Find 1031 Exchange Rental Property Experts

Have a high priced property that isn’t cash flowing or appreciating? Get expert help with your 1031 exchange & find better replacement properties, stress-free.

Off-Market 1031 Exchange Replacement Properties | Expert 1031 Advisors | Pre-Vetted Local Teams in Landlord-Friendly States | 100% Free Membership

*Sign up for your free membership to get started

Avoid the 45-Day Panic. Let Us Help You Find the Right 1031 Exchange Rental Property for You.

You’ve sold your property or you’re about to, the 1031 clock is ticking, and now you’re racing to find the right 1031 exchange replacement property. But here’s the truth: you don’t have to settle for a subpar deal or do it alone.

At RealWealth, we help investors like you create their 1031 exchange strategies and identify income-generating, 1031-eligible rental properties in the nation’s strongest housing markets.

Our team connects you with experienced and thoroughly vetted property providers, helps you understand your options, and gives you the support you need to complete a successful exchange.

Why Choose RealWealth To Help with Your 1031 exchange?

How it works

1. Join for Free

Create your free RealWealth membership to unlock access to 1031 exchange resources and property inventory.

2. Enjoy Members-Only 1031 exchange Education

Learn from weekly webinars, in-person tours, and member-only content designed to help you find the right 1031 exchange rental property fast.

3. Meet with an Investment Counselor One-on-One

Meet with an experienced Investment Counselor to discuss your exchange timeline, replacement property goals, and vetted market options.

4. Connect with Property Teams & Developers To Explore Investment Opportunities

Explore fully renovated, tenant-ready rentals and new opportunities from trusted property providers that qualify for 1031 exchanges.

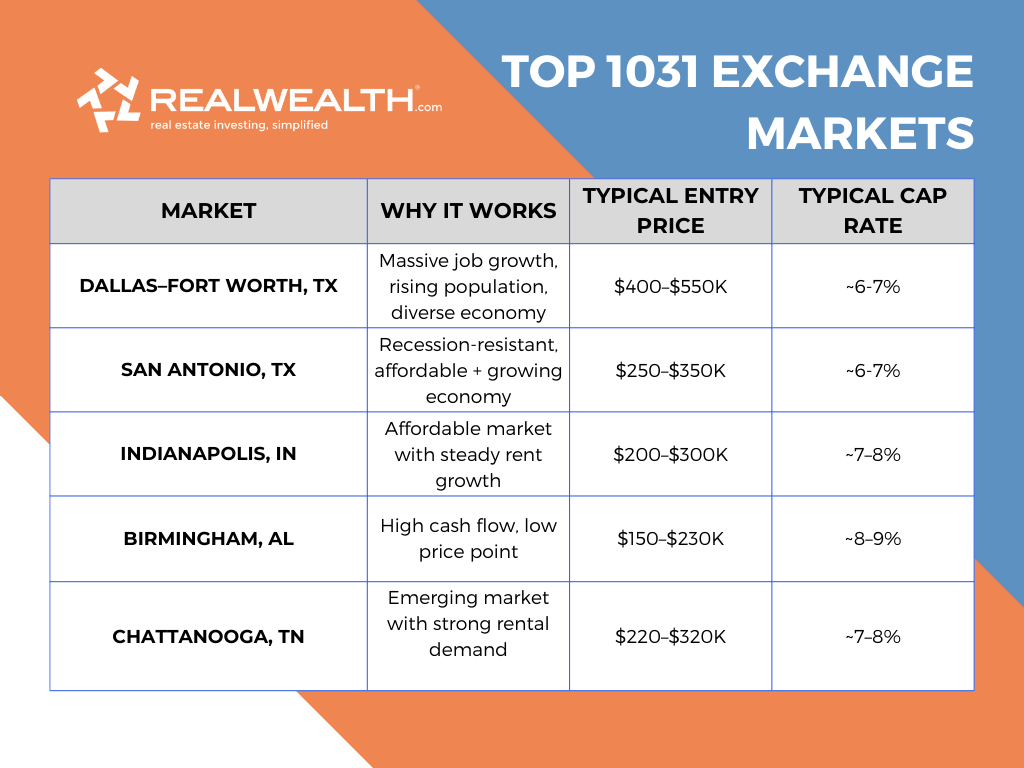

RealWealth Markets With 1031-Eligible Rental Properties

RealWealth members actively acquire turnkey rental properties in markets that balance strong cash flow, job growth, population growth, and affordability. These factors are all ideal for 1031 exchanges. Below are a few standout metros that were featured in our article 1031 Exchange Properties for Sale in Top U.S. Markets.

1031 Exchange-Eligible Rental Property Pro Formas

Here’s a glimpse at the types of turnkey properties RealWealth members are acquiring right now to complete successful 1031 exchanges:

1031 Exchange Success Stories from RealWealth Members

If you’re interested in doing a 1031 exchange, watch some of our member success stories.

