In today’s market, many investors are struggling to find cash-flowing real estate. Although it may be more challenging to find than in previous years, there are still real estate markets that can deliver strong returns.

If you are on the hunt for investment properties that cash flow, RealWealth is here to help you find them. The trusted teams we work with operate in hand-selected U.S. markets where turnkey real estate investing remains financially viable, even with today’s interest rates.

Below, you’ll find our top real estate markets for cash flow, along with links to the turnkey teams in those markets. We also discuss important considerations, such as investing in rental resales and incentives provided by turnkey real estate companies.

RealWealth’s Cash Flow Real Estate Markets

In each of the following markets, RealWealth members can invest with vetted, turnkey teams selling properties with projected cash-on-cash (COC) returns that meet or exceed conservative investment standards. Many of these properties are fully rehabbed to meet our unique-to-the-industry REAL Income Property Standards™, and others are new construction.

Here’s a quick look at where our members are finding the best cash-flowing investment opportunities right now.

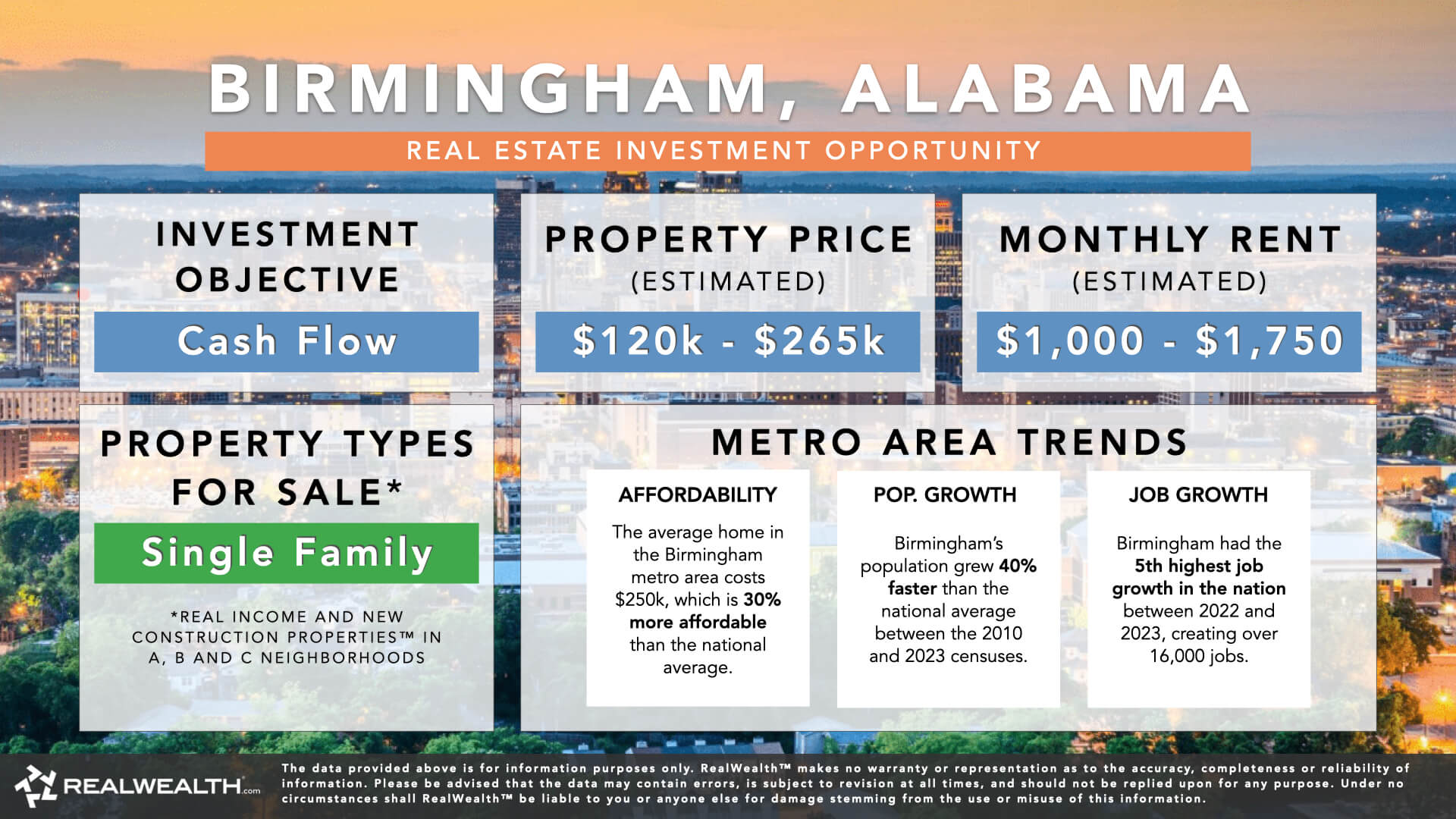

1. Birmingham, AL

We work with three property teams in Birmingham that offer both rehabbed and new construction properties throughout Alabama. These investment properties consistently cash flow, with estimated 7–10% cash-on-cash returns, making this market a reliable choice for long-term hold investors.

