Over the past decade, real estate syndications have surged in popularity. The reason is simple: syndications make it possible for everyday investors to access large-scale real estate opportunities without having to manage properties themselves.

They accomplish this by gathering funds from several investors to buy bigger real estate assets, such as apartment complexes, self-storage facilities, or commercial buildings, which would be difficult to buy on their own. A sponsor manages the real estate syndicate, making it a hands-off investment for the investors.

In this guide, we’ll break down what you need to know about real estate syndications, including what a real estate syndication is and how they work, the benefits of this model, why it is attractive for busy people, the potential risks of real estate syndicate investing, and key questions to ask before committing your capital.

Quick Answer: Real Estate Syndications for Passive Investors

Real estate syndications enable passive investors to pool their funds with others to acquire large, income-producing properties, such as apartments or self-storage facilities. Investors (Limited Partners) earn cash flow and profit shares without having to manage the property themselves. Most syndications require minimums of $50,000–$250,000, hold periods of 3–7 years, and offer tax advantages through depreciation. Unlike REITs, syndications are private, illiquid investments where choosing a trustworthy sponsor is key.

Top Benefits of Real Estate Syndications for Passive Investors

Real estate investors are drawn to syndications because of their many benefits like:

- Truly passive income: No property management or tenant issues.

- Diversification: Access to larger assets across different markets.

- Tax advantages: Depreciation and cost segregation can offset income.

- Potential higher returns: Compared to single-family rentals or REITs.

- Hands-off wealth building: Partner with experienced operators.

Top Risks of Real Estate Syndications for Passive Investors

While syndications can be a powerful wealth-building tool, they also carry risks every investor should weigh:

- Illiquidity: Your money is typically tied up for 3–7 years with no easy way to exit.

- Operator risk: Performance depends heavily on the sponsor’s expertise and integrity.

- Market fluctuations: Economic shifts, interest rate changes, or local demand drops can impact returns.

- No guarantees: cash flow distributions and projected returns are not assured.

- High minimums: Most syndications require $ 50,000–$ 250,000 upfront, limiting accessibility.

How to Get Started with Syndications

Learning about investing in real estate syndications doesn’t have to be difficult, level up by:

- Networking with experienced investors or joining real estate investing clubs like RealWealth: Attend educational webinars and connect with other investors who have participated in real estate syndications.

- Understanding investor requirements: Knowing whether you are an accredited or non-accredited investor helps you focus on real estate syndication opportunities that fit your profile.

- Asking the right questions before you invest: Take the time to vet both the sponsor and the deal so you avoid unpleasant surprises later.

Ready to learn more? Join RealWealth for access to upcoming syndicate opportunities designed for passive investors just like you.

What Is a Real Estate Syndication?

A real estate syndicate is a way for multiple investors to pool their money together to purchase and manage large-scale properties that would be difficult—or impossible—to acquire individually.

This investment model appeals to passive investors because it allows them to enjoy the benefits of real estate ownership (cash flow, equity growth, and tax advantages) without the hassle of managing tenants or property upkeep. It also opens the door to portfolio diversification, since investors can spread their capital across different property types and real estate markets.

An experienced sponsor or operator handles the heavy lifting and serves as the key decision-maker and point of contact for the investment. They:

- Identify the investment opportunity

- Conduct due diligence

- Secure financing

- Assist in the development process

- Oversee the property’s management and operations

At the same time, passive investors contribute capital and share in the profits. By combining resources, investors can participate in deals that offer greater income potential, diversification, and economies of scale.

Common Types of Real Estate Syndications & Roles

Some of the most common types of syndicated real estate investments are:

- Multifamily apartments are one of the most popular asset classes due to consistent rental demand.

- Self-storage facilities are a rapidly growing sector driven by lifestyle changes and downsizing trends.

- Industrial properties, warehouses, and distribution centers play a crucial role in supporting e-commerce growth.

- Land development provides shorter-term deals that convert raw land into development-ready projects.

- Build-to-Rent communities are one of the fastest-growing sectors in the housing market.

- Single-family home developments feature new ground-up communities ready for homebuyers on the retail market.

Every real estate syndication has two leading roles:

- General Partners (GPs) / Sponsors / Managers: They are the active managers of the deal. They are responsible for sourcing the property, securing financing, overseeing renovations (if any), and managing operations to ensure strong performance. In return, they typically receive management fees and a share of the profits.

- Limited Partners (LPs) / Members: They are the passive investors who provide the bulk of the capital. LPs have limited liability and don’t take part in day-to-day management but benefit from regular distributions, potential appreciation, and tax advantages.

