If you spend any time around real estate investors, the term cash flow comes up a lot. Sometimes it’s spoken with excitement (“This property cash flows $500 a month!”), and other times with disappointment (“It’s a great deal… except it doesn’t cash flow”). It’s likely the idea of real, tangible dollars in your bank account is one of the reasons you want to invest in real estate, but it has left you wondering how to calculate cash flow on a rental property.

For rental property investors (especially those just getting started), owning a cash-flowing property is often the difference between a stress-free investment and one that keeps you up at night. It’s what helps you ride out vacancies, unexpected repairs, and the inevitable “the water heater just died” phone call.

Let’s break down exactly how to calculate cash flow, how to run the numbers on rental properties, and why your cash flow today may be different from the cash flow five or ten years down the road.

Quick Answer: How to Calculate Cash Flow on a Rental Property

In real estate investing, cash flow is the money that actually ends up in your pocket each month after all of the bills are paid. Not “paper” profits. Not the appreciation you hope will happen someday. Real, tangible dollars that you can use to buy additional properties, pay down debt, or save for the future. To calculate it:

- Start with your monthly rent

- Subtract 5-10% for vacancy

- Subtract operating expenses (property taxes, insurance, repairs, maintenance, property management)

- Subtract your mortgage payment

- What’s left = your monthly cash flow

For example, a rental property rents for $2,200/month. It has $726 in operating expenses and a $1,340 mortgage. The cash flow at purchase would be $24/month. That’s a low starting number for cash flow, but over time, that number typically grows as rents increase and your mortgage payment stays the same.

Keep in mind that cash flow alone doesn’t always tell the whole story. Real estate investors should also consider:

- Cash-on-cash return: How efficiently your invested capital is working

- Internal rate of return (IRR): Your total annualized return, including appreciation and debt paydown

- Property location: A property in a rough area might show great cash flow on paper, but deliver terrible returns due to high vacancy, turnover, and maintenance costs

RealWealth members gain access to vetted teams selling cash-flow properties in investor-friendly markets, plus tools to analyze deals and guidance from an experienced investor. Join RealWealth for free to see properties that actually work for investors.

What Exactly Is Cash Flow?

At its core, the concept of cash flow is very simple:

Cash Flow = Money In − Money Out

For a rental property, that usually means:

- Money in: all rental income (and sometimes other income like laundry, storage, etc.)

- Money out: mortgage payments, taxes, insurance, repairs, maintenance and other operating expenses

If there’s money left over after everything is paid, you have a rental property with a positive cash flow. If not, you’ll have to contribute your own funds to cover the expenses, which is called negative cash flow.

Positive cash flow doesn’t automatically make a property a great investment. However, consistently negative cash flow is a red flag, especially if you don’t expect it to improve in future years.

The Cash Flow Formula: Step by Step

Now, let’s break down how to calculate cash flow on a rental property, step by step, and review the different components that make up the calculation.

Step 1: Gross Rental Income

Gross rental income is the total rent you collect from your tenants each month. If your tenant’s lease lists this at $2,200/month, you’ll use that amount.

Some rental properties may have additional income sources, such as:

- Parking fees

- On-suite laundry machines

- Storage unit rental

- Additional pet rent

If any of these apply, include them as well. Just don’t get overly optimistic and always assume realistic numbers, not best-case scenarios.

Step 2: Vacancy Allowance

No rental property will be occupied 100% of the time. Tenants move, units need turnover. Sometimes you will have missed rent payments or even evictions.

Vacancy is the percentage of time a rental property is expected to be vacant. While vacancies will differ by property type and area, a good rule of thumb is to assume at least a 5-10% vacancy rate.

Using our previous rent of $2,200, and assuming a vacancy rate of 5%, that will bring our effective (or net) rental income down to $2,090/month.

Yes, it’s tempting to skip this step (especially if the property is currently occupied), but vacancy will happen eventually. Ignoring it will just set you up for being disappointed later.