2. Chattanooga, TN

In Chattanooga, the team focuses on fully rehabbed properties in stable neighborhoods in the Chattanooga, Tennessee, metro area, and also in Georgia. These cash-flowing turnkey properties for sale generate solid rental income with 5–9% COC returns and benefit from a growing local economy.

3. Cincinnati, OH

The Cincinnati, Ohio, turnkey team offers rental resale properties that are in high demand. Investors can expect cash-on-cash returns of 7–9%, accompanied by strong tenant placement and well-maintained, income-producing homes.

Rental resales are typically already rented and cash-flowing, but the investment properties were renovated a couple of years ago and may have some deferred maintenance.

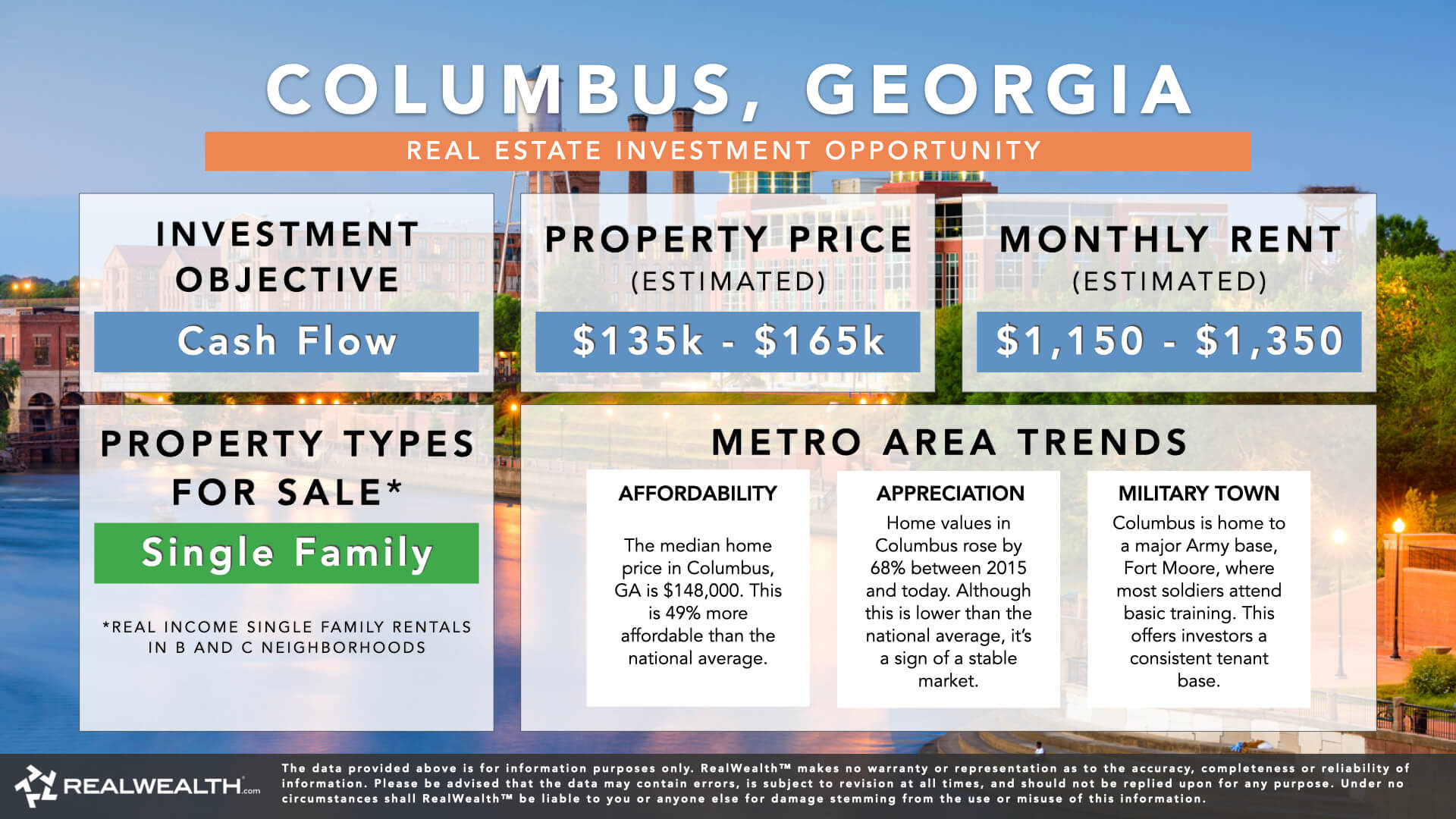

4. Columbus, GA

This hidden gem is catching the attention of real estate investors. The turnkey investment properties in Columbus boast exceptional real estate cash flow, with up to 12% cash-on-cash returns—one of the highest among all RealWealth markets.