Together, GPs and LPs form a partnership where everyone involved shares in the risks and rewards of the syndicated real estate investment property. Doing so makes investing in real estate syndications an accessible path for passive investors to participate in institutional-quality real estate opportunities.

Real estate syndicate example: There is an apartment complex that cost $10 million to purchase. Instead of one investor having to fund the whole complex, several investors contribute at least $50,000 as Limited Partners. The General Partners handle the financing and manage the project. They purchase the property together, and everyone shares in the rental income and future profits when the asset is sold.

Why Passive Investors Choose to Invest in Syndications

For many, syndicated real estate offers an ideal hands-off approach. Here’s why:

- Truly Passive Income: Limited Partners invest their capital while professional sponsors handle acquisitions, renovations, tenant management, and operations. As an LP, you collect distributions without becoming a landlord.

- Access to Institutional-Quality Assets: Syndicates enable individual investors to participate in large-scale or commercial projects that may not be attainable on their own.

- Diversification: Pooling capital spreads the risk across different property types, markets, and operators. This approach reduces reliance on any single deal.

- Potential for Strong Returns: Well-run real estate syndications can provide stable cash flow and equity growth. They often do better than many traditional investments, such as IRAs and stocks.

- Tax Advantages: Real estate syndicates allow Investors to gain benefits from depreciation, cost segregation, and 1301 exchange opportunities, which can greatly reduce taxable income.

RealWealth Advantage: Many of our members choose to invest with RealWealth Developments syndications and real estate investment funds because of our:

- Rigorous due diligence processes

- Transparent investor updates

- An extensive network of real estate professionals

- Off-market, hard-to-find deals

- High preferred returns

- Personalized service and coaching for long-term wealth

You can learn more about our current real estate syndication offerings here.

How Real Estate Syndications Work

A real estate syndicate allows individuals to participate in larger real estate deals. If you are new to this investment model, you may not realize that there are no standard guidelines, which means the deal structure can vary. Here’s a breakdown of how most real estate syndications work.

1. Investment Minimums

Most syndications require investors to contribute between $50,000 and $250,000. This range allows passive investors to access larger assets. Some deals may have a significantly higher minimum.

2. Legal Structure

Syndications are usually structured as a Limited Liability Company (LLC). Investors (LPs / Members) own shares of the entity, while sponsors (GPs / Managers) manage the property and operations.

3. Timelines

Investing in real estate syndications is typically suited for medium- to long-term investments, usually lasting 3 to 7 years. During this period, the property is purchased, managed, improved, and eventually sold or refinanced for a profit.

4. Offerings

A syndicate typically has two types of offerings.

- A 506(b) Offering up to 35 non-accredited (but sophisticated) investors and unlimited accredited investors, but prohibits general solicitation or public advertising, meaning General Partners can only approach investors with whom they have pre-existing relationships.

- A 506(c) Offering permits general solicitation and public marketing but restricts participation to verified accredited investors only. This requires the GPs or sponsors to take reasonable steps to verify each investor’s accredited status.

Investor tip: When evaluating a potential real estate syndication company, be sure to ask how they identify, analyze, and vet their investment projects. At RealWealth Developments, we’ve developed a rigorous nine-step vetting process, from our initial screening and site visits to background checks and full underwriting with third-party validation. This ensures we’ve done all of our due diligence and maintained a high standard every step of the way.

Phases of a Real Estate Syndication Deal

While the structure of a real estate syndication varies from deal to deal, it follows a clear life cycle, which helps investors know what to expect from start to finish. Understanding these phases helps set realistic expectations about cash flow, timelines, and potential returns, and enables you to feel more confident before committing your capital.

1. Acquisition & Capital Raise

General Partners identify the property, negotiate terms, and raise capital from investors. Limited Partners contribute funds during this stage.

2. Stabilization & Operations

Once acquired or construction begins, the General Partners focus on improving operations, increasing occupancy, and executing the business plan (e.g., renovations, repositioning, or new construction).

3. Cash Flow Distributions

As the property stabilizes, rental income is distributed to investors, usually on a monthly or quarterly basis, in line with the preferred return structure.

4. Exit & Investor Payouts

At the end of the hold period, the property is sold or refinanced. Profits are distributed to investors based on the agreed-upon equity split. This often leads to a significant lump-sum payout. (We recommend discussing this with your tax professional well in advance so there are no surprises at tax time.)

Investor tip: Pay close attention to the syndication’s projected timeline and exit strategy. Delays in the business plan can affect your cash flow and returns, so look for real estate syndication companies with a proven track record of meeting or exceeding timelines.

Quick Recap: How Real Estate Syndications Work

- Investment minimums are usually $50K–$250K.

