investor, you need to keep this in mind if you choose to exchange California property for property in another state. A good rule of thumb is to try and never sell your replacement properties, but just continue doing 1031 exchanges and eventually leave your assets to your children or donate them to charity.

This “buy and hold forever” strategy is commonly used by successful real estate investors who want to:

- Defer capital gains indefinitely through successive 1031 exchanges

- Pass properties to heirs with a stepped-up basis (eliminating deferred gains)

- Build generational wealth through real estate

Working with the Right Team

To ensure a successful 1031 exchange from California to another state, you’ll need:

- A qualified intermediary experienced with multi-state exchanges

- A tax advisor familiar with California’s FTB 3840 filing requirements

- Local property management in your target markets

- An investment counselor who can help you identify cash-flowing replacement properties within your 45-day deadline

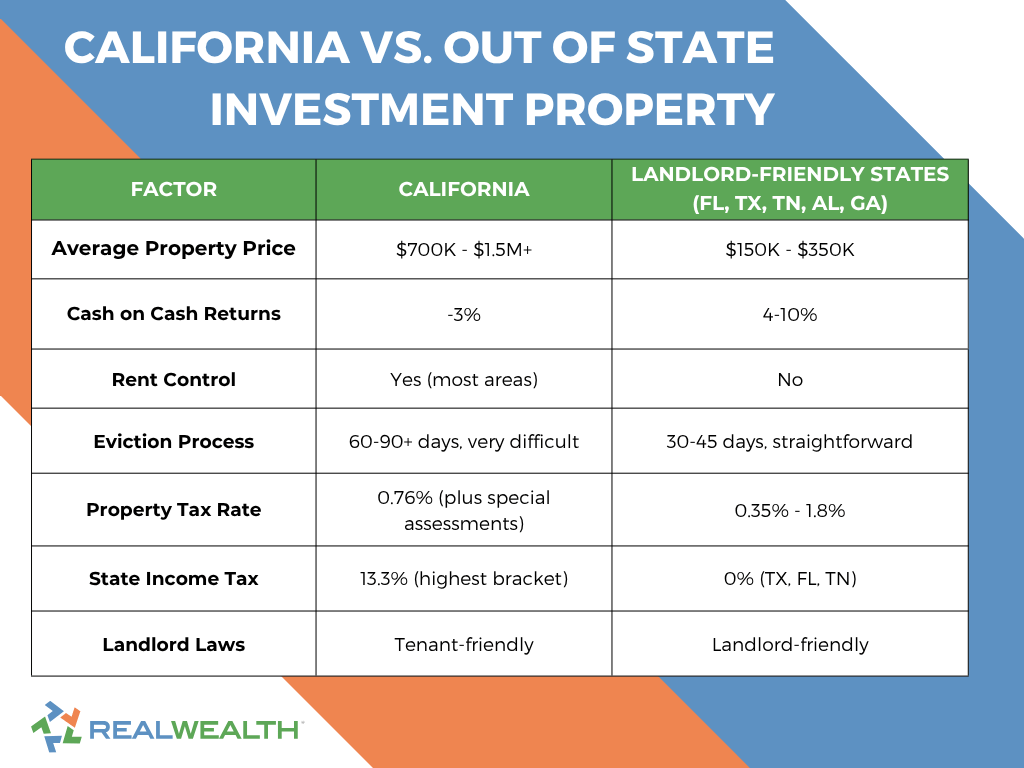

At a Glance: California vs. Out-of-State Investment Property

Best States for California 1031 Exchanges

When exchanging California property for out-of-state rental properties, these states consistently offer the best combination of cash flow, appreciation potential, and landlord-friendly laws:

Florida

- No state income tax

- Strong population growth (especially from California)

- No rent control

- Average property price: $200K-$350K

- Top markets: Jacksonville, Cape Coral, Ocala

Texas

- No state income tax

- Business-friendly environment

- Landlord-friendly eviction laws

- Average property price: $180K-$320K

- Top markets: Dallas-Fort Worth, Houston, San Antonio

Tennessee

- No state income tax

- Growing tech and healthcare sectors

- Low property taxes

- Average property price: $200K-$300K

- Top markets: Nashville, Memphis, Chattanooga

Alabama

- Extremely low property taxes (0.35% – The second lowest in the US!)

- Affordable housing market

- Strong landlord protections

- Average property price: $150K-$250K

- Top markets: Birmingham, Huntsville, Tuscaloosa

Georgia

- Business-friendly environment

- Strong job growth

- Affordable housing prices

- Average property price: $180K-$280K

- Top markets: Atlanta, Augusta, Columbus

Ann’s 1031 Exchange Success Story

Turning One Short-Term CA Rental Into 5 Rental Properties in AL

We recently helped our member Ann upgrade her real estate portfolio with a 1031 exchange from California to another state. From one short-term rental, with negative cash flow and declining revenue, she purchased four investment properties across diverse cities in Alabama. All of the properties have property management in place, and she is cash flow positive!