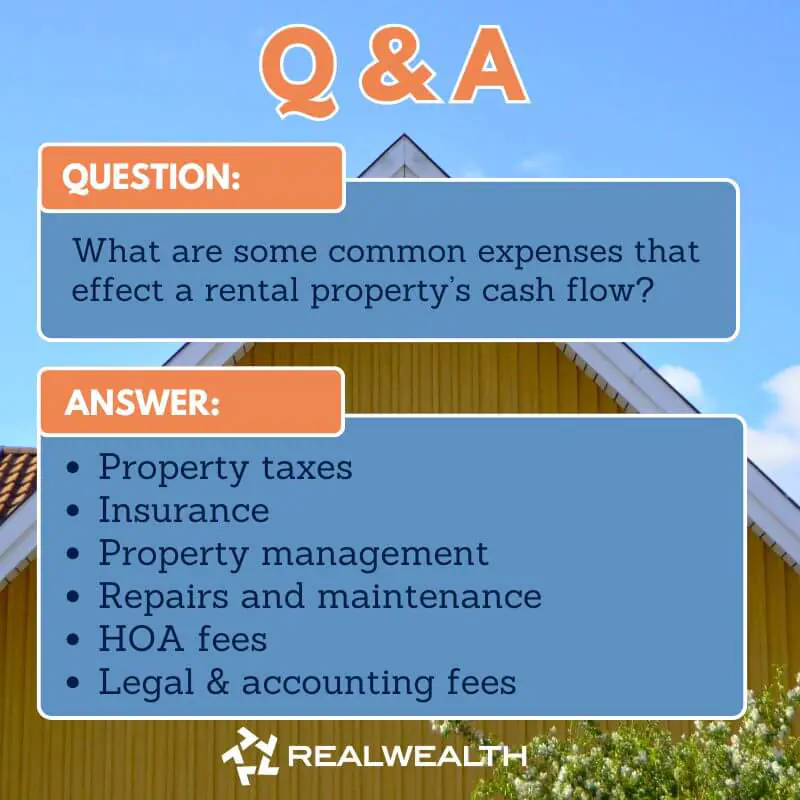

Step 3: Operating Expenses (Not Including the Mortgage)

Operating expenses are all costs and fees you will pay to keep the property running and in good condition, excluding your mortgage payments.

For a rental property, the most common operating expenses include:

- Property taxes

- Insurance

- Property management

- Repairs and maintenance

- Capital expenditures (CapEx)

- HOA fees (if applicable)

- Utilities paid by the owner

- Legal and accounting fees

Take your time when estimating these expenses, as an under-estimated or omitted expense will artificially inflate your cash flow projections.

Investor tip: When calculating cash flow on a rental property, it’s always smart to verify all expenses against their actual sources (e.g., county records for property taxes or insurance costs), instead of relying on the seller disclosures or estimates, which can often be misleading.

Step 4: Net Operating Income (NOI)

Once you subtract your operating expenses from your net rental income, you get what’s called the net operating income (NOI):

NOI = Net Rental Income − Operating Expenses

NOI is an important number because it shows how the rental property performs before financing. Lenders, appraisers, and experienced investors all care a lot about this metric.

Step 5: Debt Service (Your Mortgage Payment)

Your debt service is the mortgage payment you make to your lender each month.

Taxes and insurance are already included above in the operating expenses, whether they are paid out of escrow or not, so don’t double-count them here.

Step 6: Cash Flow

Finally, we have all the pieces in place to calculate the cash flow for your rental property. The complete cash flow formula can be written out as follows:

Cash Flow = Gross Rental Income – Vacancy Allowance – Operating Expenses – Debt Service

You can calculate it as a monthly or yearly number, although monthly cash flow is used more often. Just make sure the formula inputs (such as rent, expenses, and debt service) are consistently calculated as monthly or yearly amounts.

A Practical Example: Calculating Cash Flow on Rental Property

Let’s run through a real-world example of what the cash flow calculation may look like for an actual property:

Assumptions:

- Purchase price: $350,000

- Monthly rent: $2,200

- Down payment: 20%

- Loan amount: $280,000

- Interest rate: 4%

- Monthly mortgage: ~$1,340

Step 1: Gross Rent

- $2,200/month

Step 2: Vacancy (5%)

- $2,000 × 5% = $110/month

- Net rent: $2,090/month

Step 3: Operating Expenses

- Property taxes: $3,000/year = $250/month

- Insurance: $1,200/year = $100/month

- Property management (8%): $2,200 x 8% = $176/month

- Repairs & maintenance: $150/month

- CapEx: $50/month

Total operating expenses: $726/month

Step 4: NOI

- $2,090 − $726 = $1,364/month

Step 5: Debt Service

- $1,340/month

Step 6: Cash Flow

- $1,364 − $1,340 = $24 per month

- Yearly cash flow: $24 x 12 = $288 per year

In this case, the property has a very small amount of positive cash flow at purchase.

That doesn’t automatically make it a bad deal, but it does mean you need to understand why you’re buying it and what you expect to happen over time.

Cash Flow at Purchase vs. Long-Term Cash Flow

When learning how to calculate cash flow on a rental property, one of the most misunderstood concepts for newer real estate investors is that cash flow changes over time.

In most cases, cash flow usually grows the longer you own an investment property. The primary driver is that, in many markets, rents tend to increase over time, often outpacing inflation and expense growth.