- Structured as LLCs with sponsors (GPs) managing the deal and investors (LPs) providing capital.

- Expect a 3–7 year hold period.

- Key phases: Acquisition & Raise → Operations & Stabilization → Cash Flow → Exit & Payouts.

- Returns come from potential cash-flow distributions and targeted profit at sale or refinancing.

Understanding Returns in Real Estate Syndications

One of the main appeals of investing in real estate syndications is the way returns are structured and distributed. Here are the key components investors should understand:

Preferred Return

Many real estate syndicates offer LPs a preferred return, often 6–8%. This means passive investors receive their share of profits before the General Partners take theirs. It’s not a “guaranteed” return, but it sets a priority on payouts. At RealWealth Developments, we frequently offered higher preferred returns, ranging from 10% to 12%, to our investors.

Cash Flow Distributions

Investors typically receive income distributions on a monthly, quarterly, or yearly basis, depending on the deal structure. These payments come from rental or sale income after expenses, monthly principal and interest payments, and reserves are covered.

Equity Split

Profits are shared between GPs and LPs. A typical structure is 60/40, 70/30, or 80/20, where 60–80% of the profits are allocated to investors, and 20–30% are allocated to the sponsors after the preferred return is met.

Performance Metrics (Explained Simply)

- IRR (Internal Rate of Return): Measures the total return over time, factoring in the time value of money. Think of it as your “annualized return” over the life of the deal.

- Equity Multiple: Tells you how many times your investment grew. For example, a 2.0x equity multiple means that your $50,000 investment is now worth $100,000.

- Average Annual Return: A straightforward measure of a yearly return, often used to compare deals at a glance.

Investor tip: Always ask the real estate syndication sponsors for a detailed breakdown of projected returns and compare it with their past performance. Transparency in the numbers is a strong sign of a trustworthy company. Depending on the asset types, different performance metrics will be used to calculate returns.

Example Real Estate Syndication Scenario

Let’s say you invest $50,000 into the RealWealth Development MultiFamily Fund that offers:

- 10% preferred return

- 80/20 equity split (investors/sponsors)

- A projected 1.85x equity multiple over 3 to 5 years

Here’s what that could look like:

- Once the property is stabilized, you’d expect to receive $5,000 in cash flow annually (10% of $50,000).

- This means each year, before the sponsor can receive any distribution and share its profits, the preferred return of 10% must be hit. After the 10% return is achieved, members and sponsors share in the profits based on an 80/20 profit split.

- When the property sells, the return of your adjusted capital (initial investment) is distributed first. Once the capital is returned, then members and the sponsor share in any additional profits based on an 80/20 profit split. The Members’ total share of the profits could bring your total return to $92,500 ($50,000 original + $42,500 profit).

That’s the power of a real estate syndication or fund—you earn steady cash flow, and receive a one-time profit when the property is sold or refinanced!

Investor tip: Don’t just pay attention to the headline numbers. Check the return structure and the timeline for payouts. A deal with a high IRR but delayed distributions may not meet your cash-flow needs.