1031 Exchange: San Diego, CA → Alabama

- Real data: Sold $930K STR in San Diego (negative cash flow)

- Bought four properties across Alabama for $957,900

- Went from NEGATIVE cash flow to $29,483/year positive

- 9.8% return on equity

- Diversified across 4 Alabama cities (Huntsville, New Market, Birmingham, Bessemer)

Need help Finding replacement properties fast?

Join RealWealth (it’s free!) for expert guidance and access to all our 1031 Exchange resources.

Need Help Finding Cash Flowing Replacement Properties in Another State?

We can help! Along with free real estate investing education, RealWealth members get:

Join 80,000+ investors today, membership is 100% free!

Frequently Asked Questions

A 1031 exchange lets real estate investors defer paying capital gains taxes when they sell an investment property and purchase a “like-kind” replacement property with the proceeds. You must use a Qualified Intermediary (QI) who holds the funds, identify replacement properties within a 45-day window, and close within 180 days. Learn the complete rules and step-by-step process →

There are seven primary IRS rules that all 1031 exchanges must follow:

1. Like-Kind Property – Both properties must be investment real estate

2. Investment Property Only – No primary residences or personal use

3. Equal or Greater Value – Replacement property must be worth same or more

4. No Boot – In order for the exchange to be completely tax-free, you must not receive a “boot.”

5. Same Taxpayer – Title must be in the same name as the taxpayer on the relinquished property.

6. 45-Day Identification – Identify up to 3 properties within 45 days (no extensions)

7. 180-Day Purchase – Close on replacement within 180 days (no extensions)

You have 45 calendar days from the closing of the rental property you are selling to identify up to three replacement properties and a total of 180 days to close. These IRS deadlines are very strict with no extensions, so proper planning is critical. See the complete 8-step timeline and avoid missing deadlines →

Start early, and do so long before you put your property on the market. Planning early reduces the anxiety of the 45-day identification window, helps you connect with the best QIs, lenders, property teams, and find the best 1031 exchange replacement properties so you can meet all of your deadlines and not end up stressed out and settling for mediocre deals. RealWealth can help streamline the process for you, by connecting you with trusted 1031 exchange qualified intermediaries and property teams who have turnkey rental properties for sale now.

The IRS mandates two critical deadlines. The identification period is a 45-day window to identify potential replacement properties. The exchange period is the acquisition of the replacement property, which must be completed within 180 days of the sale of the relinquished property. Learn more about 1031 exchange timelines and mistakes to avoid →

There are four main types of 1031 exchanges in real estate: Delayed Exchange (most common, where you sell first and then buy), Simultaneous Exchange (where you close both properties on the same day), Reverse Exchange (where you buy first and then sell), and Construction Exchange (where you make improvements using exchange funds). Each has different requirements and timelines. Compare all four types and choose the right one →

Yes, a 1031 exchange qualified intermediary is required by law for 1031 exchanges. The QI holds the sale proceeds, prepares documents, coordinates closings, and ensures IRS compliance. If you touch the funds at any time without a QI, you’re disqualified and will owe capital gains taxes. Learn what a QI does, costs, and how to find one →

To find 1031 exchange investment property, focus on markets with population growth, job growth, affordability, low property taxes, and landlord-friendly laws. Start your search before selling and consider multiple properties in two to three markets, so if one of the rental properties falls through, you have a backup plan. Get the 12 rules for identifying cash-flowing replacement properties →

While all RealWealth property teams have ample inventory for 1031 exchange replacement properties, some of the most popular locations have been Dallas-Fort Worth, Alabama (including Birmingham and Huntsville), San Antonio, Jacksonville, Tennessee, and Cleveland. These markets offer strong cash flow, appreciation potential, affordability, and landlord-friendly laws with available turnkey rental property inventory. Explore available properties in top markets now →

Yes! As long as the properties meet the “like kind” requirement and you can replace the full value of the relinquished property or properties, you can defer all capital gains taxes with a 1031 exchange.