So, even if a property barely breaks even today, or even slightly loses money in the first few years, it is likely to become a much better investment five or ten years down the road.

Of course, this isn’t guaranteed. Taxes, insurance, and other expenses can also increase, potentially outpacing rental increases. Rent growth can stagnate or weaken in weaker markets. An older property may need significant repairs or upgrades in the future.

It’s important to consider all of these factors and your future assumptions when analyzing rental properties, rather than basing your investment on the hope that it will perform well.

Why You Shouldn’t Use Cash Flow Alone

Calculating cash flow on a rental property is a critical analysis metric, but it’s not the only indicator that matters.

Two properties can have the same cash flow, but widely different overall returns, so it makes sense to look at other metrics, like the ones below, to get the full picture:

- Cash on cash return (COC): The COC compares the yearly cash flow to the total invested money and measures how hard your invested capital is working for you. A more expensive property will have a worse COC than a cheaper one with the same cash flow.

- Internal rate of return (IRR): The IRR takes into account many different factors, including the cash flow, debt paydown, and appreciation, and gives you a “full picture” annualized return on your capital. It’s excellent for comparing the total performance of rental properties.

- Property location: even a property that looks great on paper but is located in a “bad” area with low-income tenants, crime, or other issues will probably not be a good investment. These areas tend to have higher vacancy rates, turnover, and maintenance costs, all of which will eat into your cash flow and returns over time.

Cash flow is a strong starting point, but experienced investors will also consider returns on capital and property location before making their decision.

Making Cash Flow Analysis Easier

Manually calculating cash flow on a rental property is a great learning exercise, but it can get tedious, especially when analyzing multiple properties.

That’s where tools like DealCheck come in. With just a few clicks, you can calculate cash flow, cash on cash return, IRR, and dozens of other metrics in seconds, all without juggling spreadsheets or worrying about making mistakes.

For new investors, especially, this tool can help you stay consistent, conservative, and confident in your analysis.

Final Thoughts

Cash flow is one of the most critical metrics in rental real estate because it represents the core benefit of owning rental properties—collecting passive income from your investments each month.

Understanding what it is, how to calculate cash flow on rental property, and how it changes over time will put you far ahead of most beginner investors.

Focus on realistic assumptions, use multiple metrics, and remember: the goal isn’t just owning a rental property. It’s owning a property that will actually work for you.

Frequently Asked Questions

Take your gross rent, subtract vacancy (usually 5-10%), then subtract all operating expenses (taxes, insurance, repairs, property management, etc.), then subtract your mortgage payment. What’s left is your cash flow. Most people calculate it monthly, but you can multiply by 12 to get the annual figure.

It depends on your market and strategy. Some investors are thrilled with $100/month, others won’t touch anything under $300. If you’re buying in a high-appreciation market like Florida, you might accept lower cash flow knowing appreciation will grow and rents will climb. If you need income today, consider markets such as Ohio or Birmingham. Learn how much cash flow is good in a rental property →

Only if you’ve got reserves and a plan. Why? Betting on future appreciation is very risky—what happens if the water heater fails and you’re already feeding the property $200/month? New investors, in particular, should avoid properties with negative cash flow unless they fully understand what they’re getting into. Learn mroe about mistakes to avoid→

To identify cash-flowing properties for sale, we suggest joining RealWealth. Members gain access to pre-vetted, turnkey property teams across cash-flow, appreciation, and hybrid markets. If you are unsure of what market is best for your situation, schedule a strategy session (it’s free!) with your RealWealth Investment Counselor. They are here to help support you on your journey. Join RealWealth.

Yes. Even if you’re planning to self-manage. Here’s why: managing an out-of-state rental property gets old fast, and if you don’t budget for property management upfront, you’ll likely feel trapped when you’re ready to hand it off. Budget 8-10% of rent for management, so you’re not scrambling later.

Cash flow is the amount of money in your pocket each month. Cash-on-cash return is how hard your invested money is working. A property earning $200/month sounds great until you realize you put $80,000 down. That’s only a 3% return. Same $200 on a $25,000 investment? Now you’re at 9.6%.

Yes! Tools like DealCheck save time and catch math errors. That said, it can be helpful to learn the manual calculation first to understand each component. Too many investors plug numbers into a calculator without questioning whether the inputs are realistic.

Usually, it gets better. That’s the beauty of a fixed mortgage payment, as rents typically go up. A property that breaks even today might cash flow $400-500/month in five years as rent increases while your payment doesn’t. Of course, insurance and taxes can also climb, so it’s not guaranteed.

We suggest starting here. Key indicators are areas with job growth, population growth, and affordable properties. RealWealth tracks market trends and connects its members with trusted, turnkey teams that sell off-market investment properties. Join RealWealth