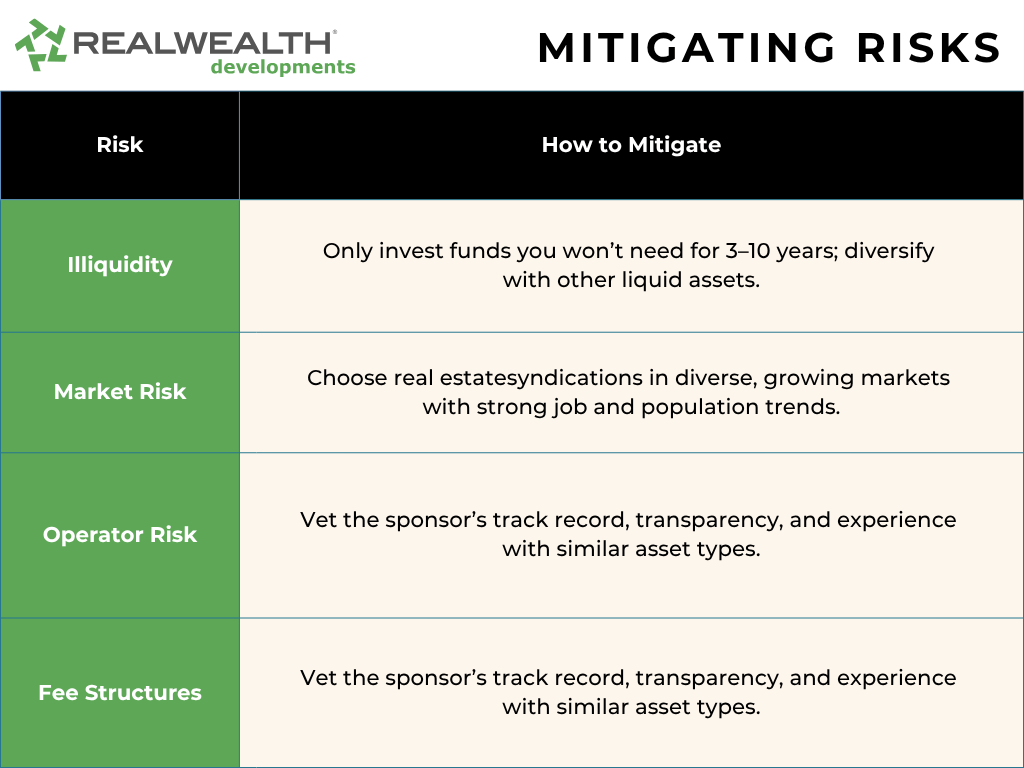

Risks to Be Aware Of With Real Estate Syndications

Like any investment, investing in real estate syndications carries risks that passive investors should understand before committing their capital.

Illiquidity

Real estate syndications are long-term investments. Once you commit funds, your capital is typically locked up for 3–7 years, with little to no option to withdraw early. If you need quick access to your money, syndications may not be the right fit.

Market Risk

Even strong real estate investment deals are subject to broader economic forces. Rising interest rates, declining rents, increased vacancies, or regional downturns can reduce projected returns. While diversification helps, market cycles still carry risk.

Operator Risk

The syndication company’s success depends on the sponsor’s ability to execute the investment plan. Inexperience, poor communication, or overpromising can threaten the project’s performance. Always check the operator’s track record and evaluate how transparent they are.

Fee Structures

Real estate syndications have fees for acquisition, development, construction management, loan origination, and asset management oversight. While reasonable fees are common, excessive or poorly structured fees can eat into investor profits. It’s critical to understand the full fee breakdown outlined in the Private Placement Memorandum (PPM) before investing.

Investor tip: Don’t focus only on the syndicate’s projected returns. Evaluate how risk is being managed and whether the sponsor has weathered different market conditions. Experienced sponsors should be able to explain risks and how they plan to mitigate them openly. If they avoid the tough questions, that’s a red flag.

What to Look for in a Real Estate Syndication (Due Diligence Tips)

Before committing your capital, it’s critical to perform your own due diligence to ensure the opportunity aligns with your goals and risk tolerance. Here are the key factors to evaluate:

1. Track Record of the Sponsor Team

Look for General Partners with a history of successfully managing similar real estate assets across various real estate market cycles. Experience in acquisitions, operations, and investor relations is a strong indicator of stability.

Helpful questions to ask:

- Has the General Partner successfully managed similar assets?

- Do they have experience across multiple market cycles?

2. Transparency and Communication

Reputable real estate syndication companies also provide clear and consistent updates on property performance, distributions, and market conditions. Ask how often you’ll receive reports and whether you’ll have access to financials.

Helpful questions to ask:

- Will I receive regular financial reports and updates?

- Is the team open and responsive to investor questions?

3. Market Fundamentals of the Property’s Location

A great real estate deal in a weak market won’t perform well. Evaluate the property’s city or region for job growth, population trends, economic diversity, and landlord-friendly regulations. Strong market fundamentals drive stable occupancy and appreciation.

Helpful questions to ask:

- Is the property located in a growing market with strong job and population trends?

- Are there diverse industries supporting the local economy?

- Are landlord laws favorable?

4. Deal Structure and Investor Protections

Review how profits are split between the General Partner and Limited Partners’ preferred returns and fees. Look for structures that prioritize investor payouts first and include safeguards against excessive sponsor compensation.

Helpful questions to ask:

- What is the profit split between?

- Are there preferred returns?

- How are risks shared?

5. Alignment of Interests Between GPs / Managers and LPs / Members

Ideally, sponsors should co-invest their own money in the deal. When the GPs have “skin in the game,” it demonstrates confidence in the project and creates alignment with investors’ long-term success.

Helpful questions to ask:

- Is the sponsor investing their own capital in the deal?

- Do their incentives align with the success of investors?

Ask the General Partner for references from past investors, or do some digging online. Always review offering documents carefully, and don’t hesitate to walk away if something doesn’t feel right. This is your money, and as you grow it, you want to protect it.

Investor tip: If any of these answers are unclear or unsatisfactory, think twice before committing your funds. The best real estate syndication deals prioritize transparency and investor protection. At RealWealth Developments, we thoroughly review every aspect of our projects with investors, including one-on-one phone calls with the syndication manager.

