When I started investing in real estate, I was all-in on finding great deals, connecting with partners, and maximizing returns. Like many new real estate investors, I was so focused on cash flow that I didn’t spend enough time considering how to protect my growing portfolio with the proper asset protection strategy.

If that sounds familiar, you’re not alone—and that’s precisely why I created this guide. Whether you’re a first-time limited partner or stepping into your role as a general partner, protecting your assets should be part of the plan from day one, and I don’t want you to become a statistic of the DIY LLC approach.

Because here’s the truth: one lawsuit, or even the threat of one, can put everything you’ve worked for at risk. And while it’s tempting to assume your cookie-cutter limited liability company (LLC) from a Do-it-yourself (DIY) online service or a well-meaning friend will have you covered, it’s worth taking a closer look.

This guide walks through the core principles of asset protection for real estate investors. Along with some real-world stories, I’ll show you why the details matter, even in real estate syndication. Watch the full webinar for an in-depth look at strategies to protect your real estate investments or schedule a strategy session.

Asset Protection Is Not Optional—Even for Passive Investors

Let me tell you about two real estate investors I’ve worked with.

One had sold a rental property nearly a year and a half earlier. Out of the blue, he was served with a lawsuit—an old tenant claimed they were injured before the sale.

Most people would panic. But this investor did not do a DIY LLC and had structured things the right way.

The property was held in a Wyoming LLC. His name wasn’t on public record, and his personal assets were completely separate. The lawsuit targeted the LLC, which didn’t hold a dime. The case went nowhere. He walked away untouched.

Then there was the other call—the one I’ll never forget.

A man running a nonprofit for veterans, helping those struggling with PTSD.

A donor passed away. And when money got involved, the donor’s family turned aggressive. They filed a claim worth hundreds of thousands of dollars. A prejudgment writ froze his accounts. He couldn’t pay his staff or feed the therapy horses. His mission stopped cold because he didn’t have a plan in place.

Two stories. Two very different outcomes. Which one do you want to be?

Why DIY LLCs Are a Trap

I’ve seen this scenario play out far too often.

A new real estate investor decides to save money by doing a DIY LLC themselves via LegalZoom, Stripe Atlas, or maybe a friend who “knows a guy.” They form an LLC using their personal name and address, open a bank account with their Social Security Number (SSN), and assume they’re protected.

But they’re not.

The moment your name shows up in public records, whether as a member, manager, or registered agent, you’ve become easy to find. A plaintiff’s attorney can use a free search, connect you to your entity, and launch a lawsuit aimed directly at your personal assets.

Even worse, if you tie your business accounts to your SSN, a personal judgment can pierce that LLC and result in garnished funds, regardless of who technically owns the asset.

Kevin, a viewer of mine, found this out the hard way. He used a Wyoming LLC, but opened accounts under his SSN. When a creditor came after him, they wiped the accounts clean. Every dollar was gone because the structure wasn’t built to hold up.

The Right Way to Set Up Legal Protection for Real Estate Investors

Rather than offering a “one-size-fits-all” filing, we build structures that reflect your investment strategy, lending needs, and long-term goals.

Here’s what that looks like in practice:

1. Start with Anonymity

Use a Wyoming LLC as your top-level entity. It doesn’t list owners in public databases and offers charging order protection. You then use this Wyoming LLC to own your other LLCs, so when someone looks up your property in Texas, they find no trace of you.

2. Protect Against Personal Liability

Insurance isn’t always enough. We’ve seen mold exposure claims denied and lawsuits in the millions where coverage caps fall short. Proper legal entities are your backup defense when insurance fails, and they’re often the reason investors walk away unscathed.

3. Use Real Operating Agreements

Most DIY setups use generic, untested agreements. We build custom ones with built-in protections: forced distribution limitations, manager protections, and even jurisdiction transfer options if needed. These aren’t just documents—they’re shields.

