Despite what some investing gurus tell you, you don’t need to create a real estate empire. Simply investing some of your nest egg in rental properties for retirement income can complement your Social Security/IRAs enough to make real estate investing worthwhile.

If you’re looking to learn what role real estate – an asset class that’s uncorrelated to the volatile stock market – could play in your retirement planning, or how to boost your retirement income with rentals, read on.

Creating Retirement Rental Income with Single Family Rental Properties

First, it’s essential to understand the economics of a single-family rental property, as this kind of bread-and-butter investment property type will be the basic building block for your real estate portfolio.

In the example (Figure 1), you’ll see two scenarios for a $200k investment property: one is purchased with financing, and the other is all-cash.

As shown in the first pro forma, the financing option would require a $40K down payment (20% down) and some closing costs for an all-in investment of $50K. Below that, we see the monthly income statement, with rent of $1,600 and total expenses of $1,449 netting $151 of monthly cash flow, or $1,816 per year.

Your first-year return-on-investment (or cash-on-cash return) is $1,816 divided by your $50K investment, or 3.6%. As rents increase over time, your returns will increase accordingly.

Under the all-cash option in the second pro forma, the initial investment is the total purchase price of $200,000. Closing costs are lower because you wouldn’t be paying points and other fees for financing. There’s no mortgage, so your cash flow would be higher at $1,157 per month, or $13,888 per year, for a return of 6.8% on your initial investment.

One Rental property or four+?

With $200K to invest, you could buy one house all-cash or four houses with financing. Which is better?

As shown in Figure 1, your cash-on-cash return is higher under the all-cash scenario because interest rates are relatively high, so your mortgage payment is high. Four houses with financing would get you $604 per month vs. $1,157 per month for one house purchased all-cash. If your retirement is imminent, buying all-cash might be the way to go.

However, if your retirement is 10 or more years away, you’d be better off buying four houses with leverage. With time on your side, four homes appreciating will grow your net worth faster than one home appreciating, so using leverage will build your portfolio faster and accelerate your results.

The leveraged cash flow of $151 per month isn’t a life-changing number for retirement rental income, and it is not going to get you rich. However, its purpose is to keep you solvent over those 10 years so that the rental property can pay for itself while it’s appreciating. All you have to do is plant the seed by investing the down payment and then letting it grow.

Your wealth will come from investing in a $200K rental property that will grow your equity by $100K over 10 years, and even more so if you buy four of them. Let’s see how that works.

Equity Growth

At a modest annual appreciation rate of 4.0%, the property appreciates by almost $85K over ten years. Your tenants will pay down the mortgage for you, adding another $24K of principal paydown to your returns for a total of $109,021.

While real estate offers cash flow, appreciation, principal paydown, and tax benefits, most of your long-term returns will come from the appreciation and principal paydown. The example of a single home in Figure 2 shows how powerful this is.

If you buy four such rental properties for retirement in this scenario, your net worth will have grown by $436K in just 10 years!

Rental Properties For Retirement: Investing Over Time

We started this discussion by assuming you had $200,000 to invest and had to decide whether to buy one house all-cash vs four houses with leverage. But suppose you don’t have $200,000 right now? In that case, you can follow this same strategy, only you’d have to space out your purchases over time.

You could buy one house per year for four years, or one house every two years. The economics are the same; it’s just that your equity growth will be spread over a longer period. Instead of increasing your net worth by $436K in 10 years, it might take you 12. But you’ll still be better off for having done it.

Bottom Line

Do you remember where you were in 2015? It seems like yesterday, doesn’t it? If you had bought four properties then, you’d have $400K (plus or minus) of additional net worth today, a significant addition to your retirement nest egg.

Similarly, ten years from now, in the year 2035, you’ll look back and be glad you purchased four rental properties back in 2025.

To find out what a real estate portfolio would look like for you, join RealWealth to view sample property pro formas and schedule a one-on-one strategy session with an experienced investment counselor, like me. There is never any pressure to buy. It’s all about giving you the resources, connections, and confidence you need to invest smartly. Membership is 100% free!

Frequently Asked Questions

The best cities for rental property investing strike a balance between affordability, job growth, population increases, and strong rent-to-price ratios. Many investors are finding great opportunities in the Midwest, Southeast, and parts of Texas and Florida. See the complete list in our guide, 25 Best Places To Buy Rental Property.

Common mistakes include underestimating expenses, skipping due diligence, selecting the wrong market, or failing to have property management in place. Learn from other investors’ missteps in the Top 18 Biggest Mistakes When Buying Rental Property.

Investors earn returns from four primary sources: monthly cash flow, property appreciation, principal loan paydown, and tax benefits. We break these down in How to Make Money from Rental Properties Today.

Yes, with the right roadmap. Many busy professionals successfully close on their first property in three months or less by following a proven process. See the plan here: How to Buy Rental Property in 90 Days to Start Earning While You Sleep.

The best strategy depends on your goals and risk tolerance. Options include turnkey investing, BRRRR, house hacking, short-term rentals, and long-term buy-and-hold. Explore strategies in How to Invest in Rental Properties and Actually Build Wealth: 10 Proven Tips.