How to Get Started with Syndications

Getting started with a real estate syndicate is simpler than many first-time investors expect, but success begins with preparation and asking the right questions.

1. Network with Experienced Investors

Join real estate investing clubs, attend webinars, and connect with other investors who have participated in real estate syndications. At RealWealth, members gain access to live events, recorded educational content, and introductions to vetted syndication opportunities, which can significantly shorten your learning curve.

2. Understand Investor Requirements

Some syndications require you to be an accredited investor. This means you meet certain income or net worth thresholds (typically $200k+ in annual income or $1M+ in net worth, excluding your primary residence). Others are open to non-accredited investors under Regulation A or Regulation CF offerings. Knowing where you stand helps you focus on opportunities that align with your eligibility.

3. Ask the Right Questions Before You Invest

Before committing capital, here are some sample questions to ask:

- What is the track record of the sponsor team?

- What fees are involved, and how are profits split?

- What is the expected hold period and projected returns?

- How often will I receive updates and distributions?

- What risks could affect performance, and how are they mitigated?

Taking the time to vet both the sponsor and the deal helps you invest with confidence and avoid unpleasant surprises later.

Investor tip: RealWealth Developments regularly hosts webinars about syndications and our offerings. To learn from our experts and stay updated on our current syndication offerings, join RealWealth today! Membership is 100% free!