Yes, you can exchange a California investment property for an out-of-state 1031 exchange investment property, provided you follow the rules. However, California requires annual Form FTB 3840 filings to track deferred gains until you sell or pass away (please consult with your tax advisor or CPA). Many investors exchange their high-equity California rental properties to dramatically increase cash flow in landlord-friendly states. Learn about California-specific requirements and why investors leave →

Buy properties in appreciating markets, hold for 4-6 years while they generate cash flow and appreciate, then exchange them for multiple properties in growth markets. RealWealth’s investment counselor Joe Torre turned two properties into five, then plans to turn two into four again—doubling his portfolio every four to six years. Read the complete portfolio doubling case study and strategy →

Yes, RealWealth offers a free 1031 Exchange Masterclass webinar covering all the critical rules, timelines, qualified intermediaries, partial exchanges, and real investor case studies. The webinar features a live Q&A session with 1031 exchange professionals and is ideal for both new and experienced real estate investors. Watch the free 1031 exchange masterclass now →

RealWealth connects its members with property teams that sell off-market, turnkey rental properties in top U.S. markets. These turnkey teams sell single-family and multi-family properties that are fully rehabbed or newly built, and come with property management in place. Free membership includes one-on-one strategy sessions and ongoing support from investment counselors who specialize in helping real estate investors find replacement properties within the 45-day deadline. Get help finding properties fast →

RealWealth specializes in connecting investors with vetted turnkey property teams in landlord-friendly states across the U.S. Our network includes trusted providers in top markets like Texas, Alabama, Tennessee, and Ohio—all offering professionally managed, 1031-eligible properties with strong cash flow and appreciation potential. Connect with vetted property teams now →

Before you begin your search, it’s critical that you know that the 1031 exchange intermediary industry is not well-regulated. Be very careful with whom you use and be sure that they will not invest your money in risky ways while you are in between purchases.

You could start by getting referrals from escrow officers, researching online reviews, and checking credentials. Look for a 1031 exchange facilitator with thousands of successful exchanges and experience with your specific exchange type (delayed, reverse, or construction). Learn how to find and vet a qualified intermediary →

To save time, become a RealWealth member (100% free). We have worked with the same reputable 1031 exchange facilitator for over a decade. We know they are great, because we use them too! Let us introduce you →

Start your search before selling. Focus on markets with strong cash flow and appreciation. Target properties in areas with population growth and job growth. Choose landlord-friendly states with low property taxes. Work with property teams that have immediate inventory to avoid missing your 45-day identification deadline. Get the 12 strategies for finding cash-flowing properties →

You can start by viewing sample investment properties here. But the best way to find qualified properties is to become a RealWealth member. After you join, schedule a strategy session with your investment counselor, who can help you identify a market that matches your goals and connect you with a property team that has 1031 exchange replacement properties for sale now. Depending on the market you choose, these turnkey properties may include single-family rentals ($120,000-$350,000), duplexes ($200,000-$600,000), and fourplexes ($500,000-$985,000) in markets such as Texas, Alabama, Ohio, and Tennessee. Properties range from rehabbed turnkey to new construction, with options for cash flow, appreciation, or hybrid strategies. View property types and examples by market →

A quick internet search will help you find 1031 exchange services. Whomever you choose, be sure to vet them thoroughly. Investors choose to work with RealWealth because we connect them to trusted 1031 exchange facilitators (whom we use ourselves) and vetted property teams. These teams have off-market turnkey properties in growth markets and have property management in place. In addition, we offer personalized strategy sessions with investment counselors who understand the stress of the timeline crunch. RealWealth membership is 100% free and provides access to educational content and a network of trusted professionals, including qualified intermediaries, attorneys, and CPAs. Explore services and get started free →

The key is to find a property of like kind. Based on what you are selling, your options may include single-family rentals for steady cash flow, duplexes and multi-family properties for higher returns, new construction in growth markets for appreciation, and rehabbed turnkey properties for immediate rental income. You can choose from markets offering various price points ($120,000-$985,000+) and investment strategies based on your goals. See available options in top markets →

RealWealth members get free access to a comprehensive directory of vetted professionals, including 1031 exchange qualified intermediaries, turnkey property teams, real estate attorneys, CPAs, lenders, and more—all experienced in real estate investing strategies. This network helps streamline your exchange process and ensures you’re working with trusted experts. Access the professional directory free →

If you don’t identify a replacement property within 45 days or close within 180 days, your entire exchange fails, and you’ll owe capital gains taxes on the full sale amount. Other risks include settling for an underperforming property due to time pressure, overpaying in competitive markets, or selecting a property in the wrong market that fails to meet your investment goals. Learn the complete timeline and avoid these risks →

Membership to RealWealth is free and gives you access to vetted Qualified Intermediaries (we’ve used them ourselves), off-market turnkey rental properties in landlord-friendly states, one-on-one strategy sessions with experienced investment counselors, educational webinars, and market research to help you complete your exchange successfully and meet critical deadlines so you avoid paying capital gains taxes. Get expert help with your 1031 exchange →

Membership to RealWealth is free and gives you access to vetted Qualified Intermediaries (we’ve used them ourselves), off-market turnkey rental properties in landlord-friendly states, one-on-one strategy sessions with experienced investment counselors, educational webinars, and market research to help you complete your exchange successfully and meet critical deadlines so you avoid paying capital gains taxes. Get expert help with your 1031 exchange →