The Strategy Behind Structures That Actually Protect You

Now, you might say, “I can do a DIY LLC on LegalZoom for $179.” Sure. You can also build your own parachute on YouTube, but you probably wouldn’t want to test it at 10,000 feet.

So what’s the real difference when you go beyond the DIY LLC route?

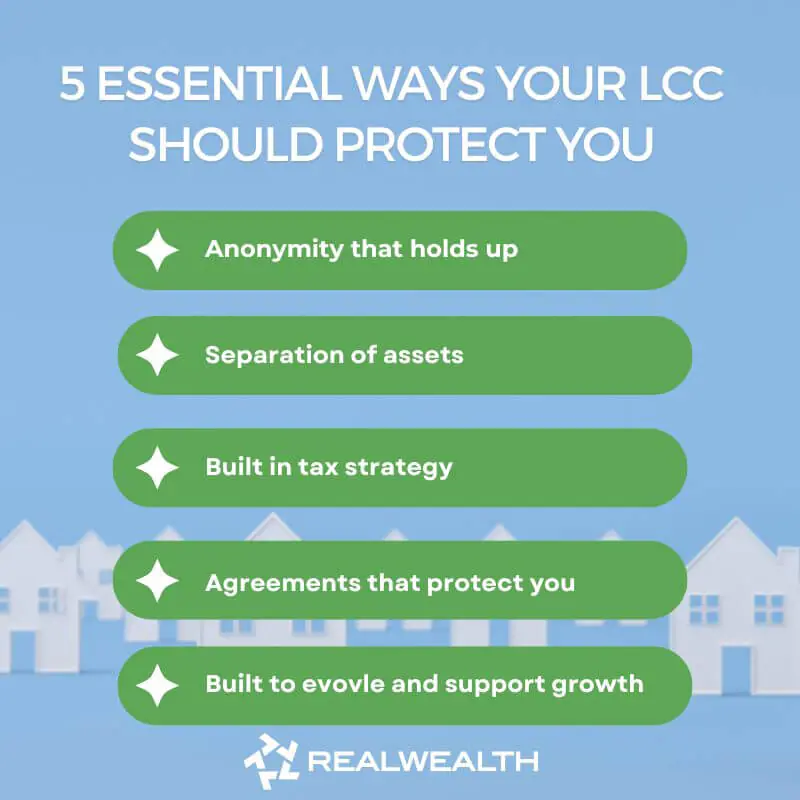

- Anonymity that Holds Up: Smart structures keep your name out of public records, making it harder to connect you to a target.

- Separation of Assets: Effective protection means personal wealth and business activity stay legally apart.

- Agreements That Actually Protect You: Strong operating agreements aren’t optional but foundational. Ours are strategic and built for real-world defense.

- Tax Strategy Built In: Legal structure and tax efficiency should go hand in hand. Ours are designed that way from the start.

- Funding-Ready Foundations: Your setup should protect and support your growth. We make sure it looks strong on paper for you and your lenders.

- Built to Evolve: As your goals shift, your structure can, too. Whether you’re moving from rentals to syndications, we make adjustments that keep pace.

- Confidence That Lasts: What you’re really building is peace of mind—knowing your assets are secure, no matter what happens next.

The Clear Path Forward

The most successful real estate investors I know treat their asset protection like they treat their deal underwriting—with intention, diligence, and expert help.

Want help understanding what that looks like for your situation? We offer a free, one-hour strategy session during which we’ll review your setup, discuss your goals, and create a custom plan.

Ready to start with a solid foundation? Schedule your Strategy Session.

What You Need to Remember

I’ve been in courtrooms, reviewed lawsuits, and helped investors avoid multimillion-dollar judgments because their structures held strong.

I’ve also seen the other side, where well-meaning people waited too long, cut corners, and lost more than they could afford.

You don’t need to be one of them.

Whether you’re just starting out with real estate investing or scaling your strategy, now is the time to build protection into the plan, not after the fact.