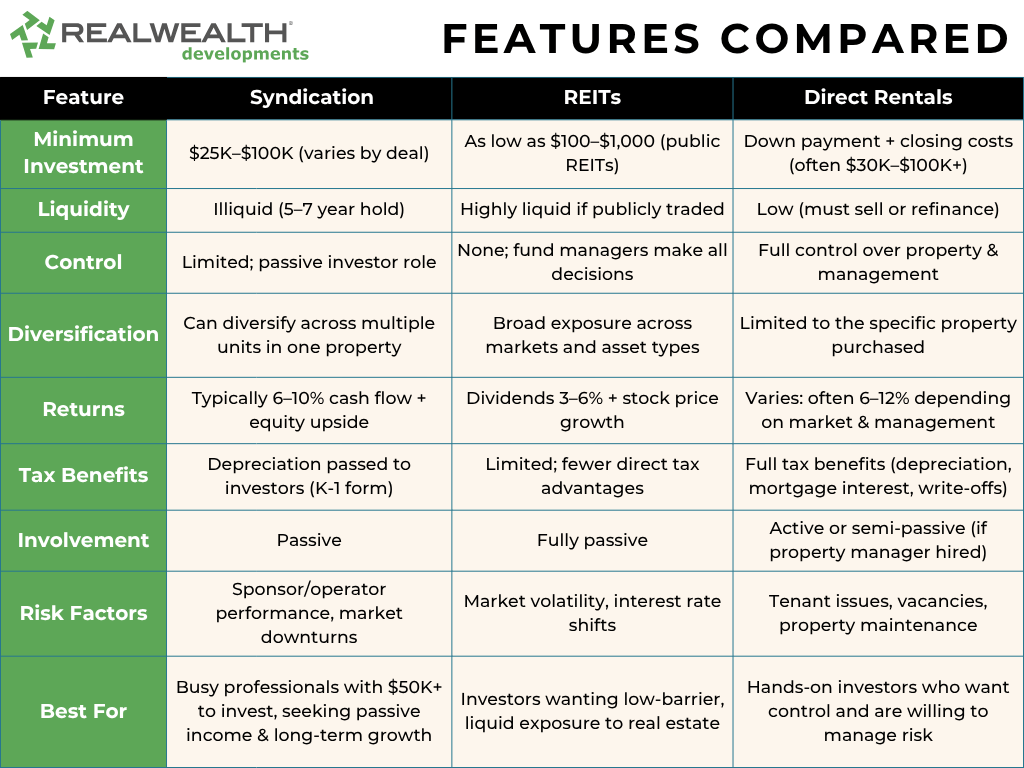

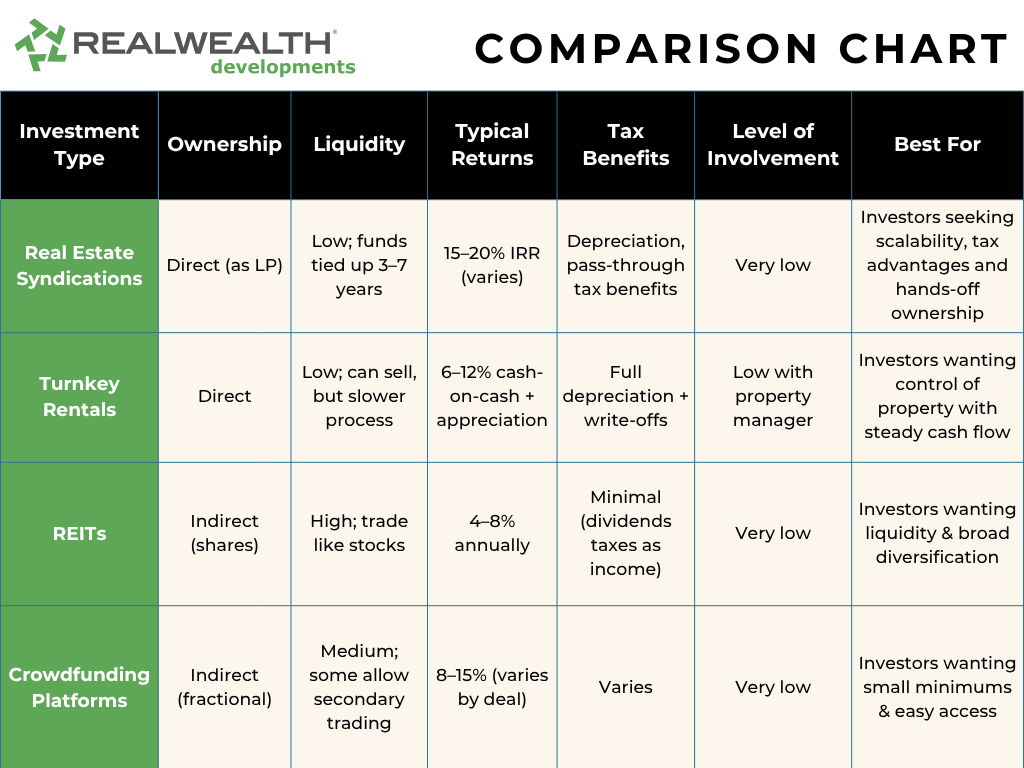

Real Estate Syndications vs. Other Passive Investments

When considering passive real estate investments, it is helpful to understand how real estate syndications compare to other options.

1. Turnkey Rentals

With turnkey properties, investors own the asset directly, enjoying monthly cash flow and long-term appreciation. However, even with property management, there’s some level of involvement, and scaling can be slower than with real estate syndications.

2. REITs (Real Estate Investment Trusts)

REITs offer the ultimate liquidity and diversification, since you can buy and sell shares like stocks. The trade-off is less control and lower potential returns compared to private deals. In addition, the tax treatment is less favorable because dividends are taxed as ordinary income.

3. Crowdfunding Platforms

Crowdfunding platforms like Fundrise and RealtyMogul allow you to invest smaller amounts of capital across multiple real estate projects, lowering the entry point. However, investor protections, deal quality, and sponsor oversight can vary significantly. Some platforms are more speculative, with limited track records.

Each strategy—syndications, turnkey rentals, REITs, and crowdfunding platforms—offers unique benefits depending on your goals, capital, and desired level of involvement.

Investor Tip: Although REITs and crowdfunding platforms allow easy entry and quick access to cash, they often lack the tax benefits and control available through real estate syndications or turnkey rentals. Some investors use a mix of strategies, leveraging syndications for scale, turnkey rentals for consistent cash flow, and REITs for liquidity.

How to Determine if a Real Estate Syndication is Right for You?

If you are considering real estate syndicate investing, but aren’t sure if it is the right fit. Start by asking yourself these questions to see if this strategy is a good fit for your investing goals:

- Do you want passive income without being a landlord?

- Can you commit capital for 3–7 years? (Most syndications are long-term holds.)

- Are you comfortable with reduced liquidity in exchange for potentially higher returns?

- Would you like access to larger, professionally managed properties?

- Do you want diversification beyond single-family rentals or your local market?

- Are tax advantages, such as depreciation, important to your strategy?

If you answered “yes” to most of these questions, investing in real estate syndications could be a powerful next step in your wealth-building journey.

If you want direct ownership in institutional-quality real estate with the potential for higher returns than REITs, more scale than turnkey rentals, and more transparency than many crowdfunding deals, syndicated real estate can be the ideal middle ground. Syndicates combine the benefits of professional management with the tax advantages of direct ownership, while still allowing you to remain a hands-off investor.

Why Choose to Invest with RealWealth Developments

- Passive Real Estate Ownership Without the Hassles: You reap the benefits of real estate ownership, like cash flow, appreciation, and tax advantages, while an experienced and professional team handles all of the real estate syndication operations.

