The beginning of a new year is a great time for a real estate portfolio review. Taking the time to assess your existing real estate investments every year shows you how they are performing and helps you plan for future real estate investing. You can evaluate your investments using three methods. They are:

- Property Review: How are your individual properties performing?

- Portfolio Review: How is your portfolio performing as a whole?

- Strategy Review: Are you on track to meet your “big picture” goals?

You may want your CPA to help you in this evaluation just to get another set of eyes on it.

Now, let’s dive into each evaluation type.

1. Property Review

At the most basic level, you want to evaluate the performance of each investment property you own.

Financial Review

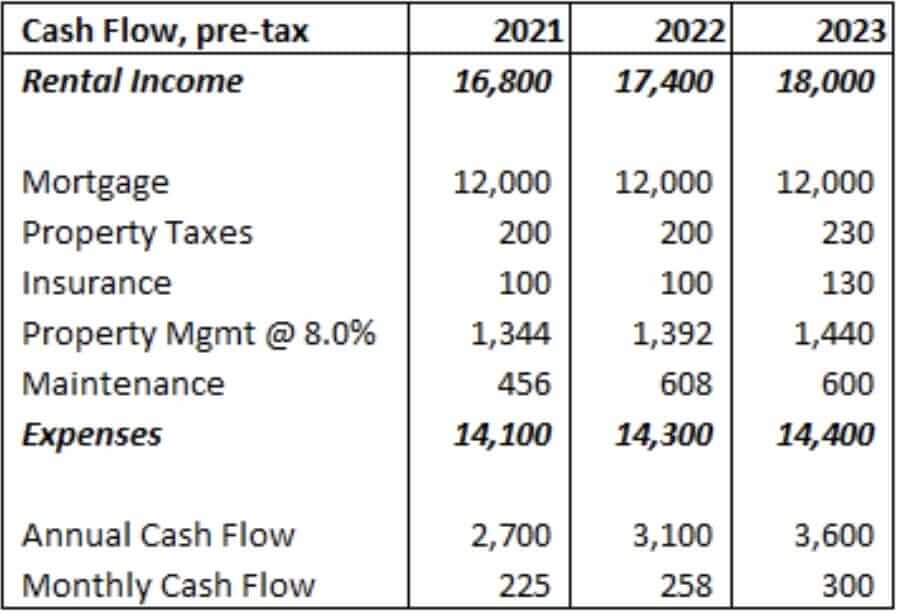

Examples of cash flow performance and price appreciation performance are shown in the tables below.

Real estate portfolio review notes:

- The last column shows the cash flow performance for the most recent year.

- After your first full year of ownership, you can compare this cash flow statement with the pro forma statement you were given when you bought it and see if the numbers are close.

- If you’ve been tracking these metrics since you first acquired the property, as shown in this example, you can notice trends over time. In this example, the rents and cash flow are steadily increasing.

- One red flag to watch out for is if total expenses grow faster than rents (usually due to maintenance expenses). If that happens year after year, your cash flow will be squeezed, and it may be time to sell the property.

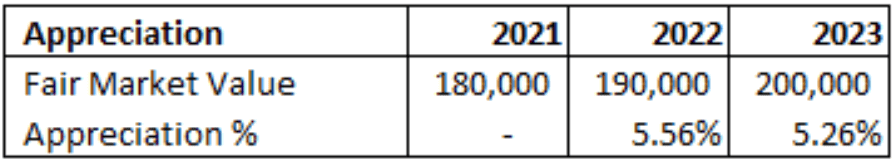

Appreciation or equity growth review

Real estate portfolio review notes:

- A ballpark estimate of Fair Market Value (FMV) can be determined by simply going to Zillow, searching for similar properties (# beds, # baths, square footage, etc.) in the same zip code, and seeing what properties similar to yours are selling for.

- It’s unnecessary to hire a licensed appraiser or even get a Broker Price Opinion (BPO) unless you’re considering selling the property.

- If you record your findings every year, you can see trends. In the above example, the property is appreciating over 5.0% per year, which, on a 25% down payment, represents a 20% return on investment just on the equity growth alone.

What if a Property Has Underperformed?

If the rental property was purchased primarily for appreciation and hasn’t appreciated much, your best bet is to wait and let time solve that problem, provided it’s at least breaking even on the cash flow.

If the property was purchased primarily for cash flow and it’s negative, the main question is: Is the situation salvageable? Maybe you had a bad tenant who trashed the place, and the next tenant will be better. Perhaps you had a major repair, like a new HVAC system, but that’s fixed now, and the property should perform. In these examples, you’d hold onto the property and monitor its performance closely in subsequent years.

If the situation is not salvageable, such as a property in a rough area of town that will never attract quality tenants or a money pit that nickels-and-dimes your cash flow with endless repairs, then you should consider selling it on MLS to an owner-occupant. An owner who lives in the property won’t be paying for property management and can do many repairs himself vs. using a licensed handyman every time something goes wrong, so a property that doesn’t work as an investment can still work well as someone’s primary residence.

If you’re unsure if you should sell your property, ask yourself during your real estate portfolio review: “If I didn’t already own this property, would I buy it today?” That question usually clarifies your path forward.

What if a Property Has Overperformed?

The flip side occurs when a property has a run-up in price, and you’re sitting on a lot of equity. In that case, you have several options:

- Hold the property and hope for more appreciation in the future.

- Do a cash-out refi to liberate some capital for more investments (not ideal when interest rates are high).

- Sell the property in a 1031 exchange and buy multiple properties elsewhere.