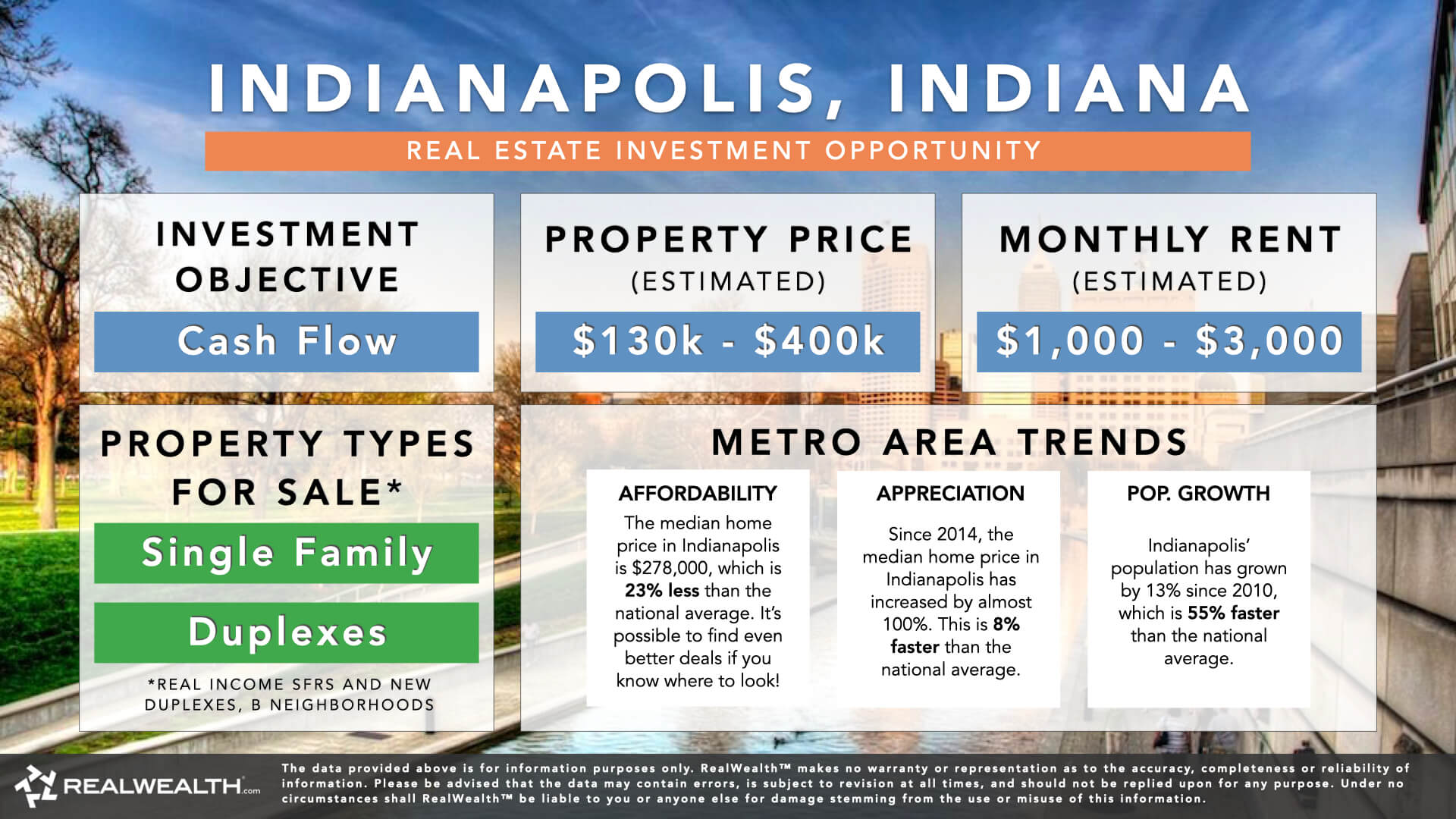

5. Indianapolis, IN

A balanced market with great inventory, Indianapolis offers both turnkey and new construction options for cash-flow real estate investing in Indiana. These properties often deliver 7–11% COC returns, backed by a strong rental base and affordable entry points.

Video: Top cash flowing real estate markets (2025)

Want to learn more? Watch this video with RealWealth Investment Counselors.

Investor Incentives: Boosting Your Real Estate Cash Flow

Another way for real estate investors to capitalize on cash-flowing real estate is to work with a turnkey property team that offers significant concessions, like:

- Seller credits

- Interest rate buydowns

- Free property management (usually 1-2 years)

Incentives like these can help the deals pencil out and boost your cash flow from day one. It’s essential to note that investor incentives fluctuate in response to developments in the housing market. If you’ve been waiting for the right moment to expand your portfolio, reposition your equity, or enter new markets, be sure to check out the types of concessions property teams are offering RealWealth members now.

How to Start Investing Where the Numbers Make Sense

At RealWealth, we work with thoroughly vetted, turnkey property teams in hand-picked U.S. cities, where investors can still find properties that generate income on day one. These cash-flowing real estate markets offer solid fundamentals, reliable property management, and projected cash-on-cash returns that help investors grow long-term wealth.

Whether you’re looking to expand your portfolio or buy your first investment properties, these cities provide the fundamentals for building wealth through real estate. To connect with teams and see pro formas, join RealWealth today—membership is 100% free!