- Access to Larger, Higher-Quality Deals: You can invest in institutional-quality developments and value-add opportunities that would be impossible to acquire on your own.

- Professional Expertise and Due Diligence: You can leverage RealWealth Development’s 25+ years of experience and rigorous 9-step vetting process so that you can invest with confidence.

- Diversification Within Real Estate: You can spread your investments across multiple asset types (multifamily, build-to-rent, self-storage) and geographic markets.

- Superior Risk-Adjusted Returns: With a target 16% IRR with 1.85X equity multiplier backed by tangible assets, you’ll gain a superior return compared to the volatile stock market or low-yield bonds.

- Tax Advantages: You can take advantage of tax benefits like depreciation, cost segregation, and 1031 exchange opportunities, which are not available with stocks or bonds.

- Transparency and Control: You’ll know exactly which properties you own, and can visit them. Plus, you’ll receive detailed quarterly performance reports.

- Time Freedom: You’ll regain valuable time, as someone else manages the real estate assets.

Final Thoughts

Real estate syndications offer passive investors an alternative to investing in large properties that would otherwise be out of reach. There is a wide range of benefits from steady cash flow to appreciation and tax benefits. Plus, it is truly passive income as the syndicate sponsor does all the heavy lifting.

Keep in mind that success relies on selecting the right opportunities, so always do your due diligence by vetting sponsors, analyzing market fundamentals, and understanding deal structures. Prioritizing these steps helps protect your capital and maximize returns.

At RealWealth Developments, we provide clear, hands-on guidance to help accredited investors connect and explore real estate syndication opportunities with confidence. Whether you are new to passive investing or want to grow your portfolio, our resources and education help you make safer wealth-building choices.

Ready to explore our current syndication opportunities? Join RealWealth today and access upcoming opportunities designed for passive investors just like you.

FAQs: Real Estate Syndications for Passive Investors

A real estate syndication is a partnership in which multiple investors pool their capital together to purchase a property or project that would be too expensive for them to buy individually. With this investing strategy, you are a passive investor: you contribute funds and receive a share of the returns, while the sponsor (such as RealWealth Developments) handles all operations, including acquisition, management, and eventual sale. Depending on the deal type, investors may receive distributions from cash flow, a lump-sum payment upon sale, or a combination of both. A real estate syndication strategy allows you to invest in institutional-quality real estate without active management responsibilities while benefiting from tax advantages and appreciation potential. Get the full breakdown of how syndications work→

Syndications are typically illiquid investments with a 3–7-year holding period. Some may be shorter or longer depending on the project.

Most syndications require a minimum investment of between $50,000 and $250,000. The amount depends on the sponsor and the size of the deal.

We put together a free webinar that walks you through the whole thing. You’ll see examples of real syndications, learn what makes a good sponsor versus a sketchy one, and understand how the money flows. Watch our free real estate syndication webinar→

For 506(c) offerings, which RealWealth Developments specializes in, you need to be an accredited investor. For a 506(b) deal, you do not have to be an accredited investor. According to the SEC, an accredited investor must have at least $200K in annual income (or $300K if married) or a net worth of at least $1 million, excluding your primary residence. Why? They’re trying to protect people from jumping into investments they don’t understand. Learn exactly what it takes to qualify as an accredited investor→

Passive investors typically receive cash-flow distributions from rental income or property sales in development projects (monthly, quarterly, or annually) and a share of profits when the property is sold or refinanced.

A Private Placement Memorandum (PPM) is a comprehensive legal document that outlines the details of a real estate syndication investment. This includes the business plan, financial projections, fee structure, distribution waterfall, and potential risks. The PPM is required by securities law and must be reviewed before investing, as it contains critical information about how your capital will be used, when you can expect returns, and what risks to consider. While it may seem lengthy and technical, reading the PPM carefully ensures you fully understand what you’re investing in and helps you make an informed decision. Here’s how to read and understand a PPM→

Your preferred return, which varies by deal structure, is typically between 6% and 12% (and has been higher on some RealWealth Development Deals). It is the amount you receive before the sponsor receives any proceeds beyond their fees. A waterfall structure determines how profits are split between the sponsor and investors throughout the life of the deal. Many real estate syndications use tiered waterfalls, where the split might start at 70/30 (investor/sponsor), but once the sponsor hits a particular IRR hurdle, it shifts to 50/50, meaning sponsors take a larger share of profits as performance improves. At RealWealth Developments, we keep the profit split consistent throughout the entire investment without any hurdles, so investors maintain their full percentage of returns from day one through exit, which maximizes your share of the upside. Learn how preferred returns and waterfalls protect your investment→