Claudia & Julian

Members since 2014

“We sold a single San Francisco rental and used a 1031 exchange to acquire 16 rental properties across 3 states — increasing our cash flow sixfold to nearly $13,000 per month.”

Wayne & Danelle Brice

Members since 2014

“I retired a month ago & can now focus on what matters most..”

Cindy & Oscar

Members since 2019

“Real estate is an asset that has historically proven to provide good return of investment…I get the cash flow, I get appreciation, I get tax benefits and I also get the debt-to-payment back to me.”

Discover cash flowing replacement Properties — Without Doing It Alone

Defer taxes and protect your equity with vetted replacement rentals, without the 45-day scramble.

Don’t Risk Missing Your 45-Day Deadline

RealWealth helps you move quickly and confidently. Thousands of investors have used our free education and vetted network of real estate professionals to grow their portfolios, and protect their equity. Membership is 100% free. No sales pressure. No upsells.

Not Ready To Join Yet?

Top U.S. Cities for Real Estate Investing

Get your free copy of our 2025 real estate market report that highlights the best cities to invest this year.

Frequently Asked 1031 Exchange Rental Property Questions

A 1031 exchange lets real estate investors defer paying capital gains taxes when they sell an investment property and purchase a “like-kind” replacement property with the proceeds. You must use a Qualified Intermediary (QI) who holds the funds, identify replacement properties within a 45-day window, and close within 180 days. Learn the complete rules and step-by-step process →

You have 45 calendar days from the closing of the rental property you are selling to identify up to three replacement properties and a total of 180 days to close. These IRS deadlines are very strict with no extensions, so proper planning is critical. See the complete 8-step timeline and avoid missing deadlines →

Start early, and do so long before you put your property on the market. Planning early reduces the anxiety of the 45-day identification window, helps you connect with the best QIs, lenders, property teams, and find the best 1031 exchange replacement properties so you can meet all of your deadlines and not end up stressed out and settling for mediocre deals. RealWealth can help streamline the process for you, by connecting you with trusted 1031 exchange qualified intermediaries and property teams who have turnkey rental properties for sale now.

There are four main types of 1031 exchanges in real estate: Delayed Exchange (most common, where you sell first and then buy), Simultaneous Exchange (where you close both properties on the same day), Reverse Exchange (where you buy first and then sell), and Construction Exchange (where you make improvements using exchange funds). Each has different requirements and timelines. Compare all four types and choose the right one →

Yes, a 1031 exchange qualified intermediary is required by law for 1031 exchanges. The QI holds the sale proceeds, prepares documents, coordinates closings, and ensures IRS compliance. If you touch the funds at any time without a QI, you’re disqualified and will owe capital gains taxes. Learn what a QI does, costs, and how to find one →

To find 1031 exchange investment property, focus on markets with population growth, job growth, affordability, low property taxes, and landlord-friendly laws. Start your search before selling and consider multiple properties in two to three markets, so if one of the rental properties falls through, you have a backup plan. Get the 12 rules for identifying cash-flowing replacement properties →

While all RealWealth property teams have ample inventory for 1031 exchange replacement properties, some of the most popular locations have been Dallas-Fort Worth, Alabama (including Birmingham and Huntsville), San Antonio, Jacksonville, Tennessee, and Cleveland. These markets offer strong cash flow, appreciation potential, affordability, and landlord-friendly laws with available turnkey rental property inventory. Explore available properties in top markets now →

Yes! As long as the properties meet the “like kind” requirement and you can replace the full value of the relinquished property or properties, you can defer all capital gains taxes with a 1031 exchange.

Yes, you can exchange a California investment property for an out-of-state 1031 exchange investment property, provided you follow the rules. However, California requires annual Form FTB 3840 filings to track deferred gains until you sell or pass away (please consult with your tax advisor or CPA). Many investors exchange their high-equity California rental properties to dramatically increase cash flow in landlord-friendly states. Learn about California-specific requirements and why investors leave →

Buy properties in appreciating markets, hold for 4-6 years while they generate cash flow and appreciate, then exchange them for multiple properties in growth markets. RealWealth’s investment counselor Joe Torre turned two properties into five, then plans to turn two into four again—doubling his portfolio every four to six years. Read the complete portfolio doubling case study and strategy →

Yes, RealWealth offers a free 1031 Exchange Masterclass webinar covering all the critical rules, timelines, qualified intermediaries, partial exchanges, and real investor case studies. The webinar features a live Q&A session with 1031 exchange professionals and is ideal for both new and experienced real estate investors. Watch the free 1031 exchange masterclass now →

RealWealth connects its members with property teams that sell off-market, turnkey rental properties in top U.S. markets. These turnkey teams sell single-family and multi-family properties that are fully rehabbed or newly built, and come with property management in place. Free membership includes one-on-one strategy sessions and ongoing support from investment counselors who specialize in helping real estate investors find replacement properties within the 45-day deadline. Get help finding properties fast →

RealWealth specializes in connecting investors with vetted turnkey property teams in landlord-friendly states across the U.S. Our network includes trusted providers in top markets like Texas, Alabama, Tennessee, and Ohio—all offering professionally managed, 1031-eligible properties with strong cash flow and appreciation potential. Connect with vetted property teams now →

Before you begin your search, it’s critical that you know that the 1031 exchange intermediary industry is not well-regulated. Be very careful with whom you use and be sure that they will not invest your money in risky ways while you are in between purchases.