The main question is: Has the price appreciation peaked or is there more appreciation to come? To find out, discuss current market conditions with your property manager and the broker who first sold you the property. Find out what the trends are with Days on Market (DOM), multiple offers, and inventory levels, and make your best call.

2. Portfolio Review

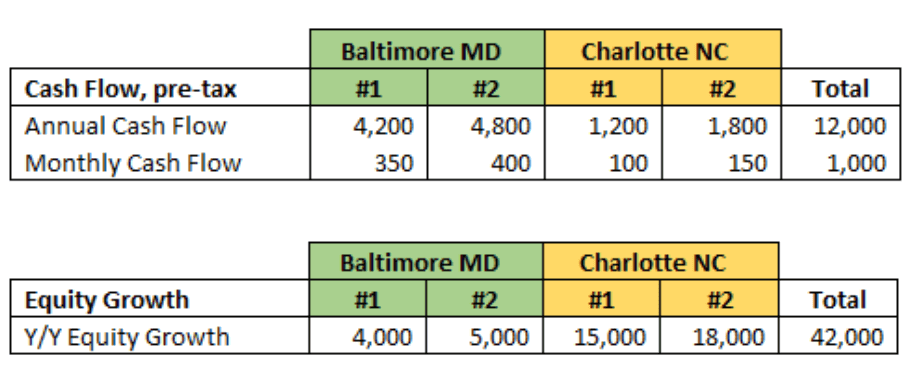

To see how your portfolio performs overall, just aggregate the results of the individual properties in your real estate portfolio review.

In this example, the investor owns four investment properties, two in Baltimore for cash flow and two in Charlotte for appreciation. His portfolio review for the year might look like this:

As you can see, the portfolio looks healthy, with both cash flow and equity growth in the past year. Over time, as rents and property values go up, this real estate portfolio will serve the owner well.

3. Strategy Review

Finally, at the highest level, you’ll want to see if your long-term real estate investing strategy is working.

The quickest way to evaluate this during your real estate portfolio review is to compare your performance to your ultimate goal. Let’s say your goal is to earn $10K per month in passive income so you can retire someday. After you file your taxes each year, look at how much of your income came from investment properties and how that compares to your goal.

If your cash flow from investments is $2,000 in the most recent year, you’re 20% towards reaching your goal! Over time, you want to see that percentage increase.

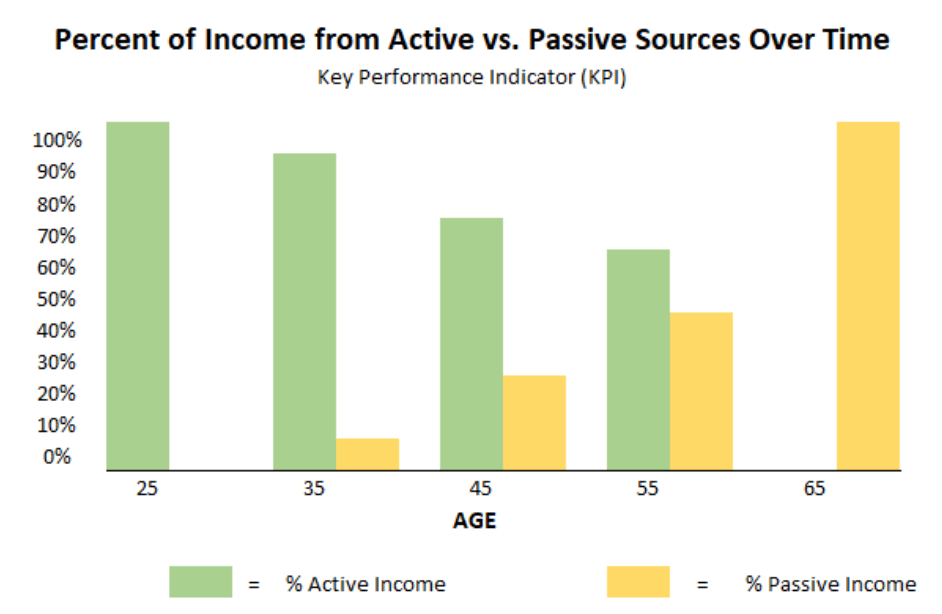

Another way to think of it conceptually, is to compare how much of your income comes from active sources (like a W-2 job) vs. passive sources (like investments) as depicted in the graph below.

When starting your career, 100% of your income will come from your day job and none from investments. Over time, if things are moving in the right direction, you should see more and more of your income coming from passive investments until the passive income completely replaces your active income.

Every year, when you do your taxes, ask your CPA how much of your income comes from you at work vs. how much of your income comes from your money at work. The percentages don’t change much year-to-year, so you may want to track it every few years (such as every Presidential election year).

The scenario you want to avoid is waking up on your 65th birthday and realizing that your passive income is not where it needs to be. By tracking what percent of your money comes from passive or active income sources every few years, you can see if your strategy is working and ensure you’re on track. Doing this also gives you time to make course corrections.

Questions to Ask After Your Real Estate Portfolio Review

When you’ve completed your end-of-year real estate portfolio review, you should have answers to these questions:

- Did your property’s cash flow and/or appreciate as expected?

- Do any of your current properties need to be sold? (Either due to poor performance or to free up capital for better opportunities.)

- Are you on track to meet your goals?

Armed with that information, you can plan how to move forward in the new year. Feel free to discuss your findings with your RealWeath Investment Counselor for a sanity check.

Don’t have an investment counselor yet? Join RealWealth today and automatically be assigned to an experienced RealWealth Investment Counselor who can help guide and support you on your real estate investing journey.