Yes. With just four well-performing rental properties, many investors create enough monthly income to retire comfortably. Learn how in Rental Properties for Retirement: How Four Rentals Can Set You Up for Success.

The answer depends on cash flow per property, location, and financing. On average, investors may need anywhere from 5 to 15 rentals. Find a full breakdown in How Many Rental Properties Do You Need To Make $100k Annually?

Yes, investors build long-term wealth through rental properties by combining cash flow, appreciation, loan paydown, and tax advantages. Over time, these factors compound, making investing in rental properties a proven strategy for achieving financial freedom and building generational wealth. Read our full guide on How To Build Wealth By Investing In Rental Properties.

While you can stress test a property using the 1% rule and 2% rule, many investors use online deal analysis calculators to evaluate if a deal pencils out and to run different scenarios. One of the most popular platforms for analyzing cash flow, cap rates, and return on investment is DealCheck. Learn exactly how to use it in our free training: How to Analyze Your Real Estate Investment Deals. RealWealth members receive a special discount.

If you’re just getting started, we recommend beginning with proven education from experienced investors. All our members start with our Investor Core Curriculum Series. This step-by-step series shows you how to begin your real estate investing journey with RealWealth and sets you up for success so you can build wealth through rental properties without the common mistakes.

You’ll find additional free resources on our website, including our free weekly webinars, learning center articles, and links to Kathy Fettke’s podcasts, The RealWealth Show and Real Estate News for Investors. We also suggest reading Kathy’s best-selling book Retire Rich with Rentals and attending a live event.

Choosing the right landlord insurance can protect your investment and your peace of mind. The key is understanding what coverage you actually need versus what’s optional. Get expert guidance on comparing providers and policies in our free webinar: Landlord Insurance for Rental Properties.

Not all lenders understand investment properties, and working with the wrong one can slow down your deal or cost you thousands. RealWealth members have access to our vetted network of lenders specializing in rental property financing and understanding investors’ unique needs.

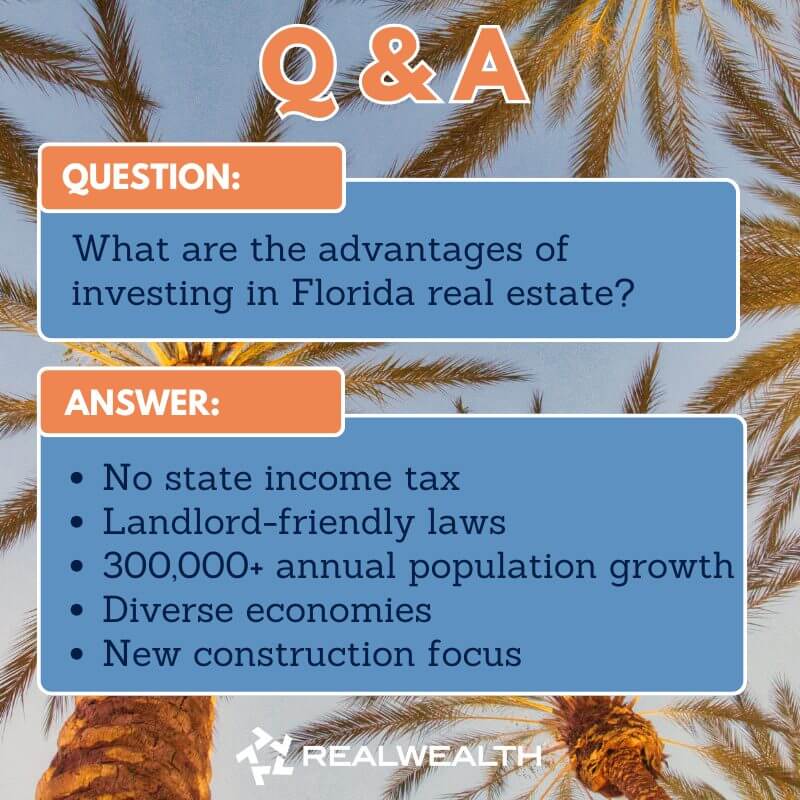

RealWealth connects investors with vetted turnkey rental properties in some of the nation’s strongest markets for cash flow and appreciation. Whether you’re looking for properties in landlord-friendly states with no income tax or growing Midwest markets with affordable entry points, our members get access to off-market opportunities with property management already in place. Explore available properties in Florida, Texas, and Ohio.

Finding quality rental properties that actually cash flow can be challenging on your own. RealWealth connects members with vetted property teams selling single-family rental properties for sale, which come with property management already in place, so you can start earning passive income right away.

Passive investors need insurance that protects their investment without adding unnecessary complexity or cost. RealWealth works with insurance providers who understand rental properties and can tailor coverage for investors who prefer a hands-off approach to property management.

Turnkey properties let you invest without the hassle of rehabs, finding tenants, or coordinating repairs. RealWealth specializes in connecting investors with vetted turnkey real estate companies offering off-market opportunities in high-performing markets. You can see how we compare here, and become a member to access rental properties ready to generate income from day one.