You could start by getting referrals from escrow officers, researching online reviews, and checking credentials. Look for a 1031 exchange facilitator with thousands of successful exchanges and experience with your specific exchange type (delayed, reverse, or construction). Learn how to find and vet a qualified intermediary →

To save time, become a RealWealth member (100% free). We have worked with the same reputable 1031 exchange facilitator for over a decade. We know they are great, because we use them too! Let us introduce you →

Start your search before selling. Focus on markets with strong cash flow and appreciation. Target properties in areas with population growth and job growth. Choose landlord-friendly states with low property taxes. Work with property teams that have immediate inventory to avoid missing your 45-day identification deadline. Get the 12 strategies for finding cash-flowing properties →

You can start by viewing sample investment properties here. But the best way to find qualified properties is to become a RealWealth member. After you join, schedule a strategy session with your investment counselor, who can help you identify a market that matches your goals and connect you with a property team that has 1031 exchange replacement properties for sale now. Depending on the market you choose, these turnkey properties may include single-family rentals ($120,000-$350,000), duplexes ($200,000-$600,000), and fourplexes ($500,000-$985,000) in markets such as Texas, Alabama, Ohio, and Tennessee. Properties range from rehabbed turnkey to new construction, with options for cash flow, appreciation, or hybrid strategies. View property types and examples by market →

A quick internet search will help you find 1031 exchange services. Whomever you choose, be sure to vet them thoroughly. Investors choose to work with RealWealth because we connect them to trusted 1031 exchange facilitators (whom we use ourselves) and vetted property teams. These teams have off-market turnkey properties in growth markets and have property management in place. In addition, we offer personalized strategy sessions with investment counselors who understand the stress of the timeline crunch. RealWealth membership is 100% free and provides access to educational content and a network of trusted professionals, including qualified intermediaries, attorneys, and CPAs. Explore services and get started free →

The key is to find a property of like kind. Based on what you are selling, your options may include single-family rentals for steady cash flow, duplexes and multi-family properties for higher returns, new construction in growth markets for appreciation, and rehabbed turnkey properties for immediate rental income. You can choose from markets offering various price points ($120,000-$985,000+) and investment strategies based on your goals. See available options in top markets →

RealWealth members get free access to a comprehensive directory of vetted professionals, including 1031 exchange qualified intermediaries, turnkey property teams, real estate attorneys, CPAs, lenders, and more—all experienced in real estate investing strategies. This network helps streamline your exchange process and ensures you’re working with trusted experts. Access the professional directory free →

If you don’t identify a replacement property within 45 days or close within 180 days, your entire exchange fails, and you’ll owe capital gains taxes on the full sale amount. Other risks include settling for an underperforming property due to time pressure, overpaying in competitive markets, or selecting a property in the wrong market that fails to meet your investment goals. Learn the complete timeline and avoid these risks →

Membership to RealWealth is free and gives you access to vetted Qualified Intermediaries (we’ve used them ourselves), off-market turnkey rental properties in landlord-friendly states, one-on-one strategy sessions with experienced investment counselors, educational webinars, and market research to help you complete your exchange successfully and meet critical deadlines so you avoid paying capital gains taxes. Get expert help with your 1031 exchange →

Absolutely. Turnkey rentals are renovated, often tenant-occupied, and professionally managed — making them ideal for investors who want cash flow without being hands-on.

Yes. We connect you with vetted turnkey property teams nationwide and provide free strategy sessions to match you with 1031-eligible inventory that fits your goals.

Every market team we work with is thoroughly vetted for experience, integrity, and performance. We only partner with teams we trust with our own investments.

We offer side-by-side pro formas, market data, and strategy sessions to help you compare properties and projects based on cash flow, appreciation, risk, and personal goals.

No. It’s 100% free to join, watch webinars, explore available properties and connect with property teams and other resources in our network. Our goal is to make high-quality real estate investing accessible and transparent.

Properties sold by property teams in our network are never marked up! We are paid by broker referrals.

Become a member for free and then book a free 1031 Exchange Strategy Session with one of our experienced Investment Counselors. Once you’re logged in as a member, you can also browse current rental property pro formas in top U.S. markets.

Related Educational Content for 1031 Exchange Investors

Looking to get the full picture before selecting your replacement property? Explore these investor-favorite guides:

- Top U.S. Markets for 1031 Exchange Properties

- 1031 Exchange Rules for Real Estate Investors

- What Qualifies as a 1031 Exchange Property?

- How I Doubled My Portfolio with a 1031 Exchange & You Can Too (Rebalancing Case Study)

- [Webinar Replay] 1031 Exchange Masterclass: How to Sell Smart & Defer Taxes Like a Pro