Underwriting is just fancy talk for “did they do the math right?” Looking at their assumptions is key to underwriting. For example, are they projecting rent increases of 10% a year in a market that’s only been increasing by 3%? That’s a red flag. Conservative sponsors might show you lower returns, but those numbers are way more likely to happen. Ask yourself: if rent growth slows or vacancies rise, does this deal still work? Get our complete guide to evaluating syndication underwriting→

Yes! In fact, storage syndications have become really popular because the business is simpler than apartment syndications: kitchens aren’t breaking, no midnight plumbing emergencies, no tenants trashing units. Someone stops paying? You cut the lock and auction off their stuff. The deals work like apartment syndications. You invest, they improve the facility, you get quarterly checks, and everyone cashes out when it sells. Here’s everything you need to know about self-storage syndications→

Good question, as people often mix these up. When you invest in a real estate syndication, you’re working directly with the company that found the property and will manage it. They’re all-in on that deal. Crowdfunding platforms are more like a middleman. Typically, different sponsors post their deals on a website. The platform takes a fee, but they are not typically involved in the management of the investment. Direct real estate syndications mean better access to the sponsor. Platforms typically offer more options to browse through, and you may not need to be an accredited investor to invest. See our detailed comparison of syndications vs crowdfunding→

REITs are like buying stock in a real estate company. You can buy and sell shares instantly, but you have no idea which specific buildings you own. Syndications are the opposite. You pick a specific property, project, or fund, you know exactly where your money’s going, but you’re typically locked in for 3-7 years. REITs are available to anyone. Most syndications require you to be an accredited investor, which means meeting certain income or net worth requirements.

Depends on what you’re looking for. Want apartments? Self-storage? A specific region or market? Something else? Some companies are great if you’re new and need lots of hand-holding. Others assume you know what you’re doing and just give you the numbers. Learn more about the major players in the real estate syndication space→

When evaluating real estate syndication sponsors, you’ll want to 1) review their past performance, but also 2) ensure you distinguish between deals where they were the lead sponsor and deals where they were a passive partner. At RealWealth Developments, we now serve as the sponsor for our current deals, giving us complete control over operations, underwriting, and asset management. This is a key difference from our earlier investments, where we participated as silent partners. Thirdly, you’ll want to evaluate the sponsor’s experience, deal structure (including investor protections), and alignment of interests with you as an investor.

Fees in real estate syndications vary significantly based on the deal type and structure. Standard fees may include acquisition, asset management, disposition, loan, and construction management or development fees. All these fees should be clearly laid out in the private placement memorandum. If you’re adding up all the fees and they’re eating half your returns, that’s a problem.

Start with the private placement memorandum (PPM), which is the primary document that covers the deal in full, including all risks. Then read the operating agreement, which outlines your rights as an investor and how decisions are made. You’ll also want to review and complete the subscription agreement before signing. That’s your legal commitment to invest, and you can’t just back out once you’ve signed. Request the property’s financial projections and the sponsor’s underwriting to see their assumptions. If you don’t understand something in any of these documents, ask questions or have a lawyer review them.

Common asset types include multifamily apartments, self-storage facilities, industrial warehouses, single-family residential portfolios, land development, and build-to-rent communities.

Your money is typically locked up for 3 to 7 years, so you can’t withdraw it if you need it. The property may not perform as projected. Construction could get delayed. The market could tank. The sponsor might not be as experienced as they claimed. Worst case? You could lose the invested capital. This is why doing your homework on the deal’s underwriting is so important.

No. While sponsors may project certain returns, there are no guarantees. Market conditions, property performance, and operator decisions can impact actual results.

You can with a self-directed IRA or solo 401(k), but not with your regular employer 401(k). You’ll need to work with a special custodian who handles alternative investments, and any money you make has to stay in your retirement account until you’re old enough to withdraw it. Not every syndication company accepts funds from retirement accounts, so ask about this upfront if it matters to you.

Investors receive a K-1 tax form, which reports their share of income, losses, and depreciation. Thanks to depreciation and cost segregation, many investors can show paper losses even while receiving cash flow, thereby reducing their taxable income.

If you want access to larger commercial real estate deals without being a landlord, and you’re comfortable tying up your capital for several years, real estate syndications can be a strong addition to your portfolio.

Join as a free member—takes less than five minutes and costs nothing. You’ll get access to our current deals, all the details on each project, and the actual offering documents so you can do your homework. You can schedule a free call with our investment team to ask questions without any sales pressure. We also offer extensive educational content on syndications, regular webinars that walk through how everything works, and real investors you can talk to about their experience.